Debt Consultants

This is yet another case of an individual struggling with debt, told to pay exorbitant fees to a debt settlement firm to deal with their debts. This time, the company was GEM Debt Law. We review the terms of the contract and explain why these debt consultants should be avoided.

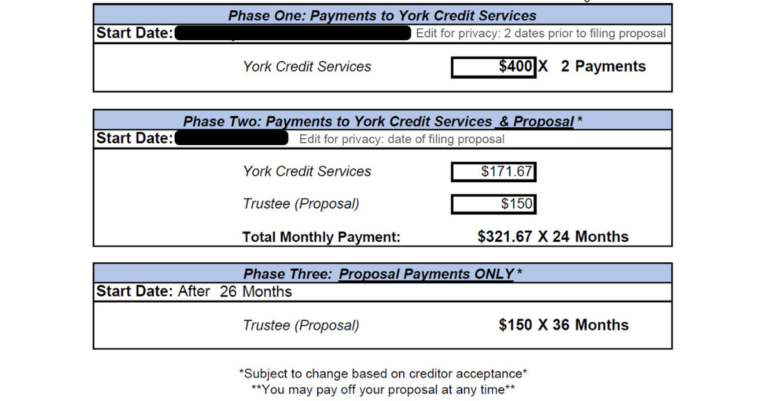

Struggling with debt? Go directly to a Licensed Insolvency Trustee. Unlicensed debt consultants like York Credit Services will charge you extra fees just for a referral to an LIT. Here's a real story of someone who was scammed into paying an extra $800 for nothing.

Use a Licensed Insolvency Trustee if you need help to deal with your debts via consumer proposal. Trust Advisory Service cannot provide these services and charge unnecessary fees. Learn more about it here.

Are you feeling overwhelmed by debt and wonder if unlicensed debt consultants can help you? Doug Hoyes exposes the facts about these consultants and how to avoid unnecessary costs.

Did you know that there are many unlicensed ‘debt consultants’ in Canada? If your answer is no, we don’t blame you because they are tricky in how they operate. Find out why you should avoid them and save your money.

Have you considered using a debt consultant? Wondering what they can do for you and if their extra fees are worth the money you'll pay? We explain the harm debt consultants cause and tips on how to protect yourself.

What’s the difference between a debt consultant and a Licensed Insolvency Trustee when it comes to your managing debts? We explain how the roles differ, which one you should avoid completely and why.

What can a debt consultant really do for you? The Office of the Superintendent of Bankruptcy released a report that delves into the unnecessary and harmful role debt consultants play in debt management.

Debtors are a vulnerable population constantly targeted by deceptive financial services. Ted Michalos explores the harm of 2 of these services and provides tips on how you can navigate misleading ads.

Unlicensed debt relief companies use specific terminology to draw clients in. We expose the facts behind debt settlement in Canada, debt management plans and why consumer proposals are often better.

Learning how to interview a debt advisor can be a useful skill if you are planning on filing for insolvency. Find out what a consumer proposal administer is, how they are licensed, associated fees and more.

What is the difference between bankruptcy trustees, debt counsellors, consultants and coaches? Which one should you use? Find out more about each of their roles, who you can trust, and how to spot a scammer.

What is the role of a debt consultant and are they individuals you turn to for financial help? Find out what the major problem is with using debt consultants and 4 things you need to know about them.

There are businesses that promote debt reduction by up to 70%, but how can you tell if this promise is too good to be true? Find out which programs can achieve this and who can legally administer them.