We understand that there is a lot of information to consider before filing for bankruptcy in Canada. If you have more unsecured debt than you can afford to repay on a monthly basis, bankruptcy could be the most efficient way to eliminate your debt. To help you get a clear picture of how this debt relief option will affect you, we have explained the pros and cons of bankruptcy below:

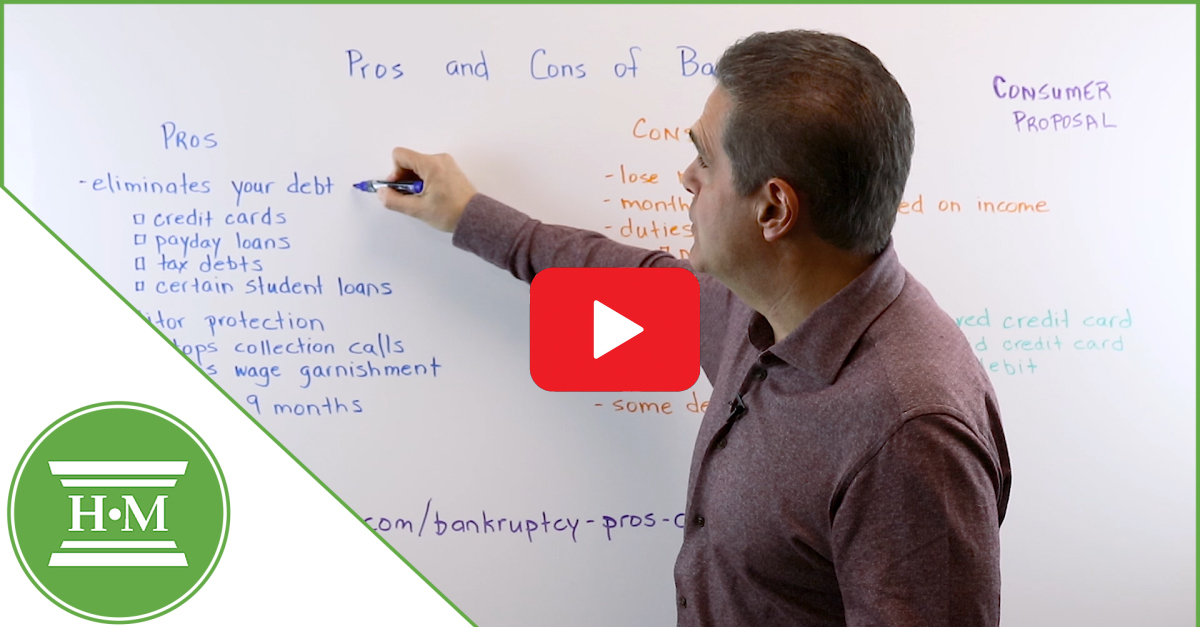

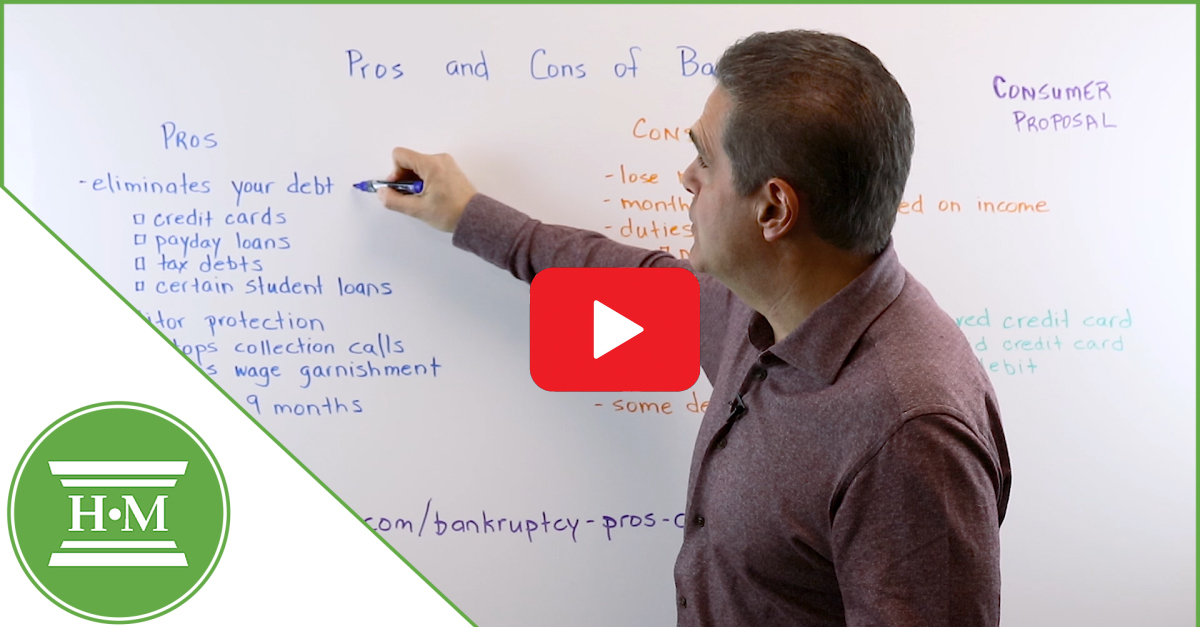

I’m Doug Hoyes, a Licensed Insolvency Trustee with Hoyes Michalos and Associates, and today I’d like to talk about the pros and cons of filing bankruptcy. There’s one main reason why you’d consider filing bankruptcy, and that is to eliminate your debt.

Bankruptcy covers unsecured debt, things like credit cards, PayDay loans, tax debts, and even student loans that are guaranteed by the government if you’ve been out of school for more than seven years.

Bankruptcy gives you protection from your creditors. So, as a result, things like collection calls will stop; no more phone calls. And, even if you have a wage garnishment when you file bankruptcy, we can stop it and prevent future wage garnishments. As a result of filing bankruptcy, you can be debt free in as little as nine months. So bankruptcy truly is a fresh financial start.

Now there are some downsides to filing a bankruptcy. You do lose your non-exempt assets. However, for most people, most assets are exempt. Things like your personal belongings, an inexpensive car, and even in most cases you can keep your RRSP. You are required to make a payment each month based on your income while you’re bankrupt. The government sets a limit, and if your income goes above that limit the payment increases.

There are some duties you are required to perform, including making those payments based on your income, attending two credit counselling sessions, and sending us a monthly budget. Now a lot of people say to me, “Well, that’s actually a good thing.” They’re really happy to attend those two credit counselling sessions where they meet with one of our credit counsellors, and they’ve got a one-on-one opportunity to get some advice on how to manage their money better.

A lot of people also say to me, “You know, I don’t know where my money goes. I’ve never actually tracked it.” Well, by filling out that monthly budget each month you see exactly where your money goes and you’re able to make adjustments and manage your money better.

There will be a note on your credit report that will stay there, in the case of a first bankruptcy, for up to seven years. And a lot of people say to me, “Oh, that means I’ll never be able to borrow money again.” Well no, and in fact, we can show you how to do things like make purchases on the Internet even while you’re bankrupt by doing things like getting a secured credit card, a prepaid credit card or a Visa debit card.

There are some debts that are not included in a bankruptcy, they don’t go away, things like court fines or alimony or child support or government-guaranteed student loans if you’ve been out of school for less than seven years. However, most unsecured debts are included.

So, what do you do if you have some assets you don’t want to lose or you’re afraid your income’s going to go up and the cost of the bankruptcy is going to increase. Well, the solution for a lot of people is to file a consumer proposal. This is a deal we work out with the people you owe money to, where you’re making one reasonable monthly payment and as a result all your debts are gone and you don’t have to file a bankruptcy.

To find out more you can go to our website at Hoyes.com/bankruptcy-pros-cons where we explain all this in more detail, or you can arrange for a no-charge initial consultation with one of our Licensed Insolvency Trustees. That’s the pros and cons of filing bankruptcy.

Pros of Bankruptcy:

- Harassing creditor calls will stop. When you file for bankruptcy, you receive an automatic stay of proceedings, which is a legal order your creditors must obey. This order gives you immediate creditor protection. Creditors will no longer be able to contact you for collection of debt or take any legal action against you either.

- Bankruptcy stops most wage garnishments. When you claim bankruptcy, your Trustee will notify your employer, the court, and the creditor to stop the wage garnishment. An exception is that bankruptcy cannot stop the garnishment of your wages by the Family Responsibility Office.

- Eliminate your debt. Once you are discharged from bankruptcy, with certain exceptions, you are debt free. While bankruptcy allows you to eliminate most of your unsecured debt, there are some unsecured debts that cannot be discharged. For example, student loans that are less than 7 years old, court fines, penalties, and child support are all debts that survive bankruptcy.

- Filing for bankruptcy will give you a target date for a clean credit report. Another benefit is knowing when you will be discharged from bankruptcy. This way, you can plan more easily how to start rebuilding your credit.

Cons to Bankruptcy:

- Bankruptcy costs money. You have to make bankruptcy payments based on your income, and may have to pay an administrative charge. The more you make, the more your bankruptcy costs and the longer it lasts.

- Bankruptcy lowers your credit rating. Filing for bankruptcy does affect your credit rating. A bankruptcy will be reported as an R9 on your credit report. It will remain on your report for 6 years after discharge for a first time bankruptcy. This will be extended to 14 years for a second-time bankruptcy. However, if you are unable to qualify for a loan before filing for bankruptcy, chances are, your credit rating is already very low and bankruptcy can be the first step to repairing your credit by eliminating your debt.

- You will lose any non-exempt assets. A common misconception is that you lose everything in a bankruptcy. The good news is there are many assets you can keep when you go bankrupt. Some non-exempt assets include RESPs and any contributions you made to your RRSP in the past year although we can help you build a plan to keep these savings if you wish. If your home has equity over $10,000, that equity will need to be paid into your bankruptcy however there are options that can allow you to keep your house when you claim bankruptcy. You will also lose your tax refund for the year in which you are filing bankruptcy, any prior year’s refunds that are outstanding, and your HST cheque.

- You have duties to perform in a bankruptcy. You need to perform all of your duties in order to get discharged from your bankruptcy. These duties include reporting your monthly income, making payments, attending credit counselling and providing income tax information. If you do not perform all of your duties, you cannot be discharged and your debts will not go away. Most people however don’t find this to be a disadvantage of filing bankruptcy. The process often helps them learn to better manage their money so they don’t find themselves dealing with too much debt in the future.

For many Canadians, the pros of bankruptcy far outweigh the cons. After all, once their bankruptcy is complete, they are debt free and have the fresh start they need to move forward.

However, if you are concerned about the cost of bankruptcy and also wish to keep your assets, like RRSP and home equity, consider learning more about a consumer proposal. A consumer proposal is another debt relief procedure under the Bankruptcy and Insolvency Act. It is a popular alternative to bankruptcy for Canadians who want to achieve debt relief and keep all of their assets.

Stressed about your debt? Give us a call at 1-866-747-0660 to talk about the benefits, and costs of filing bankruptcy. We’ll explain you options and answer any questions you have. It’s time to be debt free.