In a previous article, we compared the cost of 4 different debt relief programs and determined that in most cases a consumer proposal offers the lowest possible monthly payment, significantly better even than a debt management plan. Inevitably when we do this comparison the question comes up – but what about the impact on my credit score? A bankruptcy or consumer proposal will affect my credit so isn’t that bad?

There is a misconception that credit counselling, or a debt management plan, will not affect your credit score. In fact, it will.

Even though you are agreeing to repay your creditors in full through a debt management plan, it is still considered a repayment program that is reported to the credit bureaus.

A debt management plan will appear as an R7 on your credit report. This note will remain for the lesser of 6 years from the date of filing or 3 years after completion.

A DMP through credit counselling has the same impact on your credit as a consumer proposal yet it is much more costly.

To help clarify the confusion, below is a summary of how the various debt relief programs will appear on your credit report.

Table of Contents

How does a debt management plan appear on your credit report?

- A debt management plan will be listed as an R7 on your credit report

- This rating will remain for a maximum of 6 years after default which is usually when filed.

- It is removed the earlier of six years from filing or 3 years after completion.

- Each debt included in your debt management plan will be marked as part of a registered repayment plan.

- The individual debt will be cleared 6-7 years after the date of default

How does a consumer proposal appear on your credit report?

- A consumer proposal will be listed as an R7 on your credit report.

- This rating will remain for a maximum of 6 years after default which is usually when filed.

- It is removed the earlier of six years from filing or 3 years after completion.

- Each debt included in your proposal will be marked as part of a consumer proposal.

- The individual debt will be cleared 6-7 years after the date of default

In other words, both a consumer proposal and debt management plan have the same impact on your credit report. There is no difference in how these debt programs are reported and when the notice is removed.

The sooner you pay off your program, the sooner it is removed from your credit report.

The main benefit of a consumer proposal over a debt management plan is that you pay less than you owe. This makes your monthly payments much lower.

Let’s look at an example. If you owe $35,000 in credit cards, payday loans and other unsecured debt your payments under each program could be as follows:

- 5-year debt management plan: $642 a month (full payment plus 10% fees)

- 5-year consumer proposal: $204 (assuming your creditors settle for 35cents on the dollar)

If you have room in your budget, you can increase your proposal payments and pay off your proposal faster. Given the smaller monthly payments, this is more likely than being able to increase your debt management plan payments above $642.

Here is why this is important.

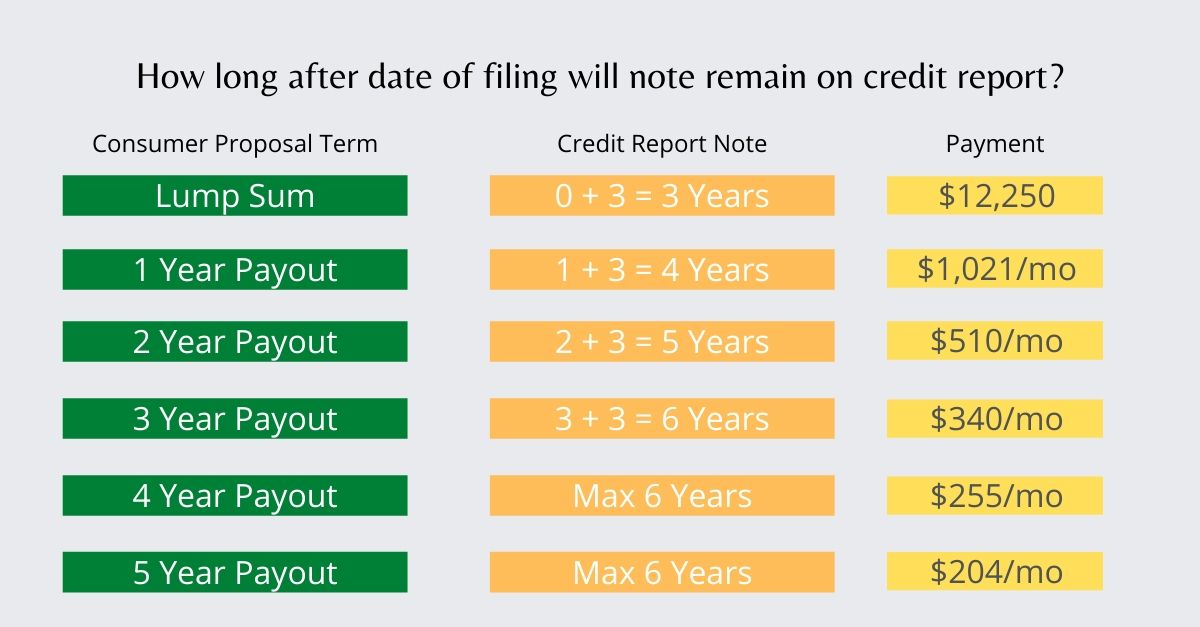

There is a direct relationship between how long it takes to pay off your consumer proposal, and how long this will impact your credit.

This holds true for both programs, but again since a proposal costs less than a debt management plan, being able to repay your proposal faster is more likely.

How does bankruptcy appear on your credit report?

- A bankruptcy is listed as an R9 credit rating.

- First time bankruptcy, no surplus income: 9 months + 7 years = just under 8 years

- First time bankruptcy with surplus income: 21 months + 7 years = just under 9 years

Individual debts are purges after 6 – 7 years

The above addresses how long the notice of any debt relief program will appear in the legal section of your credit report. In addition, each debt is purged from your credit report after a period of 7 years for TransUnion and 6 years for Equifax.

Choosing a debt relief program is about getting out of debt in the best possible way. While the impact on your credit history may worry you, the determining factor should be which program makes the most sense for you financially.

If you need debt help, contact us today to book a free no-obligation consultation. We’ll explain the cost and impact of all options so you have the information you need to make an informed decision about what solution is best for you.