It is understandable that when you are experiencing financial problems you don’t want that information broadcast to your friends, family and co-workers. This is a concern raised by many potential clients which brings us to this week’s technical podcast question:

Who will find out if you filed a bankruptcy or consumer proposal in Canada?

Table of Contents

Is bankruptcy private?

Your initial debt consultation with a trustee in bankruptcy is between you and the trustee. It’s a private, one-on-one, in person meeting designed to review your debt relief options. It’s not unusual for clients to bring someone for support – a spouse or a friend – but aside from that, the discussion is private. Your trustee will likely take notes about your assets, debts and income to better understand your situation and to have information at hand for follow-up meetings, however, the discussion about what to do is between you and your trustee.

Nothing is reported to a credit bureau or your creditors until you decide to file.

What records become public?

From a practical point of view, only those who need to know will be informed that you filed insolvency:

- your bankruptcy or proposal documents are electronically filed with the government;

- creditors will be notified so they can file a claim in your bankruptcy or vote in your proposal;

- if your debt has been forwarded to collections, a notice will also be sent to the collection agency. This is for your benefit as it will also stop further collection calls.

- Revenue Canada is notified as there are tax returns to be filed as part of the process;

- the government sends a notice that you filed insolvency to the credit bureaus;

- the only time your employer will be notified is if you ask to have a wage garnishment stopped as part of the bankruptcy process.

If someone wants to see whether you filed insolvency, they must do a bankruptcy search through the Bankruptcy and Insolvency Records of the Office of the Superintendent of Bankruptcy. To obtain any confirmation that you have filed, and see any records, there are several steps they must take.

Individuals who want to search Canada’s bankruptcy records must:

- Register an account with Industry Canada.

- They can then search by name or bankruptcy number.

- Before anyone can see the results of their search (even names) they must pay a fee (currently $8 for each search).

- Once they pay, they will only see summary information about your total assets, total debts and limited personal information (such as your address & birth date); just enough to confirm that they have the right individual.

Contrary to a popular bankruptcy myth, in personal insolvency cases, a notice does not appear in the newspaper signifying that you filed insolvency. This can be the case for business bankruptcies or if the value of your assets (excluding secured assets) will exceed $15,000, but this does not happen in most individual bankruptcies. A consumer proposal is never reported in the newspaper.

Will my employer be notified of my bankruptcy?

Your employer is not notified that you have filed bankruptcy as part of the normal process. They can do a search however, but they would have to have some inclination to want to do so. Sometimes new employers may want to conduct a search, especially if you are dealing with trust money or are in some other bondable occupation, but generally, your employer will never know.

As we mentioned, only time your employer is notified is if you have a wage garnishment that you want stopped. If that is the case, your trustee will notify your employer’s payroll department in order to stop the deductions being taken from your pay.

Bankruptcy is a fresh start

As you can see, someone has to be pretty motivated to find out whether you filed a bankruptcy or consumer proposal. In most cases, the only people likely to do a search are a bankruptcy trustee (to see if you have filed bankruptcy before) or possibly a creditor (to confirm that you have filed).

Bankruptcy was designed to be a fresh start for the honest, but unfortunate debtor. Widely publicizing the fact that you filed bankruptcy would serve no purpose and would in fact be counter-intuitive to the goal of the Bankruptcy & Insolvency Act.

If you are considering bankruptcy, you should consider the pro and cons of bankruptcy, but not really worry about whether or not your bankruptcy will be discovered by your friends and family, since this doesn’t happen unless you choose to talk about your situation.

As many as 15% of Canadians will file insolvency at some point in their life. As Ted Michalos said on the show:

There is life after bankruptcy. I mean there has to be because again, one in six Canadians at some point in their life is going to be insolvent.

To learn more about the notification process in a bankruptcy listen to the podcast or read the transcript below.

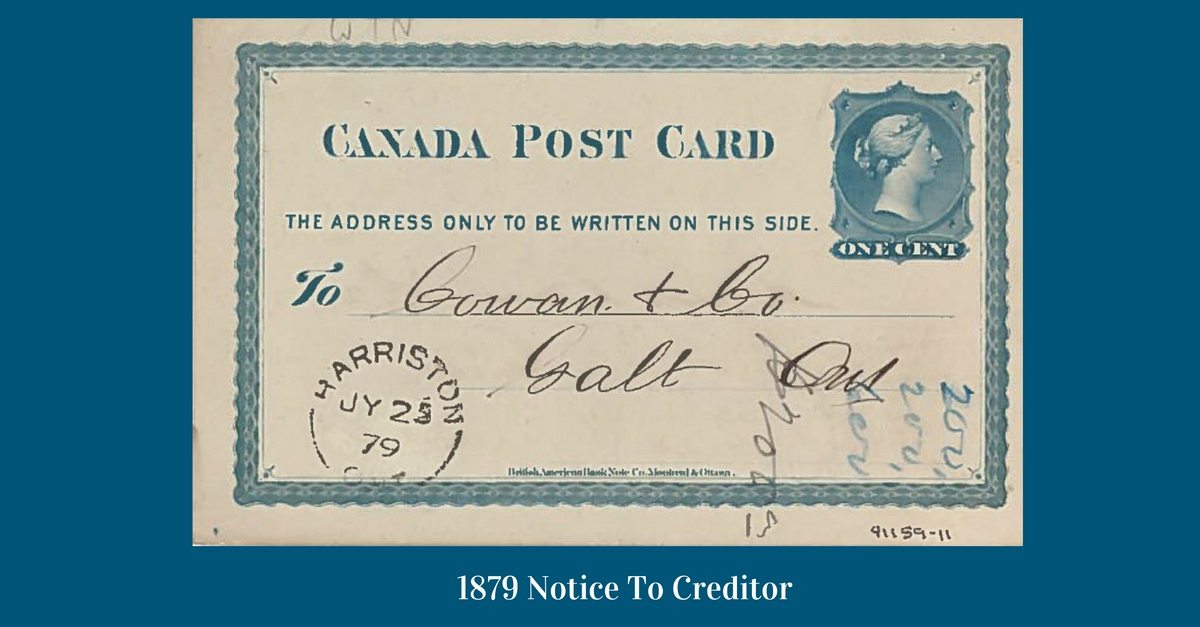

NOTE: The pictures with this post show how creditors were notified back in 1879. Trustees back then had postcards printed that were mailed to the creditors. Today creditors are notified electronically (there are no pre-printed postcards).

FULL TRANSCRIPT Show 116

Doug H: On today’s technical tidbits edition of Debt Free in 30 we’re going to address a common concern raised when someone is considering filing bankruptcy. Who will find out that I filed bankruptcy or a consumer proposal? It’s understandable that you don’t want knowledge of your financial problems broadcast far and wide an as we’ll see that’s just not the case.

However what’s even more important is to ask the right question, will bankruptcy help me and should I be embarrassed if someone finds out? To talk about these issues I’m joined by my Hoyes Michalos co-founder Ted Michalos, so Ted walk us through it. Who is going to find out if you file bankruptcy?

Ted M: Okay. Well so, people need to understand that bankruptcy is a legal process, anything done through the courts is public information. So, that makes it sound like the world is going to find out. That’s just not the case. From a practical standpoint the only people that know that you filed for bankruptcy are the folks that are informed directly about the bankruptcy, so, that means that people that you owe money to. You’re required to give your trustee a list of your creditors in a bankruptcy or proposal. We send notices to those creditors so that they can avail themselves of the process and they’ll leave you alone.

Doug H: So, that’s called the initial mailing and when does that happen?

Ted M: So it’s got to happen within five business days of your actually filing. It’s all done electronically now by most firms, certainly by our firm, so it all goes out very quickly.

Doug H: So in a day or two everybody you owe money to finds out and obviously the government is going to find out ’cause that’s who it get sent to as well. What about Revenue Canada?

Ted M: Well, Revenue Canada is notified of all the filings. I mean half the people that become insolvent in Canada owe the government money away so they’re on the list of creditors. But even if they’re not, they’re notified regardless.

Probably more of greater concern for people is what about your employer? So, if you have a wage garnishee, somebody is suing you and they’re taking money off your pay, then your employer’s going to be notified that you filed bankruptcy or a proposal ’cause that’s how we stop the wage garnishee. It’s probably the reason you filed the bankruptcy or the proposal.

If you don’t have one of these things outstanding against you, nobody’s taking money directly from your pay and there’s no reason for your employer to be told and your trustee’s not going to contact them. So, unless someone is already taking money off your pay, you don’t have to worry about your employer finding out. And presumably that means the people at work aren’t going to find out.

Doug H: Yeah and you’re actually going to tell us I want you to talk to your employer ’cause otherwise this wage garnishment can’t stop.

Ted M: That’s the reason you came in in the first place ’cause they’re taking money off your pay.

Doug H: You have to talk to the payroll person to get it stopped, they’re the only person who can stop it obviously.

Ted M: Well, there’s another aspect of this too then. So, the fact that you filed bankruptcy or proposal is going to show up on your credit bureau report. There are a few credit bureaus in Canada. The major ones are Equifax and Trans Union. They get an information tape from the government every month basically saying who’s filed an assignment or a consumer proposal this month and also who’s been discharged from their bankruptcy or proposal, who’s completed the procedure? So, that information gets reported on your credit report, so anyone looking at your report after you filed will probably notice that that’s happened.

Doug H: And obviously it’s not like anybody can just go pull anybody’s credit report but if you’re applying for a loan then they will look to it.

And you made a key point there, it’s not you and me the trustee who’s notifying the credit bureau, the bankruptcy or the proposal is filed with the Office of the Superintendent of bankruptcy and then they in turn report to the credit bureaus.

Ted M: Correct.

Doug H: And the individual creditors are also reporting to the credit bureau.

Ted M: Yep. So, the credit bureau, and we can do a whole show on credit bureaus, the credit bureau reports whatever their members, the people that you owe money to, tell them to report every month on your credit report. The government reports whether or not you’ve availed yourself of the insolvency laws to get relief from your debts. The trustees actually have no direct intercourse with the credit bureaus because there’s just no facility for us to do that.

Doug H: Yeah, we don’t have the right to discuss with them so that’s how the information gets there. So now the key question to me is not who’s going to find out, you’ve already said that. I mean anybody’s who’s involved in the bankruptcy is going to find out, your creditors and that’s a good thing. You want them to stop calling, you want them to stop garnishing your wages.

Ted M: Correct.

Doug H: I mean a lot of people are afraid to go bankrupt because they’re afraid people are going to find out. But I think it doesn’t really matter if anybody finds out because number one, lots of Canadians end up declaring bankruptcy or filing a proposal. What kind of numbers are we talking about?

Ted M: I always thought that the number were something like 11% Canadians. But I think it’s even higher than that. Somewhere between one in six or one in seven, which is as high as 15% of all Canadians. So, I don’t know. If you’re cheering on the Blue Jays these days, or you were ’cause you were at the Dome with 30,000 people look around at any one point in time, there’s at least 6,000 of those people were in financial difficulty or will be.

Doug H: Or have been, yeah.

Ted M: It’s a huge number.

Doug H: And I mean you get on an elevator with six or seven people, well one of those people at some point in the past or in the future is going to be in a situation or a bankruptcy or a proposal that’s something you’ve got to consider. So, I think that’s a key consideration. You’re not alone. I don’t think you need to be embarrassed about something that one in seven people are ultimately going to have to do.

Ted M: I mean it’s part of the indoctrination process that the lenders have still done. The whole idea of bankruptcy still makes folks uncomfortable and it does make them embarrassed. But that’s because the moral suasion is they want you to pay your debts. And frankly if you’re able to pay your debts, you should. For those who can’t though, this is a legal procedure designed to give you relief so that you don’t – it doesn’t affect the other aspects of your life. Financial problems create so much stress. You take it out on your family, your kids.

Doug H: Yeah, medical issues, it stresses you out and everything. So, I think that’s the other key point then that you’ve eliminated your debt. Let’s focus on the positive here. Okay fine there’s going to be a note on your credit report, maybe we’re going to have to talk to your employer to stop the wage garnishment but you are now debt free once the proposal is done or the bankruptcy’s done and that’s really what matters. That’s what we should be focusing on here.

Ted M: And there is life after bankruptcy. I mean there has to be ’cause again, one in six Canadians at some point in their life is going to be insolvent. You can’t just take one out of six Canadians out of the marketplace and say oh sorry you can’t use credit ever again. That’s just not realistic.

Doug H: Yeah and you can take steps to improve your credit report once this is done.

Ted M: That’s exactly right. In fact the whole purpose of this is to give you after the relief from your debt is to give you some financial tools, some knowledge so that next time around you’re a little bit wiser, a little bit more careful and you’re less likely to get in trouble.

Doug H: Yeah so it becomes a win, win. So, I guess to sum up then don’t be focused on the negative that oh people are going to find out. Look at that as a positive, you want the creditors to find out so they stop calling you, you want your employer to find out so they stop your wage garnishment. And it becomes the fresh start that you need, your debts are eliminated, you can take steps to start rebuilding your credit so in the future you actually will be able to finance a car, a house, whatever it is you need to do, which you won’t be able to do if you keep going the way you are now.

Ted M: Yeah nobody ever believes me when I say this but probably the most youthful or helpful thing you can do for your friends and [co-workers] is to tell them you’ve done this sort of thing, when you’ve relied on a consumer proposal or bankruptcy to solve your debt problems. ‘Cause most people don’t talk about their finances and therefore they suffer much longer than they need to.

If you share some of your experiences, one you can tell them to go to somebody that’s treated you properly so you get a better level of service but more importantly the stigma associated with this stuff will be removed and people will seek relief sooner so they be less stressed and less anxiety, less suffering.

Doug H: Fantastic, I think that is a great way to end it. This is designed to be a positive process and so worrying about who’s going to find out is not something that you need to worry about.