Bankruptcy is a legal process of clearing debts a debtor can no longer repay. Yet not everyone who carries debt will file bankruptcy. Over the past 20 years, the insolvency rate in Canada has fluctuated between a low of 3.6 to a high of 5.8 per 1,000 people aged 18 and over.

Why bankruptcy happens is not just a matter of how much debt someone carries. Filing bankruptcy is a matter of personal circumstances. Our annual bankruptcy study, which we call Joe Debtor, looks at the reasons people list as the primary cause of their insolvency when they file. It also identifies common demographic and risk factors among those filing a bankruptcy or consumer proposal.

Below are the findings on who files bankruptcy and why from our 2019 study of 5,800 personal insolvencies in Ontario.

Primary Reasons People File Bankruptcy

Just under 140,000 individuals filed a consumer proposal or personal bankruptcy in Canada in 2019. In our experience, financial problems and bankruptcy develop for a number of reasons. It is important to understand that cause and fault are not the same. Money problems can be caused by events beyond someone’s ability to control.

Today’s insolvent debtor is not just burdened with debt, he is struggling to keep up with a higher cost of living combined with limited income growth. It is highly misleading to state that someone spent their way to bankruptcy. In the vast majority of cases we see, Joe Debtor uses credit to survive. As debt builds, the cycle accelerates. Once interest consumes a significant portion of someone’s monthly income, it is common to turn to credit cards, and eventually payday loans, to pay everyday living expenses.

The cycle of ever-increasing debt can carry on for a significant period of time. What triggers someone to file bankruptcy, or make a proposal to their creditors, is often a catastrophic life event. A job loss, illness, injury, divorce or marital breakdown is often the final straw in what is already a risky financial situation.

Here are the most common causes of financial distress people cite as a reason for their filing bankruptcy, updated from our 2019 study:

| Listed Causes of Insolvency | Rate |

| Over-extension of credit, financial mismanagement, unexpected expenses | 62% |

| Job-related (unemployment, layoff, reduction in pay) | 31% |

| Illness, injury, and health-related problems | 19% |

| Marital or relationship breakdown | 14% |

Financial Mismanagement

Obviously, the generic term “financial mismanagement” is a large contributing factor. In fact, when asked for the cause of their financial difficulties, 62% of debtors listed “overextension of credit and financial mismanagement” as the leading cause of their financial problems.

Financial mismanagement can include overspending and excessive use of credit, but it often is as simple as not planning for unexpected expenses, such as a car or house repair. When you combine the lack of savings with a major unexpected expense, consumers often turn to credit as a means of making ends meet.

Raising family on single income. Car repairs and house maintenance. No longer able to service debt on current income.

Student debt and payday loans

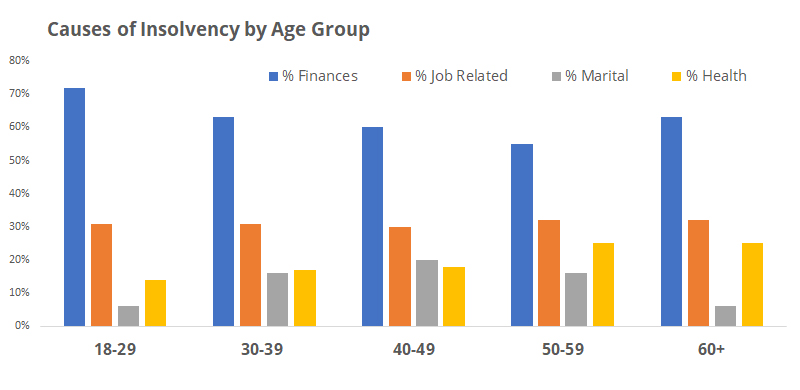

Millennials are more likely (65%) to list financial mismanagement as a contributor to their insolvency followed by seniors (59%). For millennials, student loan debt becomes a burden they cannot repay if they are unable to find suitable employment in their field. Millennials are also more likely to use payday loans. In contrast, seniors are dealing with credit card debt accumulated over a lifetime and often have the strongest moral obligation to repay their debts.

Single mother of three children and relied on payday loan companies to cover budget shortfall and unable to meet obligations as they become due.

I fell into the payday loan cycle more than a year ago and cannot pay my debts back in full given my wife’s lack of income and high living expenses for a family of 6.

Varying income over the years. Old student loans too large to manage.

An increasing factor among those filing insolvency is the increased prevalence of high-risk, high-cost debt. The use of payday loans, quick and easy cash installment loans and high-risk vehicle financing is on the rise. These debt choices are invariably more expensive than traditional debt, and often even more expensive than credit card debt. Higher borrowing costs, whether due to significant debt levels or choice of debt product, increases a debtor’s insolvency risk.

Due to the guilt associated with filing bankruptcy, most of the people we see hold themselves wholly responsible for their misfortune and they may not recognize the underlying problems that pushed them into insolvency. They try everything they can to keep up, until a secondary trigger, a life event they cannot control, pushes them over the financial edge into filing.

Helping family and friends financially

A subset of credit mismanagement is the decision to step in and help friends and family financially even though doing so puts them at personal financial risk. This can include borrowing money to support an aging parent, adult child or friend. Cosigning or guaranteeing a loan for another individual who does not pay back that loan can also lead to bankruptcy for the cosigner.

Debts accumulated over time from helping family members. Now caring for my grandchildren as my daughter passed away last year.

Cosigned on debt for another person who filed bankruptcy, and single parenting.

Overextending your mortgage and HELOCs

In recent years we have seen a significant reduction in the percentage of insolvencies involving homeowners. Our own Homeowner’s Insolvency Index has remained in single-digit lows since early 2018. This does not mean homeowners are not in financial distress. For many, however, rising equity in their home has provided a cushion against filing bankruptcy in recent years. They are able instead to lever the equity in their home to remortgage or refinance.

That is not to say that homeowners do not file insolvency. Some do. Those who do have significantly higher consumer debt ($84,189 compared to $48,963 for all insolvent debtors) and generally have a high-ratio mortgage either through refinancing, taking out a second mortgage or home equity line of credit. The average homeowner filing insolvency in 2019 had secured 79% of their home equity with debt and 3 in 10 had a secured mortgage(s) ratio of 90% or more.

Job Loss or Stagnant Income

Job loss and income reduction can cause bankruptcy, but with relatively stable employment levels in recent years, this factor has been on the decline. In 2019, 31% of our clients reported job loss as a cause of insolvency.

Loss of job four years ago and lack of continuous employment led to financial difficulties.

In fact, 8 in 10 people filing insolvency were employed at the time of filing. Joe Debtor’s average income is $2,690 a month (after-tax) and his household income is $3,162 and household income has been on the rise among insolvent debtors. This does not mean each debtor’s income has risen. What is happening is that more people with a marginally higher income are filing insolvency. The median debtor income rose from $2,280 in 2016 to $2,883 in 2019. Joe Debtor’s average household income is now 50% that of the average Ontarian, up from 48% in 2018 and 46% in 2016.

So why are insolvencies up with higher employment and income? The real issue is that Joe Debtor’s income is just not growing as fast as his debt burden and rising living expenses. In 2019, our average client had only $264 in household income available to make monthly debt payments on unsecured debt, after paying for housing, transportation, and living expenses. This amount is far less than the monthly interest payments on an average of $48,963 in unsecured debt.

Credit card debts accumulated due to poor money management. Attended school. Unable to pay debts on low income from two jobs.

Joe Debtor is effectively living paycheque to paycheque, which is why he has to use debt to pay for everyday living costs. He is often working contract, working multiple jobs or, in the case of graduates, not working full time in their area of study. With insufficient savings, he is forced to rely on high-interest debt like payday loans, multiple credit cards, and high-interest term loans to make ends meet and cover surprise expenses. Over time, an inability to keep up leads to insolvency.

Medical & Health Problems

Despite universal health care in Canada, people are filing bankruptcy for medical reasons; 19% of our clients cited illness, injury and health-related problems as a cause of their financial difficulties. Pre-retirement debtors (those aged 50-59) reported the highest rate of health-related issues at 25% as they are forced into early retirement or are on disability due to health reasons. In fact, 11% of pre-retirement debtors were on disability at the time they filed insolvency.

The financial burden when someone faces medical issues affects the entire family. It is not unusual to see the caregiver file bankruptcy.

Spouse lost job, expensive care for disabled son and overextension of credit. Current income is insufficient to meet obligations as they become due.

Health issues for wife. Vince had to retire to care for her. No longer able to service debt on reduced income.

Earlier than expected retirement due to health issues. High tax debt. No longer able to service debt on current income.

For some, financial trouble starts with time off work recovering from their health problems. During their convalescence, they may use credit to survive and pay their day-to-day bills. Once they return to work, they are left with more debt than they can handle. Others may not be able to return to full-time work and find that their disability income is not sufficient to pay their debts as they come due.

Car accident resulted in time off work, debts accumulated as a result.

Separation and Divorce

The general myth is that filing for bankruptcy may cause more family stress and may even lead to divorce. However, we have found the opposite to be true. Nearly a quarter (23%) of our clients were separated or divorced at the time of their filing and 14% of our clients cited marital or relationship breakdown as the cause of their financial difficulties.

It is easy to see how the end of a relationship might cause financial problems. While a couple is together they may have two incomes, but only one set of living expenses (rent, utilities, groceries, etc). They make plans based on the assumption that the relationship will last forever; they incur debt for cars, mortgages on houses and other consumer items. Once separated, each partner will have their own rent, utilities, and other expenses. They will also be limited to their own income. While they are adjusting to their new reality, recently separated people often rely on credit to pay their bills. This leads to more debt than either party can service, and a proposal or a bankruptcy is often the final result.

Bankruptcy and divorce can create complications in terms of ownership of assets depending on the timing of a formal separation agreement and insolvency filing. Debtors should also be aware of the obligation to repay joint debts, which cannot be extinguished by a separation agreement.

Tax Debts

Roughly 2 in 5 (37%) individuals filing insolvency owe money to the Canada Revenue Agency.

Withdrawing funds from an RRSP

We see two situations where individuals withdraw money from an RRSP prior to filing insolvency. The first can be to use RRSP savings to keep up with living costs, the second can be to use the funds to pay down debt.

In either scenario, financial institutions are required to withhold a certain percentage when someone withdraws funds from an RRSP for income tax. For amounts up to and including $5,000, that amount is 10%. For many people, their actual tax rate is between 30% and 45%. Since debtors often use the full cash flow from the RRSP withdrawal prior to filing their annual taxes, this can create a tax obligation they can’t pay.

Fell behind after separation 7 years ago. Cashed out RRSP’s to try and keep up.

Marital separation. Taxation charge on income cashed form RRSPs.

Using RRSPs to get caught up on debts is potentially very costly, and often unnecessary. Bankruptcy law in Canada protects most pension income and RRSP savings.

Part-time, multiple jobs, additional income.

Income from multiple sources can create an unexpected, or unplanned, tax liability.

Employers are required to withhold amounts from wages for income taxes. They calculate tax deductions based on the assumption that you have a basic personal income amount on which you pay no tax. This creates a problem if you have more than one job as each employer assumes you have a basic personal tax deduction. Employees are not always aware that they can ask an employer to increase the amount of tax to be deducted at source. They may also not want to do so initially as they need the income associated with the second job for debt repayment.

CRA debt due to working two part time jobs – can never get ahead.

Similarly, extra earned income can put someone in a higher tax bracket resulting in a tax obligation at the end of the year.

Self-employed not paying installments

It is not unusual to see personal insolvencies filed by self‐employed and owner‐operated businesses. The percentage of debtors listing business failure as a cause of their insolvency was 4% in 2019. Many of these are contract workers or sole-proprietors. In addition to obligations for personal credit cards and personal guarantees to support their business, many find themselves owing money to the Canada Revenue Agency for withholding taxes and unpaid tax installments. Revenue Canada remittances are often the first business payments to be postponed when someone is trying to avoid business failure. Unfortunately, once you are behind on large tax obligations it is often difficult to catch up.

Carrying Debt Into Retirement

While the majority of people filing insolvency are between the ages of 30 and 49, almost 1 in 3 insolvencies involve those aged 50 and older. While we should be reducing our debt as we approach retirement, many are not able to do so. These are seniors dealing with credit card debt accumulated over a lifetime. Seniors filing insolvency have the highest unsecured debt to income ratio of all age groups, with much of this due to credit card debt. Those over 60 owed an average of $24,192 in credit card debt at the time of filing insolvency, more than any other age group.

Debts too large as I approach retirement. I have been doing balance transfers year over year to keep interest costs down. Now at a point that I need to deal with the debts.

Of greater concern is the percentage of seniors using payday loans. In 2019, almost 3 in 10 insolvent debtors aged 50-59 and 1 in 4 aged 60 and over filed insolvency with payday loans. Borrowing against a reliable income source, their pension income, insolvent seniors aged 60+ had the highest level of payday loan debt outstanding of any age group.

The Debt-Stress-Debt Cycle & Warning Signs of Bankruptcy

In summary, for most people, severe financial problems are often the result of some major life-altering event or underlying risk factor.

People who file insolvency take on debt on the assumption that they will be able to pay it back. For individuals and families living with the daily stress of managing staggering debt payments, the burden is both emotional and financial. They turn to more credit as a solution and lenders are more than willing to continue to loan money to those who are already indebted.

Overextension of credit, several failed attempts at consolidation, finally loss of home.

I consolidated my Visa and Line of Credit in efforts to deal with my debts. I have now realized that the debts are too much to deal with based on current income.

Eventually, the cycle of debt becomes unmanageable and they file insolvency.

Without adequate savings, the costs related to one of these major life events can lead to bankruptcy.

What are the warning signs of debt problems?

- You use overdraft protection often.

- You make only minimum payments on your credit cards.

- You charge more than you repay on your credit cards every month.

- You use credit for your everyday expenses.

- Arguments about money cause problems with your loved ones.

- Creditors are threatening legal action.

- You’re unsure of how much you actually owe.

- Collection agencies are calling you regularly.

- You are over your borrowing limit on your line of credit, credit cards or overdraft.

Are you on the path to bankruptcy?

Don’t:

- Panic

- Continue to borrow money.

- Borrow from friends & family.

- Ignore the problem.

Do:

- Create a budget.

- Track your spending.

- Consider all debt relief options.

- Talk to a debt advisor.