The Bank of Canada held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5% in the April 10, 2024 announcement.

For some indebted households, increases in the Bank of Canada have had a devastating impact on their budget.

| Bank Rate Changes Since 2010 | Target Overnight Rate | Change |

| May 31st, 2010 | 0.50% | 0.25 |

| July 19, 2010 | 0.75% | 0.25 |

| September 7, 2010 | 1% | 0.25 |

| January 20, 2015 | 0.75% | -0.25 |

| July 14, 2015 | 0.50% | -0.25 |

| July 11, 2017 | 0.75% | 0.25 |

| September 5, 2017 | 1% | 0.25 |

| January 16, 2018 | 1.25% | 0.25 |

| July 10, 2018 | 1.50% | 0.25 |

| October 23, 2018 | 1.75% | 0.25 |

| March 3, 2020 | 1.25% | -0.50 |

| March 15, 2020 | 0.75% | -0.50 |

| March 26, 2020 | 0.25% | -0.50 |

| March 2, 2022 | 0.50% | 0.25 |

| April 13, 2022 | 1.00% | 0.50 |

| June 1, 2022 | 1.50% | 0.50 |

| July 13, 2022 | 2.50% | 1.00 |

| September 7, 2022 | 3.25% | 0.75 |

| October 26, 2022 | 3.75% | 0.50 |

| December 7, 2022 | 4.25% | 0.50 |

| January 25, 2023 | 4.50% | 0.25 |

| June 7, 2023 | 4.75% | 0.25 |

| July 12, 2023 | 5.00% | 0.25 |

Table of Contents

How much does a 25-basis point increase in interest rates cost?

Every time the Bank of Canada raises rates, banks and mortgage companies follow with increased mortgage rates. Here is the impact of a 25-point increase on a small mortgage.

If you have a $400,000 mortgage, amortized over 25 years, at 2.59%, your monthly mortgage payment would be $1,810 per month.

That same $400,000 mortgage at 2.84% would cost you $1,860 per month.

That’s an increase in your monthly mortgage payment of $50 a month.

Multiply this by the 5 rate increases some economists are predicting, and you are facing a possible increase in your mortgage payment of $250 a month.

With so many Canadians living paycheque to paycheque, this is going to be a shock. Yet, we shouldn’t be surprised.

In 2012, I was interviewed on CBC Radio’s The Current, on a segment about Doubting Personal Debt and we discussed, even way back then, that debt is a “ticking time bomb”. Back then I warned that low interest rates were making our debt artificially ‘affordable’. I made the comment that we could be in trouble if interest rates rise.

And on the same day in October 2018 as the Bank of Canada increased rates to the highest since December 2008, I was once again on CBC Radio’s The Current to talk about Canadian debt as part of a special they were calling Debt Nation.

When facing a rising rate environment, you need to consider what an increase in interest rates will do to your personal cash flow.

For many years the best decision a Canadian could make was to get a variable rate mortgage (not a fixed rate), because the rate was lower. That’s great, but a variable rate, obviously, is variable, so it can go down, but it can also go up.

Today you may be paying 3% on your variable rate mortgage, so on a $200,000 mortgage amortized over 25 years you are making a monthly payment of $946.40. What happens if your variable interest rate were to increase by 1%? Again, you may not think 1% is a big number, but a 4% interest rate on your $200,000 mortgage amortized over 25 years would cost you $1,052.04 per month. Can you afford to pay an extra $105.55 per month on your mortgage? Will your after-tax paycheque be increasing by $105 per month this year? If not, higher interest rates will squeeze your budget.

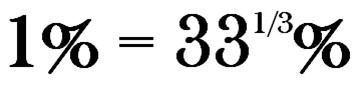

Here’s where most people miss the point: going from a 3% to a 4% interest rate is not an increase of 1% in your payments. If your rent goes from $300 to $400 per month, how much did your rent increase? Answer: one third, or over 33%.

That’s the point: if your interest rate increases by 1%, the actual interest cost of your mortgage in the example above increased by over 33%.

That’s a huge increase, and unless your pay will also be going up by 33%, higher interest rates will be a problem for your monthly cash flow.

How higher interest rates affect different loans

Will my mortgage rate increase?

If you have a variable-rate or adjustable-rate mortgage, the answer is yes. Your mortgage lender will increase your borrowing rate. Whether your monthly payment increases will depend on the terms of your variable rate loan. If you have a fixed payment for the remainder of the current term of your mortgage (not to be confused with a fixed interest rate) your payment may stay the same, but the amount of your payment that goes towards interest, rather than principal, will increase. This can be very costly. Not only are you paying more interest while rates are higher, but you’ll also pay more interest over the remaining life of your mortgage. Paying less principal now, means you have more principal on which the bank can charge you interest this month, next month and the month after.

Mortgage term – a mortgage term is the length of time in which the conditions of your mortgage, like your interest rate and amortization period, don’t change. For example, your mortgage term may renew in five years.

Mortgage amortization period – is the time period it will take to repay your mortgage in full, under the current conditions of your mortgage term. The amortization period is used, in combination with your interest rate, to determine your payment. For example, your payments may be based on a 25-year amortization period.

If you have a fixed-rate mortgage, the terms of your loan mean that your interest rate remains unchanged for the remainder of the term. That means that your interest rate, and payments, won’t immediately increase when interest rates rise. You will, however, be facing higher rates on renewal.

What happens to my Home Equity Loan (HELOC) or Line of Credit?

If you have a home equity line of credit or unsecured line of credit, you will see an immediate increase in both your interest rate and monthly minimum payment. Many people are shocked to hear that their financial institution can change the rate on their variable rate lines of credit overnight however those are the rules under the loan agreement.

What about fixed-term loans like my car loan?

Term loans have set loan conditions, including your interest rate, for the life of the loan. So if you purchased a car with a six-year car loan, your rate, and monthly payment will remain unchanged even as interest rates rise. However, if you refinance after buying a new car, or enter into a new lease, you will be purchasing during a period of higher rates.

What happens to my student loans when rates rise?

Again, this depends on whether your student loan is a fixed-rate or variable-rate loan. If you have a fixed rate student loan, whether private or government guaranteed, you won’t see an immediate increase in your monthly payment or interest costs. If you have a variable-rate loan, both your interest rate and minimum payment will rise.

Will my credit card rate increase?

Most people we work with have a fixed-rate, high interest, credit card with a typical rate in the 19-22% range. Rates on these types of cards do not typically change when interest rates rise. Just like they don’t decline during periods of low rates. If you have a variable-rate card, however, your rate will increase. The best way to avoid interest charges on credit cards, no matter what rates do, is to pay your balance in full each month.

What should you do when interest rates rise?

Now is the time to make a plan to deal with your debts before your borrowing costs become more than you can handle.

Your goal in a rising rate environment should be to reduce your debt as much as possible and have a strategy of shifting debt to lower rate loans.

Here are some steps you can take to reduce the impact of rising rates on your monthly budget:

- Make a list of your debts, how much you owe, their current interest rate and type of loan (variable rate, fixed, mortgage, credit card)

- Focus on paying down high interest debt first. Even if the interest rate on your line of credit may increase from say 2.45% to 2.70%, if you are paying 29% on credit card balances it still makes sense to pay down your credit card debt first.

- If you have no high interest debts, pay down variable rate debt next to avoid further increases to your borrowing costs.

- Explore switching from a variable-rate to a locked in fixed-rate mortgage or loan to create some certainty regarding your financial payments. Talk with your lender or a mortgage broker to see what kind of rates you can refinance at but don’t forget to factor in any penalty. Know that, in a rising rate environment, variable rate loans are riskier.

- Consider shortening the amortization period on your mortgage to pay it off sooner or switching from monthly to bi-weekly or weekly payments to accelerate your payments and become mortgage free faster.

- If you have more debts than you can afford, particularly unsecured debt like credit cards, payday loans or older student loans, consider talking with a Licensed Insolvency Trustee about options to reduce that debt and its impact on your finances.

I can’t predict the future, so I don’t know how much more interest rates will rise but it’s likely we are facing down a few more increases over the coming months. I can, however, advise you to consider all options so that you are prepared regardless of what happens to interest rates.