You’re probably wondering about all your options for getting out of debt. There are many. But, if you’re not sure which is right for you, consider creating a debt repayment plan complete with a deadline to help you decide how you can get out of debt the soonest based on your financial situation.

You need a deadline as part of your debt reduction strategy to determine if it’s feasible to cut down or eliminate debt within a certain period of time. If you want to be debt free in one, three, or five years, set that time period as your goal.

Once you have your debt reduction deadline in place, the next step is to figure out how you’ll get there financially. You need to decide if you can achieve this on your own and if so identify just how much to pay off against each debt every month to achieve your objective of eliminating debt.

If you can’t get pay off credit card debts and other unsecured debts within a reasonable time frame no matter how much you cut back on spending, then it’s time to consider legal alternatives to help you get out of debt.

To help you find your best get out of debt plan we have created a free and easy to use excel Debt Repayment Worksheet.

Below we present the steps and decisions you need to consider when looking for a way out of debt.

Paying Off Debt on Your Own

The first question to ask yourself is can you pay off your debt in full, with interest, over a specific period of time entirely on your own?

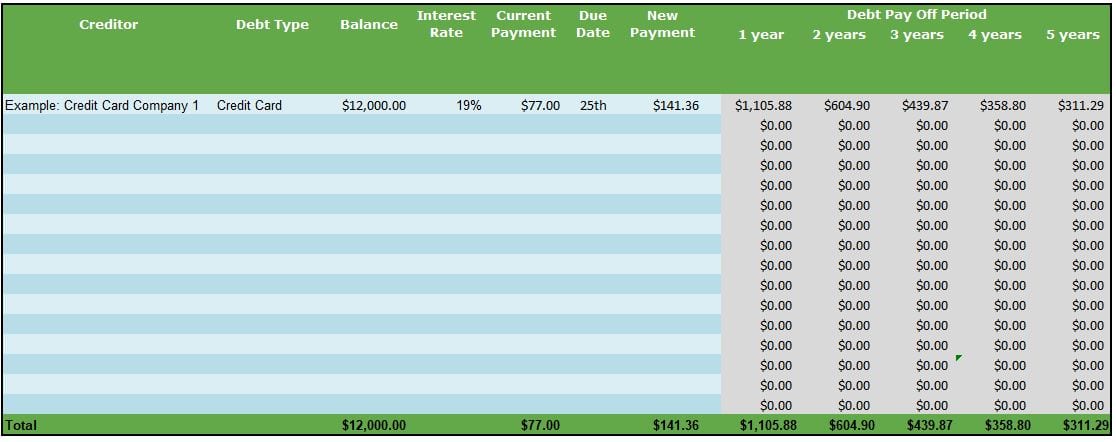

Let’s say that you want to pay off credit card debt within three years. You need to determine how much you must pay on each credit card you owe every month to achieve this goal. Here’s where our worksheet can help. Begin by making a list of everyone you owe money to, how much you owe, what the interest rate is and your current minimum payment.

Our worksheet tells you how much you must pay each month to pay off debt faster. It will provide comparison payments for repayment plans of one through five years.

Get out of debt worksheet – creditors list & payment details

Here’s an example to illustrate:

If you owe $12,000 in credit card debt, charging 19% interest, and you want to pay it off over three years, you will need to make monthly payments of $440 each month for 36 months. Extend your payment term to five years and your payment drops to $311. Reduce your timeline to 2 years and you have to put $604 towards your credit card debt each month.

If you want to repay your debt on your own, here are some tips that can help you pay off debt faster:

- Make multiple, small micro-payments throughout the month. Paying $300 a month might be feasible but if you break that down and pay off $75 a week instead you benefit in three ways. Your balances fall faster lowering your interest costs. It’s less likely that you will spend your debt reduction money before your credit card due date. And as a bonus, in a 5 week month you end up paying an extra $75 towards principal.

- If you earn a bonus at work, can sell some assets or get a gift of money, consider putting this money towards debt repayment.

- Double up on payments whenever you can. Extra payments go directly to paying down the principle. Not only have you paid off one extra months payment, the power of compounding means that more of your future payments will go towards principal reduction rather than interest as well.

- Combine your debt reduction plan with an overall budget. Our free budgeting worksheet is designed to help you start by looking at your 30-day spending plan and build in small tweaks and adjustments that can help you send more money towards debt repayment rather than unnecessary expenses.

Formal Debt Reduction Programs That Help You Get Out of Debt

For some people, however, a plan to reduce debt on their own can be challenging. It works only if you have the income to pay down debt and if your total debts are not too high.

The minimum payment conundrum

If you have multiple creditors and are only able to keep up with minimum payments, any repayment plan you make on your own could take years. Also, it’s important not to rack up new debt balances. If current debt and interest payments are taking up a significant portion of your income, reducing your balances through personal budgeting alone can be difficult.

Beware rebound debt.

This is where you make an effort to pay down debt for a few months, but soon find your balances creeping back up. In order to get out of debt, every month, in addition to your debt freedom payment, you have to be able to pay off any new charges in full. If you don’t your debt creeps up again. This is very common when someone has chosen to consolidate credit card debt through a debt consolidation loan, second mortgage or line of credit. You may have successfully reduced your monthly payments to an affordable level, but if you continue to use your credit cards without paying the balance in full each month, you will find yourself in more debt after consolidation than you were before.

Do you need debt relief?

What happens if you realize you can’t afford to pay down debt on your own and within a reasonable time frame? We’d suggest looking at your options for debt relief to see how they compare financially to your original repayment schedule.

Debt Management Plan

One option to reduce debt is a debt management plan. A debt management plan requires you to pay back 100% of your debt over a period of up to five years while the interest is lowered or sometimes even eliminated by the creditors. If you wanted to repay your debts over a period of 5 years, your monthly payments to a credit counsellor would be the total amount you owe divided by 60 months. For example, if you have $24,000 in unsecured debts to be included in a debt management plan, your monthly payment would be $400 per month.

Our free repayment worksheet provides a comparison of what your payment might be under a debt management plan. Just enter your chosen repayment period (between 1 and 5 years) and the worksheet shows what your payments might be.

One thing to note is that not all debts can be included in a debt management plan. This option works best if you have a few small balances on credit cards, a small term loan with the bank or utility bills. Payday loan companies will not typically participate and neither will Revenue Canada or student loans.

Consumer Proposal

If you have a lot of unsecured debt, the best way to reduce debt may be to speak to a local Licensed Insolvency Trustee (LIT). An LIT can help you prepare a consumer proposal to your creditors. A consumer proposal allows you to get out of debt by repaying a portion of what you owe to your creditors. It’s also the main alternative to bankruptcy and you get to keep all your assets.

In many cases, a settlement through a consumer proposal of 35 cents on the dollar is possible. Your actual settlement will depend on your income and what assets you own. The amount you offer to repay your creditors can be paid out over a period of up to 5 years. In our example of $24,000, you might be able to achieve a settlement as low as $8,400. If you want to repay this over 5 years, that would result in a monthly debt repayment of $140.

Our debt repayment worksheet allows you to compare what your payments might be in a consumer proposal based on your debt profile and your preferred timeline. If you prefer you can use our online debt repayment calculator.

Both these tools provide a simple comparison of why a consumer proposal is often the cheapest way to eliminate debt. Again, actual payments depend on factors like income or equity in your home although your payments will total less than they would be in a debt management plan. If you would like to learn more you can read our article on the cost of a consumer proposal.

If you decide a consumer proposal is best, contact us to meet with a Licensed Insolvency Trustee. We will take the time to explain all your options for getting out of debt and answer any questions you have about consumer proposals.