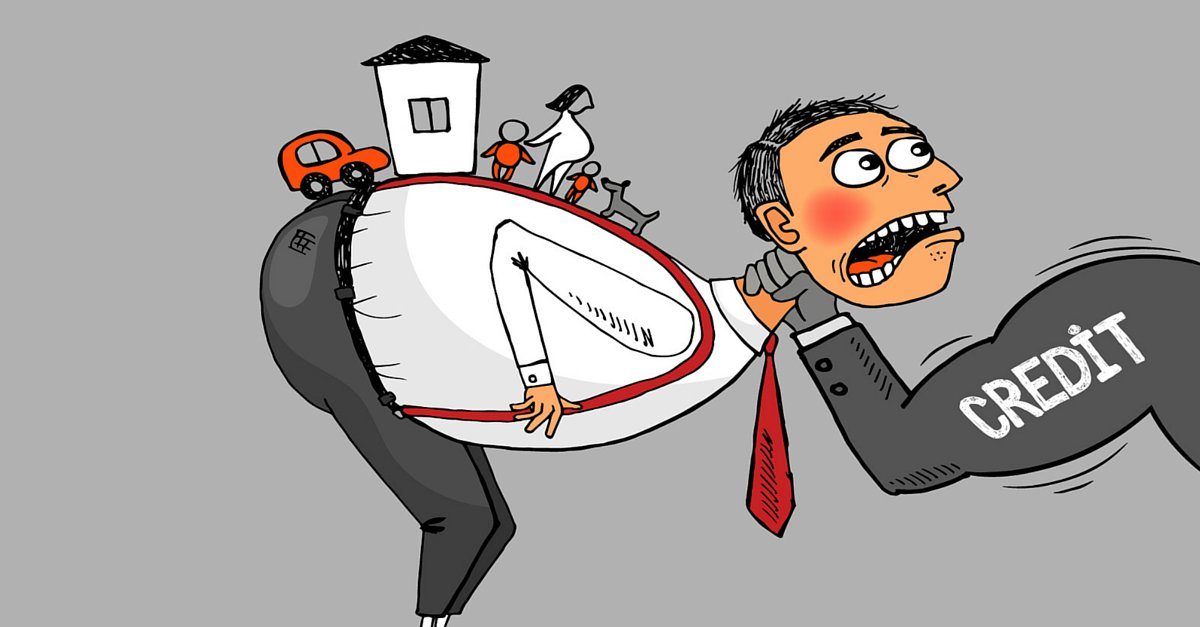

For most people it would be impossible to buy a house without a mortgage, to purchase a new car without financing, or even to attend college or university without student loans. Debt allows us to finance things we cannot buy today, but what happens when your debt is out of control?

How do you know if you have too much debt to handle? What is an acceptable debt-to-income ratio?

The average person we meet owes more than $52,000 in unsecured debt. That’s debt that doesn’t include their mortgage or a secured car loan or lease. That’s a lot of credit card debt, tax debt or student loans to repay for the average person. Yet we help people with debts as low as $10,000 and debts far exceeding the average. How much debt is too much depends on your specific situation.

And if you are struggling, what do you do when you can’t make your monthly debt payments anymore?

Table of Contents

What’s your debt service ratio?

When you borrow money, banks and other lenders decide on the amount of debt you can handle based on what percentage of your income your debt repayments are taking up.

If you add up all your expenses – including debt repayments, mortgage installments, heating bills, taxes etc. – the total monthly amount shouldn’t be more than 40% of your monthly income. This is known as Total Debt Servicing Ratio, or TDSR. Mortgage lenders look at the percentage of income you are spending on housing costs including your mortgage payment, heat, taxes and condo fees. Here a ratio of 32% is considered risky by most mortgage brokers.

But is this level of risk acceptable to you? While 40% may be a good rule of thumb for your lender, the level of debt you should consider healthy will depend on your unique circumstances. You have to be able to comfortably afford your monthly payments (both principal and interest).

If you are only including minimum payments on your debts, a debt service ratio of as low as 20% can mean you have too much debt and may need to file a bankruptcy or proposal if you ever want those debts to go away.

Warning signs you have too much debt

If you’re being pressured by collection calls from creditors for payment, your wages are being garnisheed, utility companies are threatening cut off services or creditors are threatening to repossess your vehicle or furniture, those are clear indications that you have a debt problem that needs to be resolved.

But what got you into this situation in the first place? What are some not so obvious warning signs that you might be carrying more debt than you can handle?

- You use credit for necessities because you are living paycheque to paycheque.

- You’re rolling over your credit into new credit.

- You only make the minimum payments on your debt.

- Your using expensive credit like cash advances and payday loans.

- You regularly use overdraft protection on your bank account.

If your personal financial situation resembles much of the above, then it’s time to reach out for help.

Understanding your options to get out of debt

When you can’t pay your bills, there are options that can help including credit counselling, a consumer proposal and, only when necessary, filing personal bankruptcy.

Each option will provide you with a different timeline to get out of debt and will have a different monthly cost.

Debt Management Plan

Credit counsellors offer a program called a debt management plan. To determine your monthly payment, take the amount of debts you owe and divide that by 60. This would be your monthly cost under a debt management plan. If, for example, you need help with $20,000 in debts, you could make a repayment arrangement over 5 years and your monthly payment would be $333 a month.

If you can afford $333 a month for 5 years to pay off $20,000 in debts, then you can explore this option with a reputable credit counselling agency.

Consumer Proposal

For many people struggling with a lot of debt, a debt management plan is still too costly.

A consumer proposal is the next viable alternative to bankruptcy.

With a proposal, you can settle your debts for less than the full amount owing. Your exact settlement will depend on your income and any assets you own; however, proposals often result in settlement in the range of 30 cents on the dollar or less. In our example, your monthly payment would be reduced to just $117 a month if you choose a 5-year program.

If you can afford more, you can lower your proposal term. You can also start out with a 5-year term and pay off your proposal early or make extra payments at any time. Proposals are interest-free so there is no penalty for an early payout.

Personal Bankruptcy

If you cannot afford a proposal to your creditors, then bankruptcy may be a way to eliminate debts that you cannot repay on your own.

The cost of bankruptcy and how long your bankruptcy lasts depend on your income. If this is your first bankruptcy, and your income is below a certain government limit, you can be debt free in as little as 9 months.

Debts don’t go away on their own

Some people will tell you that your debts are gone when you no longer see them on your credit report. Bad debts are purged from your credit report after six years. However, your debts won’t just go away if you ignore them. No matter how long you wait, they will still be there and so will the stress.

Debts can be sold. Creditors and collection agents will continue to call. They can try to sue you although you might be able to defend against a lawsuit by claiming the debt is too old under the Ontario statute of limitations for debts. However, I’ll repeat, the debt itself doesn’t go away.

If you try to buy a car or house, unpaid debts could make it difficult to get approved for the purchase, forcing you to shop around with different lenders which could lead to high interest rates. Putting off dealing with your debt takes away your control and puts your financial future in the hands of a lender.

One of the most common statements people make to me after they have started their plan to become debt free is “I wish I had done this sooner.”

When I ask them, “What was stopping you from contacting us to get out of debt earlier?”, the most common responses I receive are:

- I was embarrassed to call

- I didn’t know what help was available or who I could talk to

- I believed (or hoped) that one day it would get better

- The banks and credit cards kept increasing my limits or giving me new loans, so I was ‘managing’

- Something just kept coming up or life was too busy, and I kept postponing the call

- I thought being in debt with overextended credit was normal

- I didn’t know how bad my situation was until it became critical

That last reason is telling. In other words, they didn’t know how much debt much debt was too much debt for their situation.

Asking for help is a good first step

People often feel like they must try anything and everything before they speak to a bankruptcy trustee. They spend years fighting the good fight, paying one credit card debt with a different card or living on payday loans. They take out consolidation loans from either their bank or secondary lenders and end up paying extremely high interest rates just trying to stay afloat.

It’s time to stop the cycle of debt and get a fresh start.

That’s what speaking to a trustee can offer you, a fresh start.