Owning a home and carrying a mortgage, particularly a high ratio mortgage, is a financial risk. But does owning a home increase, or decrease, the likelihood that someone will file insolvency in Canada?

Homeowners in Bankruptcy Data

To help answer this question, Hoyes Michalos has created the Homeowners Bankruptcy Index (HBI). An extension of our Joe Debtor bankruptcy study, this monthly index measures the percentage of insolvent debtors in our study who owned a home at the time they filed a bankruptcy or consumer proposal.

Source: Hoyes, Michalos & Associates Inc.

Homeowners filing insolvency in Canada are not necessarily delinquent on their mortgages. The problem is the amount of unsecured debt they carry on top of their mortgage. According to our most recent bankruptcy study, the average insolvent homeowner owes an additional $111,995 in unsecured debt on top of his mortgage debt.

There are four fundamental factors that increase the risk of insolvency for homeowners:

- rising interest rates,

- falling home values,

- credit tightening, and

- rising unemployment.

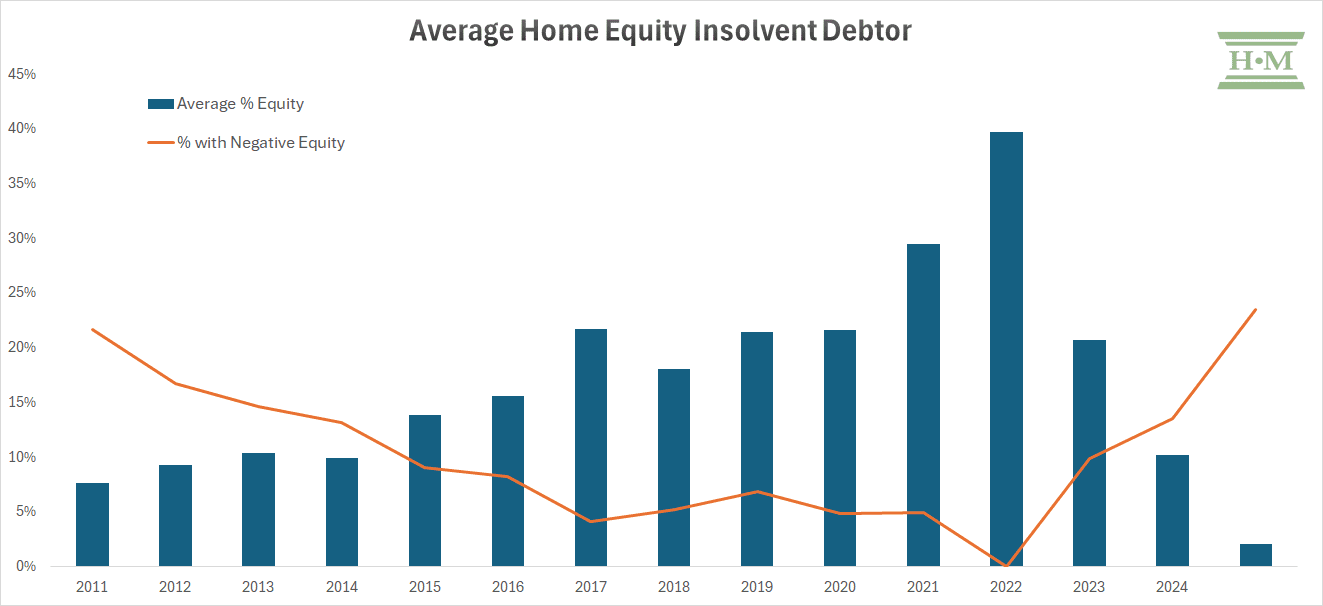

Recent data from our study indicates that falling home values are having a particularly devastating impact on heavily mortgaged homeowners. Nearly one in four insolvent homeowners (23%) in 2025 filed with negative home equity. At the same time, unsecured debt among insolvent homeowners increased 12.6% year over year, compounding the strain of higher mortgage payments. For homeowners unable to refinance all of their debts through a second mortgage, a consumer proposal is a viable alternative to bankruptcy.

For additional commentary or to obtain a CSV file of our homeowner-bankruptcy data, contact:

J. Douglas Hoyes

CA, CPA, Licensed Insolvency Trustee

Email Doug

Ted Michalos

CA, CPA, Licensed Insolvency Trustee

Email Ted