No-one wants to go bankrupt, but sometimes declaring bankruptcy is the best way to deal with debt and get debt relief.

As an Ontario bankruptcy trustee firm licensed to file bankruptcies by the Canadian government, Hoyes Michalos has been helping individuals eliminate debt since 1999.

We believe there are several facts you should know before deciding to declare bankruptcy which is why we’ve put together this guide about bankruptcy in Canada and what happens if you file bankruptcy.

What is Bankruptcy?

Personal bankruptcy is a legal process designed to help an honest but unfortunate debtor who cannot afford to repay their debts find debt relief. At the end of the bankruptcy, your debts are legally discharged, meaning you are no longer required to pay them back.

People file bankruptcy for a lot of reasons; in most cases, something happens that triggers the knowledge that they can no longer pay back their debts on their own. This might be harassing phone calls from debt collectors, a wage garnishment, or the inability to get more credit. A life event like a divorce or separation, illness, or job loss are common causes of bankruptcy in Canada.

Officially, debtors assign their rights to non-exempt assets for the benefit of their creditors in exchange for which they are released from unsecured debts. This is why bankruptcy is known as a fresh start.

Laws governing bankruptcy in Canada

Federal bankruptcy laws are set out in the Bankruptcy & Insolvency Act.

The BIA defines three types of insolvency proceedings available to individuals seeking a resolution to their debts:

- personal bankruptcy,

- consumer proposal,

- and a Division I proposal.

Bankruptcy can only be filed with a Licensed Insolvency Trustee. The role of the bankruptcy trustee is to ensure that the rules and laws around the bankruptcy process are applied fairly to both the debtor and creditors.

Bankruptcy legislation is what provides immediate protection from creditor actions, known as an automatic stay of proceedings. It is the stay that ensures collection agencies and creditors stop calling and allows your trustee to stop a wage garnishment.

Provincial laws also impact your bankruptcy, including legislation that defines what assets are exempt from seizure when you declare bankruptcy.

Who qualifies to file bankruptcy?

To be eligible to file bankruptcy in Canada you must be an insolvent person which means you:

- owe at least $1,000 in unsecured debt,

- are unable to pay your debts as they come due or

- you owe more in debts than the value of the assets you own, and

- you must either reside, do business, or have property in Canada.

You do not need to be a citizen to claim bankruptcy. You can be a permanent resident or even live abroad but have property here.

What Happens When You File Bankruptcy in Canada?

There are three common concerns people have when considering bankruptcy to eliminate debt.

- What happens to my possessions? Do I lose everything?

- What happens to my debts, and what debts are covered by bankruptcy?

- What happens to my credit score, and how soon can I borrow after bankruptcy?

What happens to your assets?

There are consequences of declaring bankruptcy, but this does not mean that you lose everything. Bankruptcy is meant to help you start over financially; it is not intended to be punitive.

Provincial laws and exemption amounts vary, but in general, you can keep most personal belongings, household furnishings, tools of the trade used to earn your income, and a vehicle you own that is valued below the provincial limit. Learn more about Ontario bankruptcy exemptions.

In Canada, secured creditors (like your mortgage or car loan) are not affected by bankruptcy. Secured creditors retain their rights to the collateral or assets you pledged against the loan if you are behind on payments. As long as you can keep up with your monthly payments, it is possible to keep assets like your car and your home in a bankruptcy.

If you have a lot of equity in your house, or other possessions you might lose after filing bankruptcy, you may want to consider a consumer proposal as an option to make a repayment offer to your creditors.

RRSPs are also protected in a bankruptcy in Canada except for contributions made in the last year.

You will lose your tax refund for the year of bankruptcy, plus any tax refunds for previous years that you have not yet received.

What happens to your debts?

Bankruptcy will clear most, if not all, of your unsecured debts. Debts that you owe as of the date of filing are included in your bankruptcy.

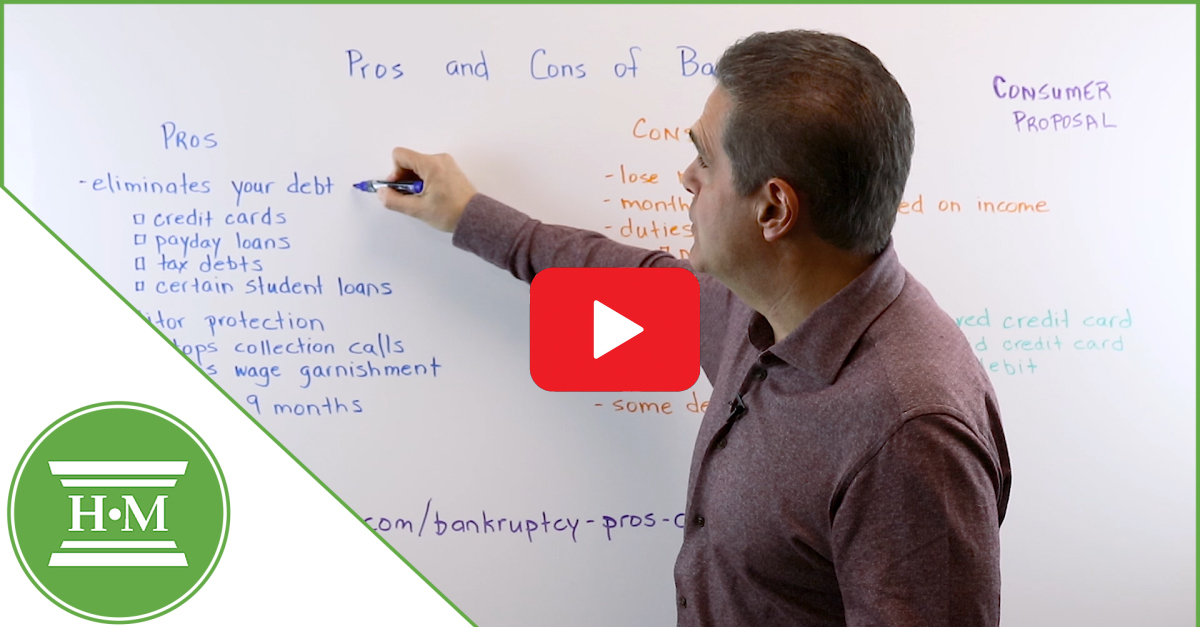

Specifically, bankruptcy eliminates credit card balances, unsecured bank loans, lines of credit, payday loans, outstanding bill payments, even tax debts.

Student loans can also be included in a bankruptcy if you have been out of school for seven years.

Some debts cannot be forgiven through bankruptcy including spousal and child support payments, debts due to fraud, and court fines.

Bankruptcy cannot remove a secured lien on your property since bankruptcy does not deal with secured debt.

You will be required to provide a list of who your creditors are and an estimate of how much money you owe at the time of filing, but your creditors will be the ones responsible for making a claim and proving the debt.

For more information, see our article on debts included in a bankruptcy.

What happens to your income?

While your trustee does not seize your wages, bankruptcy in Canada is based on the principle that the more you make, the more you will pay.

Technically this is called a surplus income payment, and this will affect the cost of bankruptcy. If your income is above the government-mandated threshold for your family size, you can avoid surplus income by filing a consumer proposal.

How long will you be bankrupt?

The length of bankruptcy depends on two factors: if you’ve declared bankruptcy before and your income level.

If you are a first-time bankrupt with no surplus income, have completed all your duties, and if no creditors object, you could begin your life debt free in just 9 months.

If you have surplus income, your bankruptcy will be extended to 21 months.

Those claiming bankruptcy a second and third time will be bankrupt longer.

As part of the bankruptcy process, you will need to attend two credit counselling sessions that will help you learn to manage your money and rebuild credit. At Hoyes, Michalos, we offer a free ‘for clients only’ website to help support you through this learning.

What happens to your credit score?

Your credit rating will fall because of filing bankruptcy; however, this is temporary. The information about your bankruptcy will remain on your report for six to seven years for a first bankruptcy, but this does not mean you have to wait that long to get new credit.

Depending on the reasons you filed, and what your payment history looked like before your bankruptcy, some creditors will offer an existing bankrupt person a credit card. It is almost always possible to get a secured credit card even while bankrupt. Getting new credit is your chance to build a new credit history and show future creditors that you can handle credit wisely.

Many people opt to file a consumer proposal since a consumer proposal can be better for your credit report.

What happens to your spouse’s credit or assets?

If your debts are your own, your spouse is not affected by your bankruptcy. Your bankruptcy does not appear on their credit report.

If you have joint debt, your creditor will pursue your spouse for collection. In this case, you may want to talk to your trustee about a joint bankruptcy.

Only your share of any assets you own is included in your bankruptcy. If you own any assets jointly, such as a marital home, it is essential to discuss options with your trustee. Again, a consumer proposal may be a more viable alternative in this scenario.

If your spouse, or anyone, co-signed a loan for you, they are still liable for repayment of any debts forgiven to you in your bankruptcy.

What do you have to do during your bankruptcy?

As your bankruptcy proceeds, you have a list of obligations as a bankrupt known as bankruptcy duties.

Out of these tasks, the most common include:

- Sending your trustee proof of your income every month

- Paying your trustee if you have surplus income

- Completing two credit counselling sessions

- Going to a creditor meeting or attending bankruptcy court (if required)

If you do not fulfill your duties as described, then there are serious consequences. Your trustee has the option to oppose your bankruptcy discharge and apply for a hearing in court. Failing to complete your duties means your debts will not be eliminated.

What happens after bankruptcy?

Once your bankruptcy is finished, you will receive your discharge certificate. This is the bankruptcy step that releases your obligation to pay back your remaining debts.

Will you ever get credit again? The answer is yes.

You can apply for credit immediately after filing bankruptcy; you are, however, required to state that you are an active bankrupt if you apply for credit of $1,000 or more. Many people can get a secured credit card and car loan soon after filing. At this stage, your income and past payment history will be the most significant factors in determining if you qualify for new credit. Your interest rate will be high initially, but you can take steps to rebuild your credit and we’ll help you with that.

Most people feel relief as soon as they declare bankruptcy. The advantages of bankruptcy outweigh the downsides for anyone struggling with significant debts:

- Collection agencies stop calling

- You no longer have to juggle debt payments

- You can begin to save money as a result of eliminating all that high-interest debt

- Your credit improves if you follow the right steps because you no longer have the negative factor of high debt utilization on your credit report.

We recommend monitoring your credit report to ensure your creditors report your debts accurately (whether in a bankruptcy or consumer proposal). You should submit a dispute resolution if creditors have made mistakes in their reporting to the credit bureaus.

Understanding your Debt Relief Options

Bankruptcy is an option of last resort. It is just one solution available for Canadians struggling with debt.

Before choosing bankruptcy, your trustee will talk with you about your financial situation. What assets you own, what debts you owe, and your income will affect the choice about which debt solution is right for you.

Not every person experiencing debt problems needs to file bankruptcy. When you meet with a Licensed Insolvency Trustee for a debt assessment, part of the review includes a discussion of the alternatives to bankruptcy.

Some bankruptcy alternatives your trustee will review with you will include:

- Filing a debt management plan. If you do not have enough debts to file bankruptcy, a credit counsellor can help you work out a plan to pay back your debts. This has the same credit impact as a consumer proposal but is good for small debt amounts.

- Taking out a debt consolidation loan. We’ll help you consider whether you have the credit capacity to afford a new loan to consolidate debts and if you can qualify at a reasonable rate.

- Making a proposal to creditors. Settling your debt through a consumer proposal is less harmful to your credit and has significant advantages over bankruptcy.

A consumer proposal might be a better solution for you. Where bankruptcy is a way to surrender assets in exchange for the elimination of your debts, you can think of a consumer proposal as a way to restructure your debts. It is a debt consolidation option that allows you to repay a portion of what you owe based on your income.

As one of Ontario’s largest consumer proposal administrators, we have the experience to help you choose between claiming bankruptcy and making a debt proposal to creditors.

Evaluate your alternatives to bankruptcy with our Debt Options Calculator.

Should You Claim Bankruptcy?

Deciding if bankruptcy is the right solution for you begins with a free financial assessment of your situation. You will meet with a Licensed Insolvency Trustee who will ask questions about your debts, your income, and your budget.

A good trustee does not assume declaring bankruptcy is what you should do. The goal of talking with a Licensed Insolvency Trustee is to discuss your personal financial situation and debts. Your trustee will look at the big picture. Something that is hard to do when you are avoiding calls from collection agencies and trying to figure out how to make your next bill payment.

If filing bankruptcy in Ontario is the right solution for you, your trustee will fully explain the process and answer any further questions you may have.

At Hoyes, Michalos and Associates we are proud to be a team of understanding professionals who can help you decide if personal bankruptcy is the right solution to deal with your debts.

Hoyes Michalos & Associates provides personal bankruptcy services in the following locations

Other service areas

We offer the convenience of phone and video-conferencing only services for the following additional areas. Many people find it advantageous to begin the initial consultation and debt assessment over the phone or by video. If you decide to file, you can sign and complete your paperwork electronically. Credit counselling sessions can also be completed through video conferencing, which eliminates the need to miss work or schedule a time to attend the office.