A consumer proposal must be filed through a Licensed Insolvency Trustee. Only an LIT is licensed by the federal government to work as a consumer proposal administrator. When contacting a company to file a consumer proposal, make sure they are Licensed Insolvency Trustees. You should never pay someone to help you craft your offer (trustees will do this initial planning for free as part of the debt consultation process) or to refer you to a trustee to file.

How to File a Consumer Proposal

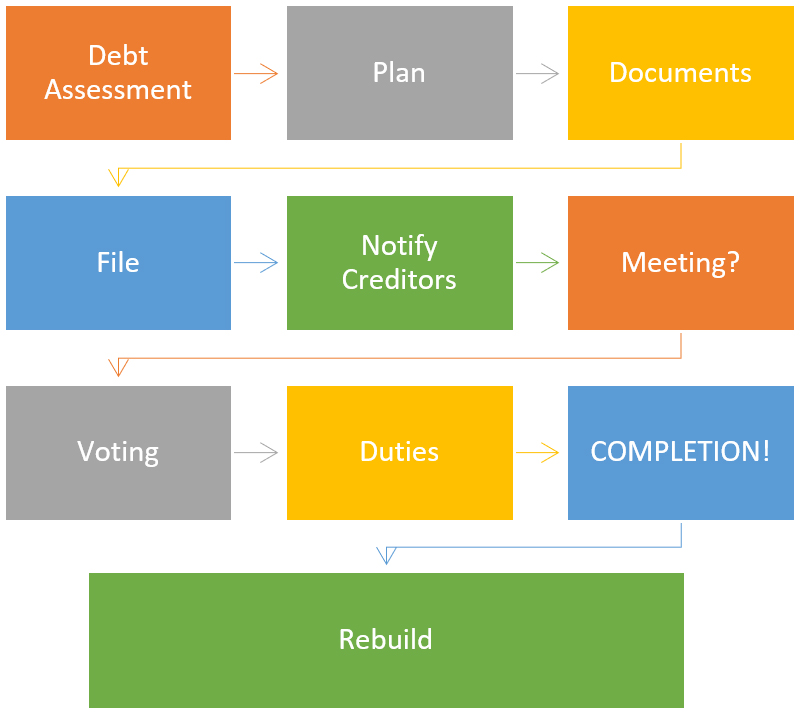

A consumer proposal is a legally binding, negotiated debt settlement made between you and your creditors. Here are the 10 steps for filing a consumer proposal in Ontario:

1. Contact a Licensed Insolvency Trustee for a debt assessment

All LITs in Canada provide a free initial debt assessment. During this consultation, your trustee will explain all your debt relief options to determine if a consumer proposal is the right solution for you. A consumer proposal helps you manage different types of debt, including unsecured debts that aren’t secured by assets. Types of debt that are unsecured generally include:

- Credit cards

- Lines of credit

- Personal loans

- Overdue phone and utility bills

- Payday loans

- Income tax debt

- Student loans (if you haven’t been a student for 7 years)

2. Determine the Offer and Payment Plan

Your trustee will ask you questions about your income, what you own and who you owe money to and work with you to determine how much to offer your creditors and how much your monthly payments will be.

3. Prepare the Consumer Proposal Documents

Your trustee will prepare all the necessary paperwork to document your proposal to creditors. This will include information about your current finances as well as how much debt you propose to repay, how long your proposal will last and what your monthly payment will be.

4. File the Proposal & Creditor Protection

Most trustees now file proposal documents electronically with the federal government and the court. Immediately upon filing you receive what is called a ‘stay of proceedings’ meaning your creditors can no longer pursue you for collection. You can now stop making payments against your unsecured debts. If a wage garnishment order has been issued, your trustee will arrange to have the garnishment stopped.

5. Creditors are Notified

Your LIT will send a copy of your proposal to all creditors listed in your proposal. If you forgot a creditor and they call you don’t worry. Just let them know you are in a proposal and have them contact your trustee for a copy of your proposal.

Your creditors have 45 days to decide to review your proposal or ask for a creditors meeting. During this time, the stay of proceedings is in place.

6. Potential Meeting of Creditors

Creditors have the right to ask for a meeting in order to discuss your proposal and ask questions. If creditors, totalling at least 25% of your debts, ask for a meeting then one must be held within 21 days. At this meeting, your creditors will vote to accept or reject your proposal or may propose a modified offer. Your LIT will attend the meeting with you and work as an intermediary to negotiate an offer that works for everyone.

7. Creditors Vote on the Proposal

If no meeting is required at the 45-day mark, your proposal is deemed to be accepted. If a meeting is held, creditors vote at the meeting. If a majority of the dollar value of your debts (51%) are voted in favour of the proposal, it passes and is binding on all creditors, even those who voted no.

8. Complete your Proposal Terms

Once the proposal is accepted, you will make your agreed-upon monthly payments. You will also be required to attend two credit counselling sessions. The credit counselling sessions provide financial education to help you budget and manage your finances more effectively. These sessions typically cover debt management, financial planning, budgeting, and related topics to help you understand the cause of your financial challenges and strategize on how to restore your credit. Attending these sessions and adhering to your payment schedule helps satisfy the terms of the proposal.

9. Obtain your Certificate of Full Performance

Once payments are completed you will receive a certificate that shows the terms of the consumer proposal have been completed and you will be relieved of any balance still owed from the debts that were in the proposal.

10. Rebuild your Credit History

Many people are worried about having a consumer proposal appear on their credit report. However, most clients find they are able to begin the process of improving their credit score while in the proposal by obtaining a secured credit card if they choose and most find they are able to build some savings both during and after the proposal since they are no longer making high debt payments.

If you are considering filing a consumer proposal with your creditors, contact us today at 1-866-747-0660 or email us to request a free evaluation and get started towards total debt freedom.

What is the Role of your Consumer Proposal Administrator?

All consumer proposal administrators in Canada are Licensed Insolvency Trustees. Your proposal administrator’s role is to:

- Review all your debt relief options

- Determine if you qualify for a consumer proposal

- Explain how a consumer proposal works

- Help you determine an affordable repayment plan

- Prepare the necessary forms for you to sign

- File your proposal agreement with the government (to make it legally binding)

- Talk to your creditors (so you don’t have to).

If you feel making an Ontario consumer proposal is the right debt solution for your debt problems your next step is to speak with a Licensed Insolvency Trustee. Hoyes Michalos is licensed as a consumer proposal Ontario trustee.

Questions about the Consumer Proposal Process

While these are the basics, many people have additional questions about what happens when you file a consumer proposal. Here are some additional topics that may interest you.

A Sample Proposal: Let’s assume you owe different creditors a total of $45,000 in unsecured debts. You may be able to propose to repay your creditors a total of $15,750 in exchange for the elimination of all your debt. You could offer to make payments over 36 months which would result in a payment of $437.50 a month. Alternatively, if your budget requires a lower payment, you could extend your repayment plan to a maximum of 60 months (the maximum time period for a consumer proposal is 5 years). That would result in a monthly payment of $262.50. Either way, you save $29,250 plus interest.

As you can see, the cost of your consumer proposal is structured through the negotiation process to ensure you can afford the monthly payments. In addition, as a debt settlement program, you repay much less than you owe.

How Long Does It Take for a Consumer Proposal to Be Approved?

When your Licensed Insolvency Trustee files your consumer proposal, they’ll inform your creditors by sending them copies of the proposal. Once notified, you enter consumer protection, and your creditor must cease collection activities against you.

Creditors have up to 45 days from the proposal filing date to review it and respond. They can accept, reject, or request changes to the proposal, in which case your LIT assists with negotiations. Meetings for negotiations must be held within 21 days of the request.

If the creditors holding the majority of debt accept, all creditors in the proposal are bound to its conditions. If creditors don’t respond, your proposal is considered accepted and proceeds according to the set terms.

What Happens if a Consumer Proposal is Rejected?

If the proposal is rejected, we will contact your unsecured creditors to determine if they would accept alternate terms. In many cases increasing your payment by $50 or $100 per month may be enough to get your creditors to accept the proposal. You also have the option of filing bankruptcy. Creditors realize that if they don’t accept your proposal you may file bankruptcy, and that often encourages creditors to accept all reasonable offers.

What if I Stop Making the Payments and Default on the Performance of the Proposal?

At Hoyes, Michalos we offer convenient pre-authorized payment plans, and you can select the payment frequency that works for you; weekly, bi-weekly, semi-monthly or monthly. Having a convenient payment schedule reduces the likelihood that you will fall behind on your proposal payments.

If you fail to keep up with the terms of your debt proposal, then the proposal will be annulled. Your creditors would have a claim against you for the amount owed to them before the proposal, minus any amount you paid to them during the proposal.

More common questions about consumer proposals can be found on our Consumer Proposal FAQ page.