Why File a Consumer Proposal?

The purpose of a consumer proposal is to help you get out of debt sooner by making a deal with your creditors to repay less than you owe. Consumer proposals are the only government-approved debt settlement program in Canada.

While there are pros and cons with a consumer proposal, 75% of Ontario insolvencies are consumer proposals, and 70% of Canadians choose a proposal over bankruptcy as their preferred debt relief solution. A consumer proposal is considered the #1 alternative to bankruptcy for good reason.

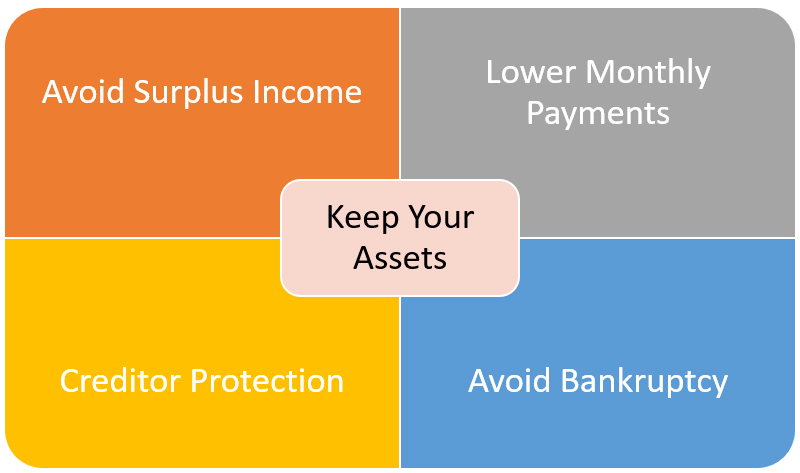

Top Advantages of Consumer Proposals

For those who qualify, a consumer proposal has several key advantages over other debt relief programs:

- It is a negotiated debt settlement arrangement that can reduce debts by up to 70%

- You repay only a portion of your total debts

- You make one affordable monthly payment

- Interest is frozen when you file

- You keep all your assets, including your car and home equity

- It is legally binding on all your creditors as long as the majority agree

- The payment terms do not change even if your financial situation improves

- It stops all creditor actions, including collection calls, lawsuits and garnishments

- You will have a better-balanced budget and can be debt free in 3 to 5 years

- You avoid filing bankruptcy

Let’s look more in-depth at how effective a consumer proposal can be to eliminate debts.

You Keep Your Assets With a Consumer Proposal

One of the biggest advantages of a consumer proposal is that your assets are protected. In a bankruptcy, you are required to surrender all non-exempt assets. In a proposal, you keep all assets, including any tax refunds, investments and equity in your home. A consumer proposal is a viable debt consolidation option for homeowners struggling with high credit card balances and other unsecured debts.

You Can Avoid The Surplus Income Penalty

Bankruptcy has a concept called surplus income which means the more you make the higher your bankruptcy payments. This can make monthly bankruptcy payments very expensive.

Consumer proposals can be a more strategic solution because they have a fixed payment that never increases. If you have a higher household income or expect your income to increase, consumer proposals can help you avoid the surplus income penalty by extending your repayment term.

Consumer Proposals Mean Lower Monthly Payments

In a consumer proposal, you negotiate to repay only a portion of your debt. It is not unusual to see debts reduced by as much as 70% of the original amount owed. A consumer proposal is one of the best and safest debt consolidation options available. Creditors will generally accept your consumer proposal if you offer more than they would expect to receive in a bankruptcy.

Interest stops during a consumer proposal, resulting in significant savings over a debt consolidation loan or second mortgage.

You Get Creditor Protection

As a legal process under the Bankruptcy & Insolvency Act, a consumer proposal provides creditor protection through a legal stay of proceedings. This stay is effective as soon as you file and will stop collection calls and wage garnishments.

Once your consumer proposal is approved by the majority of your creditors, it is binding on all creditors.

You Avoid Bankruptcy

Many people need debt relief but want to avoid filing bankruptcy out of a sense of embarrassment. For others, a consumer proposal does not have an impact on employment or professional certifications that may be the case if they go bankrupt.

If you feel you would like to repay what you can, a consumer proposal is a safe alternative to discuss with a Licensed Insolvency Trustee.

What Are the Risks of Consumer Proposals?

Is a consumer proposal worth it? While consumer proposals are becoming more common in Canada, they are not a good option for everyone.

There are downsides of filing a consumer proposal:

- A consumer proposal will usually take longer to complete than a bankruptcy. By lowering your monthly payment through a consumer proposal, you are paying your creditors their recovery over a longer time. However, if your financial situation improves, you can pay off a proposal early.

- A consumer proposal does affect your credit rating. An R7 note will remain on your credit report for a maximum of 6 years from the date of filing. However, you can rebuild your credit, and we do find that most people can get a secured credit card during a consumer proposal.

- Your creditors may not approve your proposal terms. Creditors expect to receive a little more than they would get in bankruptcy and some creditors have higher payout expectations. While 99% of proposals are accepted, some require additional negotiation, and if you offer less than the majority (by dollar value) are willing to accept your proposal will not be approved.

- Some debts cannot be discharged in a consumer proposal. Secured debts, family law support payments, tickets and fines, debts due to fraud and student loans if you have not been out of school for seven years are not eligible to be included in a consumer proposal.

When is bankruptcy better?

If you do not have any assets or do not have significant income, filing personal bankruptcy may be your best choice. During your consultation, your Licensed Insolvency Trustee will explain the pros and cons of each alternative.

Who Should I Talk to About a Consumer Proposal?

A consumer proposal is a legally binding debt settlement process administered by a Licensed Insolvency Trustee. Trustees are licensed by the Superintendent of Bankruptcy and are regulated as consumer proposal administrators.

If you think a consumer proposal is the right solution for you, the next step is to talk with a Licensed Insolvency Trustee. Your trustee will review your debts and financial situation and help you develop a repayment plan you can afford.

A WORD OF CAUTION: You do not need a referral to speak with a Licensed Insolvency Trustee nor do you need to pay anyone to help you prepare any paperwork. Please be cautious of debt consultants who advertise about consumer proposals and offer to get you a better deal than your trustee. Creditors do not like dealing with these debt consultants and they are rarely able to arrange a better deal and certainly do not warrant the large fees they charge.

At Hoyes Michalos, you always meet with a Licensed and Certified debt expert, never a salesperson. Ask us if a consumer proposal is right for you.

More about the effects of a proposal on our blog:

Find out how to file a consumer proposal in Canada or contact us for a free consultation.