How to Choose the Right Debt Consolidation Service

Are you juggling one creditor to pay another? Balancing credit payments against household expenses? If so, you may be looking for a way to consolidate credit so you can lower your monthly payments. Unfortunately, debt consolidation comes in many shapes and sizes in Canada. Knowing which to choose can be a challenge.

What is Debt Consolidation? Debt consolidation is the process of combining several outstanding debts into one monthly payment. This may or may not involve a debt consolidation loan. Depending on the debt consolidation option you choose, you may be able to lower your interest rate or get complete interest relief. Some debt consolidation approaches can even provide debt relief in the form of some debt forgiveness.

In Canada there are 4 basic debt consolidation services to choose from. You can consolidate debt by:

- Consolidating debts or refinancing with a debt consolidation loan

- Repayment with a debt management plan

- Debt settlement programs

- Consolidating and eliminating debt with a consumer proposal

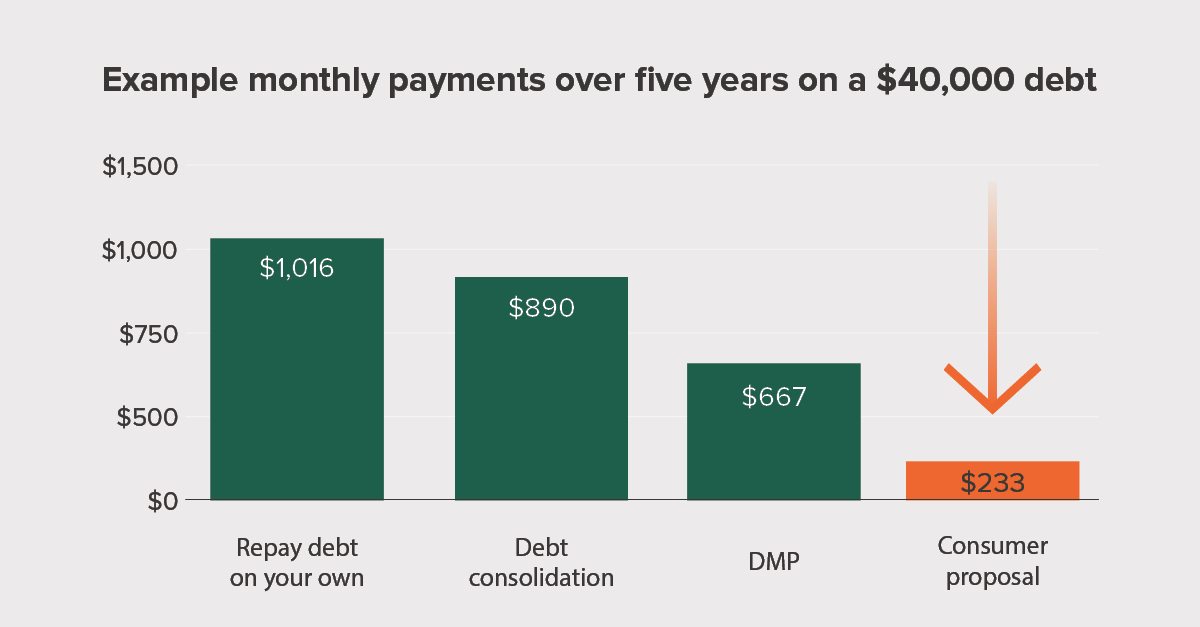

We explain the advantages, disadvantages and risks of each of these options below. A consumer proposal is often the safest, lowest cost debt consolidation option if you are dealing with more than $10,000 in debts, can’t qualify for a debt consolidation loan and are struggling to keep up with your monthly payments.

Compare the cost of different debt consolidation options based on your debt by using our debt repayment calculator.

1. Consolidating with a Debt Consolidation Loan

A debt consolidation loan is a loan that allows you to repay many other debts. For example, if you have three credit cards, you may be able to get a debt consolidation loan to pay off the credit cards, so that you only have one payment instead of three each month. You are consolidating your many debts into one, by refinancing with a new loan to pay off several old debts.

A debt consolidation loan can take the form of a second mortgage on your home (also called a home equity loan), a line of credit or a bank loan secured by some other asset or guaranteed by a family member or friend.

To qualify for debt consolidation you must meet the following:

- The bank will require a copy of your monthly budget to determine if you can meet your loan payments.

- You must be working, or have a source of income to allow you to repay the loan.

- You may require a co-signor or collateral (such as a car or a house). This could put your home or other property at risk.

- You are still paying interest and must be able to meet your consolidated payments.

Advantages of refinancing through debt consolidation:

- You replace many payments each month with only one payment, which should make it easier to budget your cash each month.

- Your debt consolidation loan may have a lower interest rate than the rate you are paying on credit cards, so the loan should reduce your interest payments.

- With lower interest rates and/or extended terms, you may be able to reduce your total monthly payments.

Disadvantages of debt consolidation loans:

There is one big disadvantage to debt consolidation: your total debt stays the same. If you owe $20,000 on five credit cards you may be able to qualify for a $20,000 debt consolidation loan, but even if you do you will still owe $20,000! You have not reduced your total debt, so you will still be required to repay $20,000 plus interest to become debt free.

- You do not eliminate any debt. A debt consolidation loan trades one new loan, for your existing loans.

- If you have bad credit, your interest rate may be high

- Depending on your payment terms, it can take longer to get out of debt with a debt consolidation loan.

Risks with consolidating through a debt consolidation loan:

- If you consolidate credit card debt with a debt consolidation loan, you may risk running up your credit card balances again.

- If you take out a second or third mortgage and housing prices fall, you may end up owing more than your house is worth.

- If interest rates rise, your monthly payments will increase.

What happens if I don’t qualify for a debt consolidation loan or second mortgage?

As a rule of thumb, most lenders will loan you up to 80% of the value of your home through a mortgage, Home Equity Line of Credit (HELOC), or second mortgage. If for example your home is valued at $400,000 you can qualify for a home equity loan of up to $320,000.

Certain secondary lenders will loan up to 90% or even 95% of the value of your home if you have reasonable credit. You should beware, however, that a high ratio mortgage will come with a high interest rate.

Even if you have some equity in your home, or think you can afford the payments, you may be denied debt consolidation due to:

- lack of income

- too much overall debt

- a poor credit score or credit history.

If you’ve contacted your bank or a mortgage broker and failed to qualify, or the rate you were quoted is much more than you can afford, your next step is to consider alternative ways to consolidate like a debt management plan or consumer proposal.

2. Interest Free Debt Management Plans

A debt management program, offered through a credit counselling agency, allows you to consolidate certain debts, like credit card debt. You make one consolidated credit payment, like any other debt consolidation program, however, your credit counsellor may be able to negotiate an interest free period or interest rate reduction.

How a debt management plan works:

Your credit counsellor will work with you to create a payment schedule to repay your credit card debts within 3 years. There is no debt forgiveness in a debt management plan. You must be able to repay your debts in full during that time period.

Advantages of a Debt Management Plan to Consolidate Debts

- You can choose to include or exclude certain debts

- You get interest relief allowing you to pay off your debts sooner

- You make one monthly payment to your credit counsellor who deals with your creditors

Disadvantages of a DMP

- Not all debts can be included such as tax debts or payday loans.

- You must repay your debts in full within 3 years.

Risks of using a credit counselling agency to consolidate debts

- Not all creditors will agree to combine their debts into the program

- If you can’t afford to repay your debts in full, you may not be able to complete the program

3. Debt Settlement or Debt Consolidation?

There are several debt consolidation companies in Canada that are really offering debt settlement services. They are not offering you a new debt consolidation loan. Instead, what they are offering is to combine selected debts (usually just credit card debt) into a single payment with their agency. Some may charge significant up-front fees and may or may not be successful in negotiating with your creditors. Our recommendation is to be cautious when dealing with any agency that is not licensed or accredited in some way.

If you only have one or two creditors, you may be able to successfully negotiate a debt settlement on your own. The advantage of talking to your creditors yourself is that you avoid any unnecessary extra fees. You will know up front that you have their agreement. This lowers the risk that you may assume if you sign a contract with a debt settlement company for debt settlement or debt consolidation services if they are ultimately unsuccessful or just refer you to a Licensed Insolvency Trustee whom you can see for free.

4. Consolidating Debt with a Consumer Proposal

A debt consolidation loan may not be your best option when it comes to consolidating and reducing your debts. There are several reasons why a consumer proposal may be a better debt reduction solution when you are looking to consolidate credit into a single, lower monthly payment.

Advantages of a consumer proposal

- Deals with almost all unsecured debts;

- Results in one, single, lower monthly payment;

- Eliminates interest;

- No loss of assets or security needed;

- Provides debt relief because you repay less than you owe

- Stops creditor actions like a wage garnishment and collection calls

While exploring a debt consolidation loan first is a good option, if you don’t qualify for a debt consolidation loan, or cannot afford to repay your debts in full, talk to us about a consumer proposal.

Hoyes Michalos & Associates provides debt consolidation services in the following locations

Other service areas

We offer the convenience of phone and video-conferencing only services for the following additional areas. Many people find it advantageous to begin the initial consultation and debt assessment over the phone or by video. If you decide to file, you can sign and complete your paperwork electronically. Credit counselling sessions can also be completed through video conferencing, which eliminates the need to miss work or schedule a time to attend the office.