When heavily indebted consumers are in a financial crunch, they often turn to what we call Rapid High-Cost Loans.

Despite warnings over the years about the dangers of these types of loans, insolvent consumers are heavy users of Rapid Loans. We see more insolvent borrowers taking on more high-interest loans in higher dollar amounts than ever before.

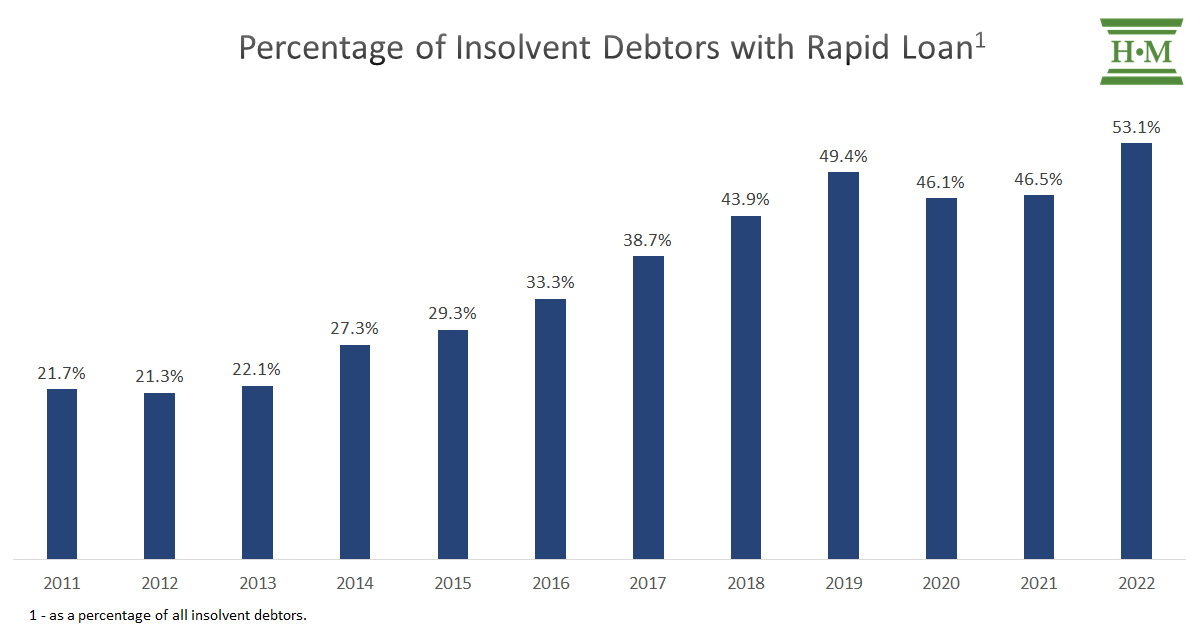

Our annual Hoyes, Michalos & Associates Inc. study for 2022 reveals that more than half of all insolvencies involve Rapid Loans. The pace of use of these ultra high-cost loans among heavily indebted borrowers continues to increase, and these loans are a significant driver of consumer insolvencies.

Over Half of Insolvencies Involve Rapid Loans

Today, more than half (53%) of all consumer insolvencies involve Rapid Loans. This is a staggering shift from when we first started our insolvency study in 2011.

Historically, subprime borrowing among insolvent debtors focused on two types of lenders: payday loans from traditional payday lenders and high-cost financing loans, the most common being ‘furniture loans’ from specialized financing companies. Today the high-cost credit market looks different. It’s rapid, easy to access, and it’s often about cash. What we are seeing today is not just an increased use of payday loans but a much more dramatic rise in the use of larger, longer-term, high-interest installment loans. These loans carry a minimum interest rate of 29.99%, and we often see loans between 39.99% and 59.99%. They also include relatively high fees in addition to higher interest rates.

Traditional payday lenders have expanded into longer-term credit options, and more specialized subprime lenders have increased their market share with convenient online access and polished advertising. Fin-tech options like Buy Now, Pay Later apps have also begun appearing more frequently among insolvent debtors.

Given this, we have defined a new category of loans for review called Rapid High-Cost Loans, or ‘Rapid Loans’ for short.

We classify loans into this category if they meet a significant number of the following criteria:

- Fast funds, easy application process, often online.

- No collateral required.

- High odds of approval, regardless of credit score.

- Payday loan fees or interest rates of 29.99% or higher.

- Loans can be short term or installment (up to 60 months).

- May carry weekly or bi-weekly payment options so payments appear low.

- Often include additional fees or high insurance premiums.

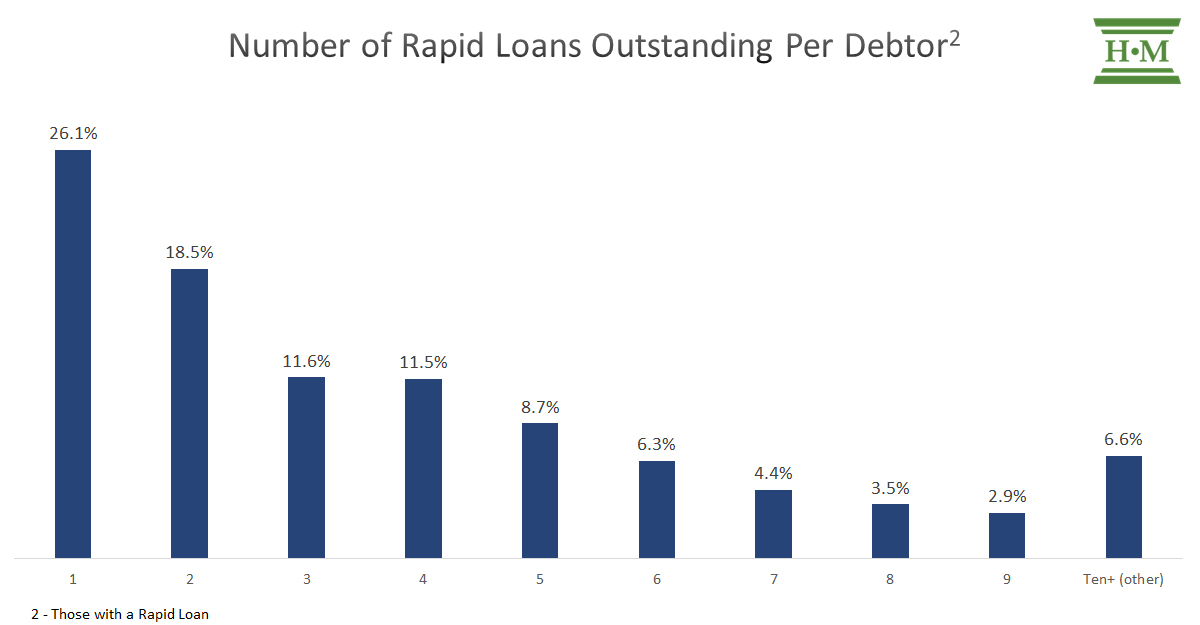

The cycle is simple. An insolvent borrower needs cash, often because pre-existing debt payments consume much of their paycheque. They borrow from their first Rapid Loan lender. Unfortunately, they still have negative cash flow, so they borrow from a second Rapid Loan lender to pay off the first. They may then borrow more through a larger installment loan, trying to consolidate debt into a smaller monthly payment in an attempt to get ahead of the cycle. Ultimately, they find themselves indebted to several rapid lenders with high interest costs consuming more and more of their income.

As we shall see, Rapid Loans are becoming a dominant factor in consumer insolvencies. We see these loans in both increasing numbers and size.

While the average insolvent Rapid Loan borrower has 4.0 outstanding Rapid Loans, 74% of borrowers have two or more Rapid Loans simultaneously, and a staggering 7% owe at least ten different Rapid Loan lenders.

Multiple loans are not hard to obtain because the lending process is often done online. Payday loan lenders do not report loans to the credit bureaus, and there is no central database to track Rapid Loans. Subprime lenders expect heavy loan losses, and as long as most borrowers make sufficient payments, these loans are profitable enough not to worry about multiple loans across different borrowers.

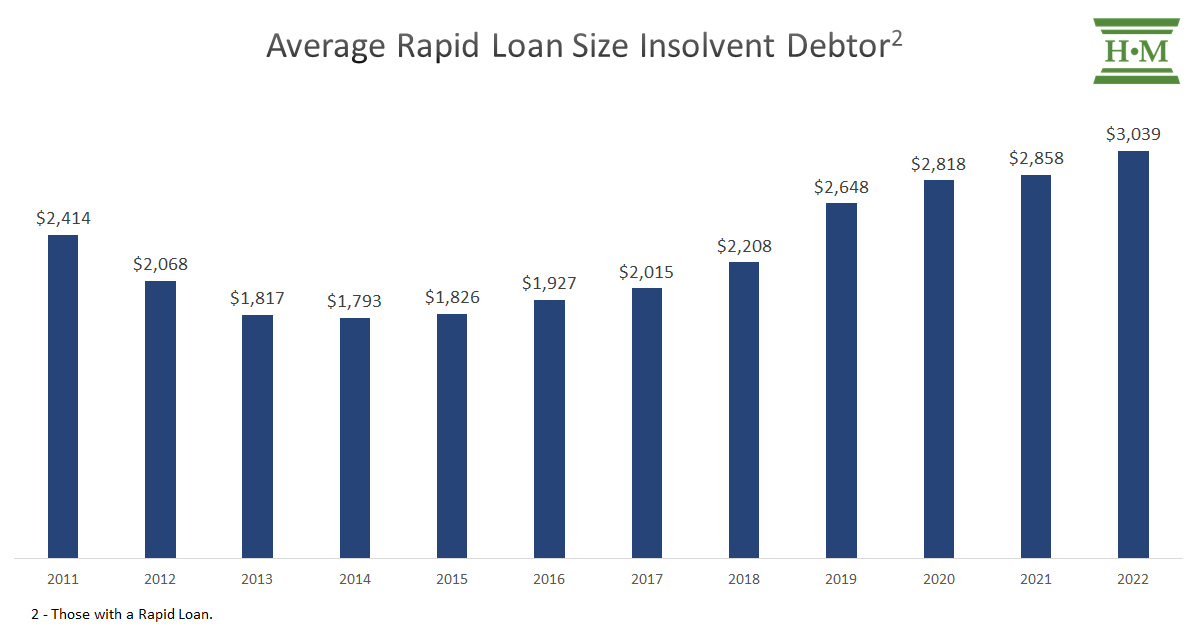

The average Rapid Loan size has increased due to the trend toward larger and longer-term installment loans. The average individual Rapid Loan size among insolvent borrowers in 2022 was $3,039, 6.3% higher than in 2021 but more than 50% higher than in 2017 when we began to warn of the rising use of payday lenders.

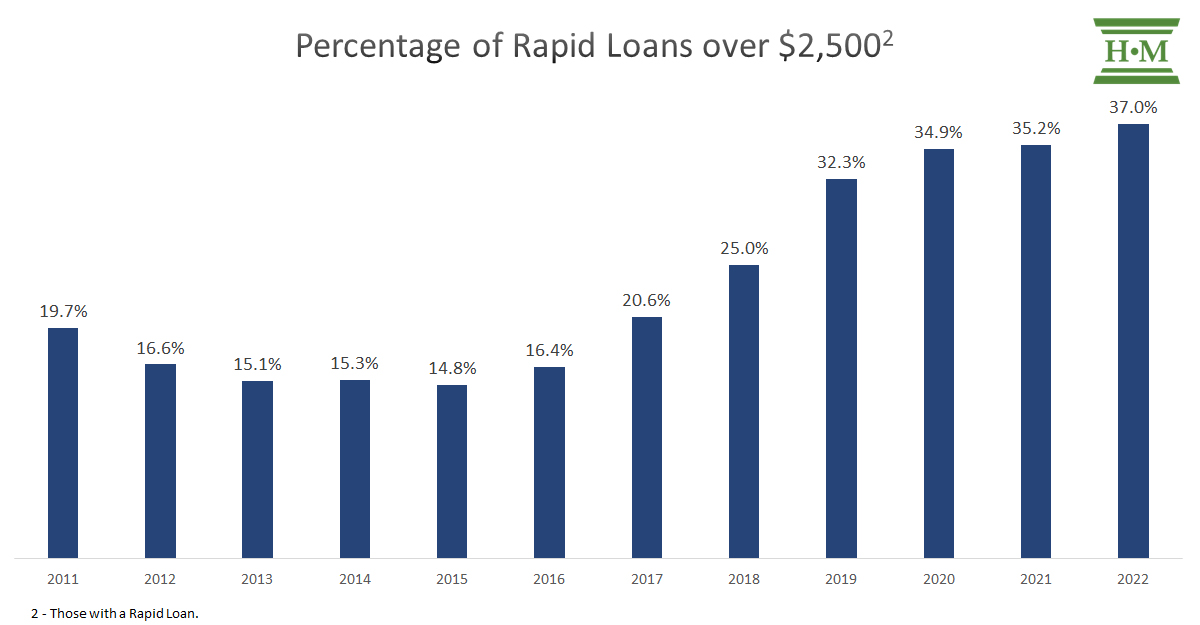

More than one-third (37%) of all individual Rapid Loans were over $2,500, a trend that has been increasing since 2016. Easy access to higher dollar installment loans is driving average loan size up.

Rapid High-Cost Loans Escalate Debt Burden

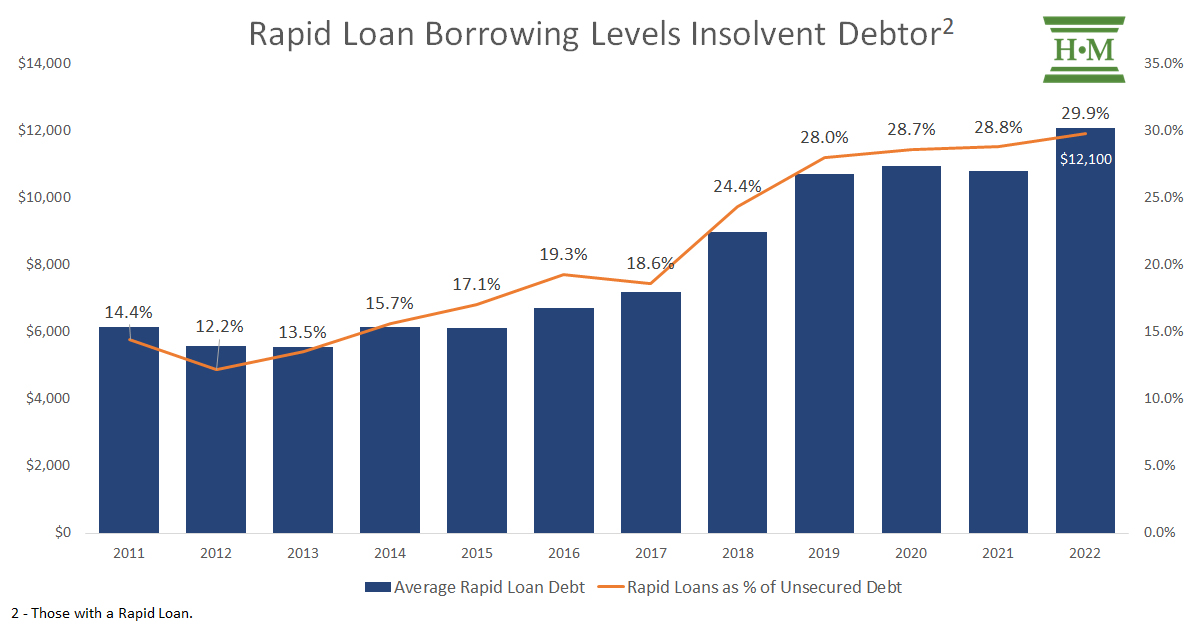

The cost of these loans has a devastating impact on heavily indebted borrowers. In 2022, the average insolvent Rapid Loan borrower owed $12,100 in Rapid Loans accounting for 30% of their total unsecured debt.

Insolvent debtors use Rapid Loans to keep up with existing debt repayment and keep up with living expenses. Unfortunately, their loan costs are higher, leading them to file for insolvency on a smaller debt balance. The average insolvent Rapid Loan borrower owes 22% less total average debt at $40,533 than Joe Debtor, who owes an average of $49,316.

And as mentioned, it’s not just payday loans. It’s high-cost installment loans. Here is a typical example of a sub-prime installment loan:

Joe Debtor borrows $3,000 at 45.9% for a term of 36 months. The interest on the loan, if paid full term, is $2,496. He is also required under the contract to carry borrower’s life insurance. He is unlikely to get this on his own, so he ‘opts in’ (under duress) to the lender’s program at a further cost of $3,858. As a result, Joe Debtor pays a total of $9,354 to repay a 3-year loan of $3,000.

And this is not the highest interest we’ve seen. Rates as high as 59.99% are legal in Canada.

Who Is Using Rapid Loans?

Below is a more detailed breakdown by demographic.

Nearly No Gender Divide

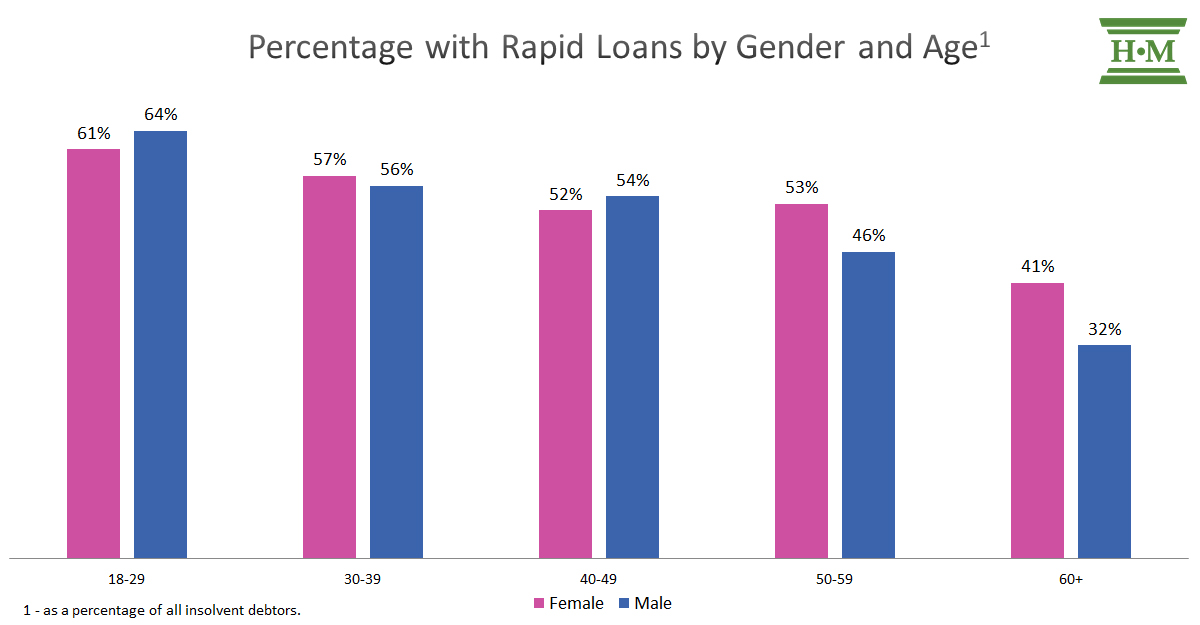

On average, female debtors are slightly more likely (54%) to use Rapid Loans to excess than male debtors (52%). Women tend to owe less, although they take out larger individual loans.

| Rapid Loans by gender | Female | Male |

| % with Rapid Loan | 54% | 52% |

| Rapid Loan debt | $11,744 | $12,495 |

| Rapid Loan as % of income | 400% | 419% |

| Number of loans | 3.8 | 4.2 |

| Average Rapid Loan size | $3,083 | $2,993 |

| % over $2,500 | 37.4% | 36.6% |

Women are more likely to use Rapid Loans than men once they reach their 50s. At this stage, they mainly turn to high-interest installment loans to supplement their income.

Young Debtors Use Rapid Loans More Often, and Older Debtors Borrow More

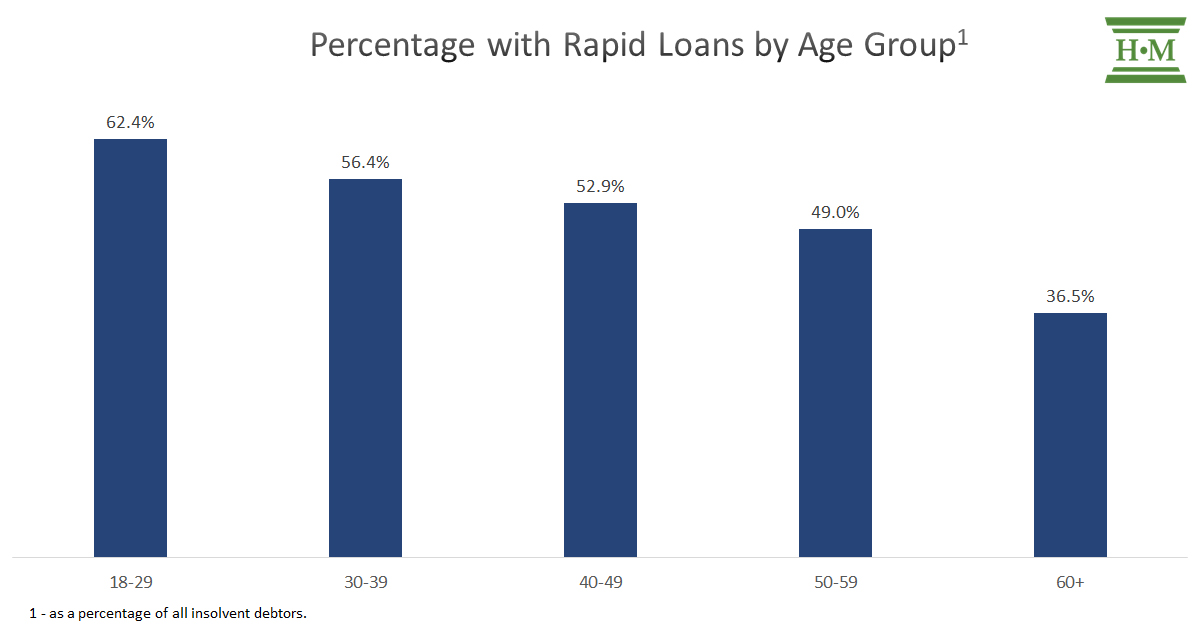

Over 62% of debtors aged 18-29 have at least one Rapid Loan, and the numbers are well over 50% for those aged 30 to 49. Even those over 60 are heavy users, with 37% of debtors 60+ having a Rapid Loan.

There are a few factors that help explain the increased use of Rapid Loans:

- The growing shift to online by subprime lenders, coupled with less hesitation to borrow loans through an app or a website.

- Debtors are attracted to the low weekly or bi-weekly payments which give a false sense that the loan is affordable.

- Debtors do not understand the full costs of Rapid Loans or are so desperate they do not fully comprehend the long-term financial implications.

- They are relying on Rapid Loans after running up their credit cards. 85% of insolvent Rapid Loan borrowers have at least one credit card.

| Rapid Loans by age group | 18-29 | 30-39 | 40-49 | 50-59 | 60+ |

| % with Rapid Loan | 62% | 56% | 53% | 49% | 36% |

| Rapid Loan debt | $10,780 | $11,861 | $13,715 | $12,447 | $10,571 |

| Rapid Loan as % of income | 415% | 394% | 421% | 440% | 374% |

| Number of loans | 3.9 | 4.1 | 4.3 | 3.6 | 3.2 |

| Average Rapid Loan size | $2,749 | $2,898 | $3,166 | $3,474 | $3,257 |

| % over $2,500 | 34% | 36% | 37% | 42% | 39% |

Loan size increases with age, partially tied to income but primarily to the increased use of larger installment loans among older debtors.

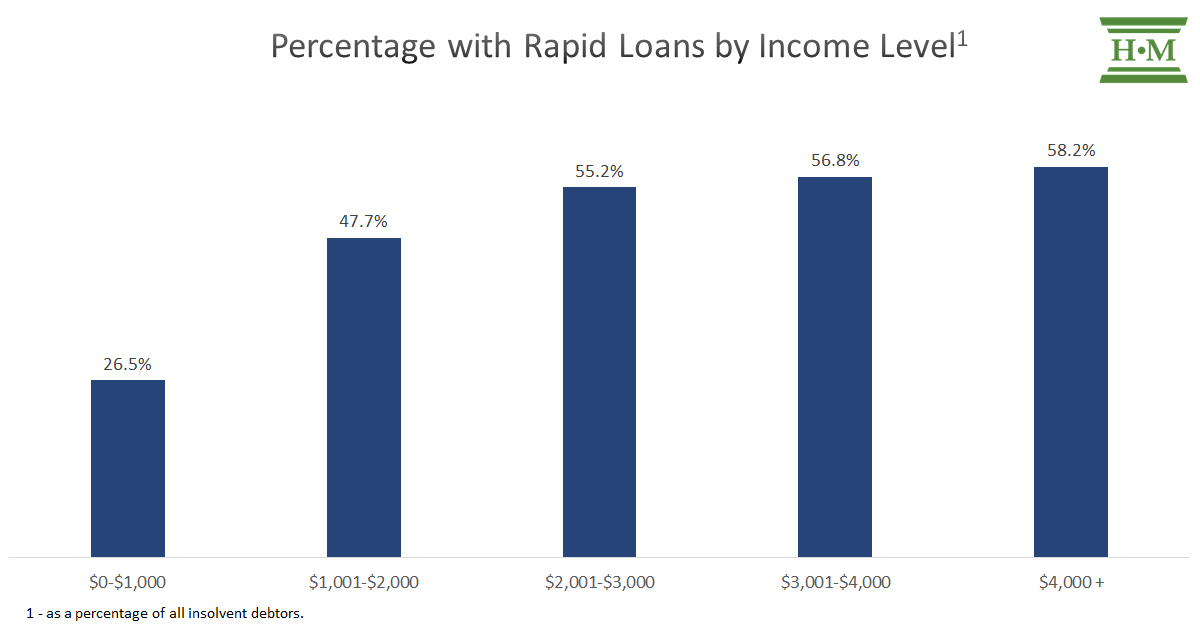

Rapid Loans Used Mostly By High-Income Earners

It is a common misconception that Rapid Loans, especially payday loans, are used primarily by low-income earners. Our study of insolvent debtors confirms that middle- and higher-income earners are much more likely to use Rapid Loans to excess. The average monthly income for a Rapid Loan borrower is $2,957, compared to $2,842 for all insolvent debtors.

Middle to high-income earners take out more multiple loans than lower-income earners. Debtors with incomes over $3,000 have an average of 4.2 Rapid Loans compared to 3.3 for those with incomes of $2,000 and below.

| Rapid Loans by income group | $0 – $1,000 | $1,001 – $2,000 | $2,001 – $3,000 | $3,001 – $4,000 | $4,000+ |

| % with Rapid Loan | 26% | 48% | 55% | 57% | 58% |

| Rapid Loan debt | $10,507 | $9,423 | $11,370 | $13,185 | $14,879 |

| Rapid Loan as a % of income |

1781% | 573% | 447% | 381% | 310% |

| Number of loans | 3.5 | 3.3 | 3.9 | 4.4 | 4.2 |

| Average Rapid Loan size | $3,034 | $2,886 | $2,927 | $2,965 | $3,565 |

| % over $2,500 | 39% | 36% | 36% | 36% | 42% |

Is There a Solution to Rapid High-Cost Lending?

The issue is that increasing availability of easy-access credit options leads to more borrowing, and high-cost options can quickly lead to insolvency.

High-cost installment loans carry a lower interest rate than a traditional payday loan, but the size can be much larger. Where traditional payday loans are usually under $1,000, installment loans of up to $15,000 are common. Larger loans, with longer repayment periods and extremely high-interest rates, create a debt cycle that is difficult to repay. As outlined in this report, many debtors take on multiple loans to continue the cycle.

The Government of Canada is considering lowering the criminal interest rate in the Criminal Code of Canada, which may help. More specifically, we agree that additional fees should be included in the calculation of what is interest as these fees severely increase the repayment burden.

Also, insurance fees should be restricted in terms of the percentage of the loan or monthly payment and should not be mandatory. We believe the extreme high interest rate should be sufficient to cover loan losses without mandatory insurance requirements and their related high premium costs.

Beyond that, little can be done except increase consumer awareness and financial literacy. Struggling debtors take on these loans because weekly or biweekly repayment options appear low and affordable. They are also desperate and typically do not have other options.

Media Inquiries

If you would like to request an interview or need background information, please contact:

Email Doug: doug@hoyes.com

Email Ted: ted@hoyes.com

or phone 1-866-747-0660.

How to cite: Hoyes, Michalos & Associates Inc. Annual Bankruptcy Study, 2021. Published February 13, 2022. https://www.hoyes.com/press/joe-debtor/

External Sources:

- A generational portrait of Canada’s aging population from the 2021 Census https://www12.statcan.gc.ca/census-recensement/2021/as-sa/98-200-X/2021003/98-200-X2021003-eng.cfm – percentage calculated by Hoyes, Michalos

- Calculated by Hoyes Michalos from data provided by Statistics Canada Table 36-10-0639-01 Credit liabilities of households https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610063901 and Table 38-10-0238-01 Household sector credit market summary table https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3810023801

Douglas Hoyes, CPA, Licensed Insolvency Trustee, Co-founder Hoyes Michalos.

Doug was inspired to bring his financial experience to work by helping individual people not corporations rebuild their financial future. Doug advocates for consumers needing debt relief to ensure they receive a fair and respectful debt management solution. He regularly comments in the media including publications and networks such as Canada AM, Global News, CBC, The Globe and Mail, The Toronto Star, Business News Network, The Financial Post and CTV News. Doug also posts regularly to our blog, on Twitter, Google+, and Huffington Post Canada.

Ted Michalos, CPA, Licensed Insolvency Trustee, Co-founder Hoyes Michalos

Ted Michalos strongly believes that debt management advice should be delivered without gimmicks and without tricks. He is enthusiastic about ensuring clients understand all of their options and that Hoyes Michalos helps them develop a custom-tailored plan to deal with their debts. Ted is a prolific writer, contributing answers and advice on our blog and on several insolvency and debt relief sites, including Advisor.ca. He has appeared as an expert on bankruptcy and debt-related matters including appearances on CBC News, Global TV and Business News Network.

Company Background

Hoyes, Michalos & Associates Inc. is a Licensed Insolvency Trustee firm that has provided personal bankruptcy and consumer proposal services to individuals in Ontario since 1999. Co-founded by Doug Hoyes and Ted Michalos, we are one of the largest firms in Canada practicing exclusively in the area of personal insolvency. With offices throughout Ontario, Hoyes Michalos provides real debt management solutions to help Ontarian’s climb out of debt.

Get Industry Insights

Hoyes Michalos issues monthly consumer insolvency updates delivered straight to your inbox. Sign up for future releases and our annual Joe Debtor study.

You can unsubscribe from e-alerts at any time. Read our privacy statement here.

You have been added to our industry insights list. We will notify you as we publish monthly consumer insolvency updates, as well as, share our annual bankruptcy study.

If you would like to request an interview or need background information, please contact:

Email Doug: doug@hoyes.com

Email Ted: ted@hoyes.com

or phone 1-866-747-0660.