If you are struggling with debt and bill payments but want to avoid bankruptcy, a consumer proposal in Toronto may be the right solution for you.

An Experienced Consumer Proposal Team

Hoyes Michalos has an experienced team of 7 Licensed Insolvency Trustees and 6 Credit Counsellors in Toronto who can help you determine if you should file a consumer proposal to deal with your debts.

With 9 locations across Ontario, an A+ rating on the Better Business Bureau and an excellent rating from our clients, we will work tirelessly to provide you with the best debt solution for you and your family.

Get Debt Help – Toronto Locations. Find an office near you:

Some of our success stories

Our team understands the unique situations faced by people living and working in the Toronto area especially the high cost of housing. We also meet with many professionals, especially in the core and downtown Toronto, for whom bankruptcy is not an option because it will affect their professional designation. Lawyers, accountants, real estate agents, insurance agents, and other professionals are not able to file bankruptcy without negative complications with their licensing body. A

Gig work is also a factor we address. If you work part-time, have a variable income, proposal payments can be structured around that option. Toronto professionals can also earn a higher income, leading to the possibility of a surplus income penalty in bankruptcy. A consumer proposal is a good alternative that helps you avoid this penalty.

As you can see, we understand the complexity of each individual situation. Our team is here to help educate you on the options available to you.

See more reviews and testimonials

What is a consumer proposal?

A consumer proposal is a negotiated agreement between you and your creditors where you offer to repay a percentage of what you owe, and your creditors agree to forgive the remainder of your debt.

For example, you might owe $35,000 in credit card debts, bill payments, and other unsecured debts. Working with a Licensed Insolvency Trustee, you may be able to make a settlement arrangement to repay only $12,000 in single monthly payments of $200. Every financial settlement is unique, and we’ll explain more about that later, but savings of up to 70% are possible.

How popular are consumer proposals in Toronto?

In 2021, almost 8,400 people in the greater Toronto area, including Brampton, Markham, Mississauga, Scarborough, and Vaughan, filed a consumer proposal for debt relief. In comparison, only 2,300 individuals filed personal bankruptcy. The growth in popularity of consumer proposals has increased in recent years.

| Year | % Proposals |

|---|---|

| 2015 | 62% |

| 2016 | 64% |

| 2017 | 66% |

| 2018 | 69% |

| 2019 | 73% |

| 2020 | 78% | 2021 | 79% |

Consumer proposals have gained in popularity as an alternative to bankruptcy because of higher incomes and higher home equity in Toronto. Consumer proposals are a more common approach than in other areas of Ontario. In 2021, 79% of GTA insolvency filings were consumer proposals compared to 75% for all of Ontario and 70% across Canada.

What are the pros and cons of filing a consumer proposal?

A consumer proposal is a good alternative to bankruptcy, but it’s not the right debt solution for everyone. Here are some pros and cons to discuss with your trustee.

Top advantages of a consumer proposal

- You repay only a portion of your total debts.

- You keep all assets.

- Settlement offers are agreed to upfront.

- Monthly payments are based on your budget, so they are affordable

- Consumer proposals are interest-free repayment plans.

- Once accepted, proposals are legally binding on all your creditors.

- A consumer proposal stops creditor actions like collection calls, lawsuits, and wage garnishments.

Disadvantages of a consumer proposal

There are some implications you need to consider carefully before signing up to file a consumer proposal.

- A consumer proposal does not deal with secured creditors.

- A proposal cannot be filed by everyone. You must be insolvent to be eligible to file.

- If you miss 3 months’ payments your proposal will be annulled, and your debts will return.

- A consumer proposal does negatively affect your credit.

Who is eligible to file a consumer proposal?

To be eligible to file a consumer proposal, your total consumer debt has to be $250,000 or less. Consumer debt is defined as all debt other than the mortgage on your principal residence. The minimum amount is $1,000 of debt. You also have to be unable to pay your debts.

A consumer proposal deals with unsecured debts including:

- credit card debt,

- bank loans,

- payday loans,

- finance company loans,

- income taxes and other Canada Revenue Agency debts.

- Canada student loans can also be discharged through a consumer proposal if you have been out of school for 7 years.

A proposal does not affect your mortgage or car loan. If you can afford to keep up with the payments, you can keep your home and car. You can choose to return the asset to the lender and include any shortfall in your proposal.

It is not uncommon for spouses to have shared debts. In these circumstances, it is possible to file something called a joint consumer proposal. To qualify your total combined unsecured debts cannot exceed $500,000.

If you owe more than $250,000, you can still make a proposal to your creditors by filing a Division I Proposal.

What does a Toronto consumer proposal cost?

The cost of a consumer proposal is determined by what kind of deal you can make with your creditors. There are no upfront or additional fees. What your creditors agree to accept is what you pay. Trustee fees are paid out of the settlement offer before monies are distributed to your creditors.

The starting point is for your trustee to calculate what you would pay if you filed bankruptcy. This is the minimum your creditors are willing to accept. Your trustee will calculate:

- The net sales value of any assets you would have to surrender in a bankruptcy

- Any surplus income payments you may have to make if you filed bankruptcy.

Toronto is an expensive city and incomes are often higher there than in other cities across Ontario. For this reason, many individuals in the Greater Toronto area trigger the surplus income penalty in a bankruptcy. That is why so many of our clients choose to file a consumer proposal over bankruptcy. A consumer proposal is a way to spread that penalty amount over up to 5 years to lower your monthly payment.

Next, your trustee will review your list of creditors. Certain creditors expect a minimum recovery, others do not. If you have a single creditor that has voting majority control, your trustee will also advise you if you might need to sweeten the pot a little with a higher offer to get them on side.

Why would my creditors agree?

A consumer proposal is not automatic. Your creditors have to agree to your offer for it to become legally binding. Many people ask why a creditor would agree to allow you to pay less than the full amount of what you owe. If you are offering more money than what your creditors would receive out of bankruptcy, most times they will say yes.

Some people ask why they would file a consumer proposal if it means paying more than bankruptcy. One reason is that bankruptcy could mean losing important assets like your house or car. Bankruptcy could also mean the uncertainty of surplus income. A consumer proposal is simply a different route to getting a fresh start from your debts.

Beware of unnecessary costs and expensive programs

Debt consultants and credit counsellors are not trained to provide consumer proposal advice. They may charge you an unnecessary fee or push you into a debt consolidation program that is not as good as a consumer proposal. Any credit counselling program requires you to pay 100% of your debts plus a 10% fee. This is much more expensive than a consumer proposal and you may not be able to successfully complete the program, leaving you in debt. And contrary to popular opinion, working with a credit counselling agency is not better for your credit score than filing a consumer proposal. Both a debt management plan and a consumer proposal have the same impact on your credit.

How does a consumer proposal affect your credit?

A proposal will remain on your credit report for a maximum of 6 years from the date you filed. Specifically, it is removed the earlier of:

- 6 years from the date you filed or

- 3 years from the date of completion

Most consumer proposals in Toronto are for a 5-year term. This means that the proposal is removed just one year after completion.

You can begin to rebuild credit, including getting a new credit card, even while in your proposal. There are steps your trustee will teach you to improve your credit.

Keep your home equity with a consumer proposal

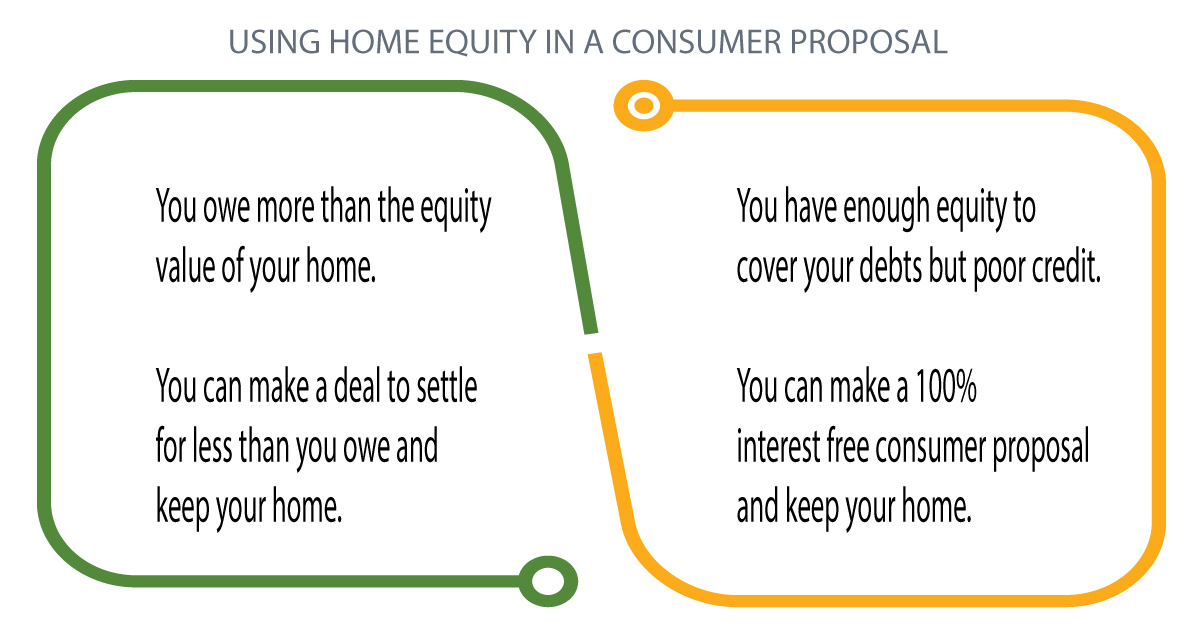

You can file a consumer proposal as a homeowner even if you have home equity. The equity value in your home will be a factor in determining how much to offer your creditors.

Debt consolidation vs consumer proposal

Home prices in Toronto have skyrocketed in recent years providing many with the opportunity to leverage their home equity to pay off debts. However, not everyone can qualify for a second mortgage or home equity loan. You may have bad credit, or you may not have enough home equity in your home to deal with all your debts. Many homeowners in Toronto can use a consumer proposal as a way to consolidate high-interest debt as an alternative to a debt consolidation loan.

There are cases, especially in Toronto, where filing a 100% consumer proposal does make sense. If you have some equity in your home but have poor credit and cannot qualify for a consolidation loan, you may want to discuss building a repayment plan through a consumer proposal to gain creditor protection.

Filing a consumer proposal should not affect your mortgage renewal with your current lender if you keep up with your monthly payments. It may affect your ability to refinance or switch lenders.

How to file a consumer proposal in Toronto

The process to file a consumer proposal in Toronto is easy:

- Contact a Toronto Licensed Insolvency Trustee for a free debt assessment to find out if you qualify to file a proposal and to see if that is your best option.

- Meet with your trustee to review your debts, your budget, and your assets to determine how much to offer your creditors.

- Sign the necessary documents that include your proposal offer.

- Your trustee will file the paperwork with the court and the stay of proceedings begins, stopping all creditor actions.

- You stop making payments on your debts when your proposal is filed with the government.

- Your creditors have 45 days to vote whether to accept or reject your proposal. If 25% (based on dollar value) ask for a meeting, a vote is held. If more than half vote in favour your proposal is approved. If less than 25% ask for a meeting, the proposal is automatically approved.

- Once accepted, there is a 15-day waiting period to obtain court approval of your proposal. Creditors can object through the court although this is very rare.

- Once accepted, you make your consumer proposal payments according to your proposal terms.

- You attend two credit counselling sessions during your proposal and begin the process of rebuilding your credit.

- Once your terms are completed, you receive your Certificate of Completion and your debts are eliminated.

Contact us for consumer proposal help in Toronto

Licensed Insolvency Trustees like Hoyes Michalos are the only professionals trained and authorized to file a consumer proposal. We have the knowledge and experience to know what creditors are looking for and to highlight any financial concerns you need to be aware of.

When working with Hoyes Michalos you are guaranteed respect, confidentiality, and expert financial advice. At Hoyes Michalos we believe you should always talk with a professional. For over 20 years we’ve focused solely on helping individuals find debt relief.

To reach us, call us at 1-866-747-0660 or contact any of the trustees in any one of our Greater Toronto Area locations.