Updated November 30, 2022

Website: https://www.cibc.com/

How to Open a Bank Account

In-person, online or mobile banking app

- In Person: book a meeting at the closest branch and bring in 2 pieces of valid ID.

- Online: by filling out the application by providing your personal information, social insurance number and address as well as provide 2 pieces of valid ID once the application has been approved when you pick up your debit card.

- Mobile app: download the CIBC Mobile Banking app and select “Open an Account.”

Here is a link to their Branch Locator to find the closest physical branch.

https://www.cibc.com/en/personal-banking/ways-to-bank/atm-and-branch-network.html

Credit Score and Credit Reports

CIBC provides your credit score, and credit report, through TransUnion via the desktop browser or the mobile app.

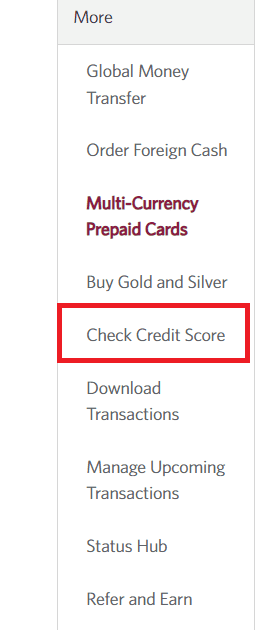

If using the browser, on the left hand navigation menu, click on Check Credit Score:

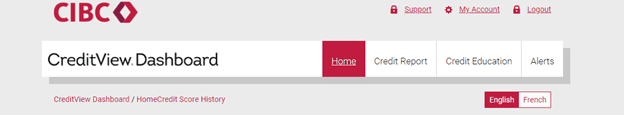

Then click on the tab that says NEXT, and you will see the CreditView Dashboard

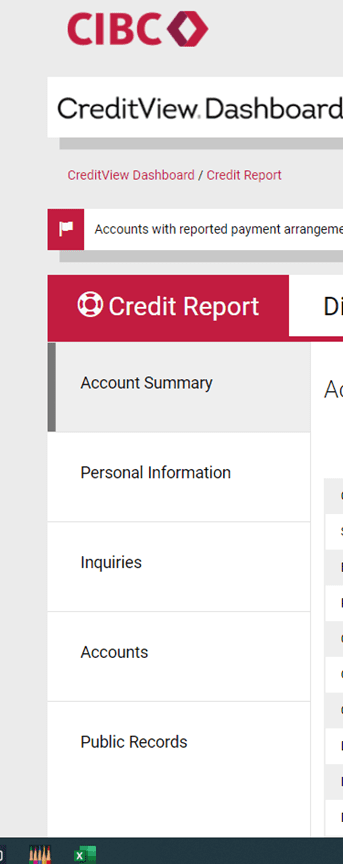

You can see your credit score on this screen, you can also click the Credit Report tab which will bring you to your credit report. You will be able to see all information on your Trans Union credit report that is currently being reported.

The process is similar on the CIBC Mobile App:

Log In

Click on the 3 lines in the top left-hand corner, scroll down until you see “Check Credit Score.”

Click on Check Credit Score

Click NEXT

This will display your credit score.

If you want to view your credit report, click on the 3 lines just above the score on the right-hand side.

Click Credit Report

This will display all your information currently being reported on your credit report.

Budgeting Apps:

The one on the mobile app is called Insights:

- it gives you tailored advice based on your spending habits

- you can set up spending limits for each bill or category you set up

- it tells you if your bill or subscription is higher than normal

- you get reminders when you have extra money to put away

The one online is under CIBC Financial HealthCheck Goal:

- to set goals for savings, pay down debt or to manage money better

- you can put in your monthly expenses and it will create a budget for you

Services Offered:

- Savings & Business Accounts

- Pay bills online or through your mobile banking app

- Interac e-Transfer online and through mobile banking app

- Mobile banking app: https://www.cibc.com/en/personal-banking/ways-to-bank/mobile-services.html

- Deposit cheques through mobile banking app

- Free credit score through mobile banking app NOTE: Free credit score is only available through the mobile banking app, not through their website; full credit reports are not available

- Track your bills, set spending limits and more

- Financial HealthCheck

- Send money globally

- Shop and pay you way with Google pay, Apple pay and Samsung pay

- Investments Products (RRSP, TFSA, mortgages, GICs)

- Overdraft protection available

- Cheques available for a fee

Bank Accounts:

CIBC has multiple accounts with different fees depending on the account and your needs, below is simplified comparison chart for chequing accounts. For further information, please visit: Chequing and Savings | Bank Accounts | CIBC

CIBC Smart™ Prepaid Visa* Card

All CIBC Smart™ Prepaid Visa* Cards and CIBC Smart™ Prepaid Travel Visa Cards will be deactivated at midnight on January 31, 2023.

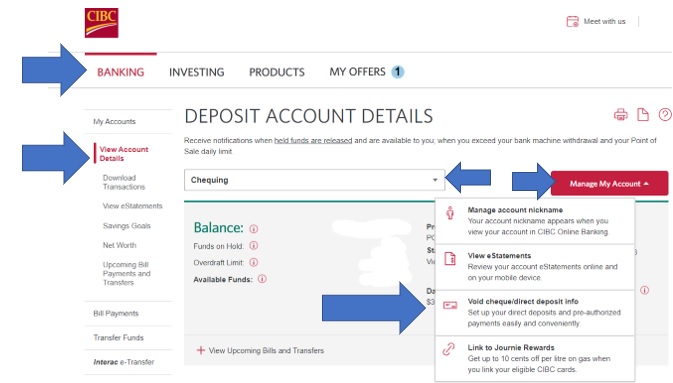

How to get a PAP Form

Sign on to CIBC Online Banking, under banking, view account details on left-hand column, choose which account you would like to get the form from, go under manage my account on right-hand side, the 3rd option down is the void cheque/direct deposit info.

Rewards program through Journie:

You can get this reward card at any Pioneer, Chevron or Ultramar gas stations. If you link your Journie rewards with CIBC debit/credit cards, and pay with debit/credit at these participating gas station, you will receive 3 cents off gas prices and once you fill up to 300 litres you will get an additional 7 cents off that one time purchase.