Bank: Meridian Credit Union

Website: www.meridiancu.ca

Last Updated: February 4, 2021

How to open a bank account

Go to www.meridiancu.ca or visit a branch near you

For those who chose to open their account digitally (online) www.meridiancu.ca Meridian verifies their identity by providing a barcode and requiring the person to attend a Canada Post location with this barcode. The Canada Post employee verifies the ID and scans the barcode to approve.

When applying in person at a branch location Meridian require 2 pieces of ID, one being photo ID.

Meridian runs a credit check for account openings and those who perhaps are struggling with their credit score may not be eligible for a chequing account but would qualify for a savings account.

There is a more robust holds policy for new Members for the first three months (10-day holds on all cheques or deposits via ATM and mobile banking). There is no minimum deposit required to open an account.

Services Offered

- Interac e-Transfer®

- Deposits through mobile banking app

- Deposit cheques on the go with Deposit AnywhereTM

- Free, unlimited use of our Price Drop feature

- Online Meridian Investing and advisors to answer questions.

- Mobile security alerts

- No fee savings account

- Pay bills online or in-branch.

- Use your Meridian debit card with Interac Flash® to make payments through Interac Debit® in Canada and ACCEL® in the U.S.

- Transfer funds between Meridian accounts and other financial institutions with Money Mover

- Surcharge Free access to meridian ABM – to view list https://www.theexchangenetwork.ca/Participating-Financial-Institutions.aspx

- Safety deposit box available

- Overdraft protection (optional)

- Eligible deposits (not in registered accounts) are insured up to $250,000 through the Financial Services Regulatory Authority (FSRA).

Service Charges

Compare each account with the following link: https://www.meridiancu.ca/Meridian/media/images/PDFs/Personal_Accounts_and_Services.pdf

- Fees start at $0.00/month for a Pay as You Go Account with a minimum monthly balance of $2,000; Seniors Account; Limitless Account and US Dollar Accounts and between $5.00/month for a Convenience Account up to $12.00/month for a Plus Package Account

- The Pay as You Go account offers multiple services with a minimum monthly balance of $2,000.

- The Seniors Account (60 years of age): Limitless Account and US Dollar Accounts have multiple free services with no minimum monthly account balance.

- The remaining cheque accounts range from 15 transactions/cheques to unlimited services or cheques per month with no minimum monthly balance.

- Free cheques with a Plus and Senior package, fees apply for all other accounts.

- Stop payment –$15-$30 each.

- NSF Fee – $48

- ABM withdrawals – free at Meridian Credit Union machines or Surcharge Free access to meridian ABM – to view list https://www.theexchangenetwork.ca/Participating-Financial-Institutions.aspx

- $1.50 – $3.00 fee on non-Meridian Credit Union and outside of Canada

- 1-year inactivity fee – $20 (on specific accounts)

- Most accounts have 4 free Bank Drafts – additional are $3.75 on specified accounts.

- Optional Overdraft Protection Fee – $5 per item when used. Interest is calculated daily at 21% (per annum) and charged monthly. When the account is overdrawn, interest will continue to be charged until the account is paid.

How To Get a Void Cheque or Pre-Authorized Payment Form on the App

From the menu screen choose settings, under set up choose manage direct deposit set up, choose deposit form, provide your email address and choose the account, hit send email. A PDF copy of the direct deposit will be sent to you.

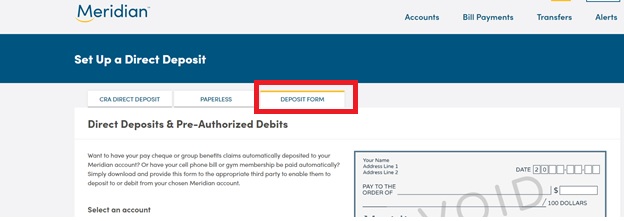

How To Get a Void Cheque or Pre-Authorized Payment Form online

From the home screen, click settings, add a direct depositor choose deposit form, select your account and create PDF