Bank: TD Canada Trust

Website: https://www.td.com/ca/en/personal-banking

Last Updated: August 3, 2021 (information subject to change, so please go to https://www.td.com/ for current information).

Special Offers

Open an eligible TD chequing account and you could get $300. Add an optional TD savings account and you could get an additional $50. The offer ends October 31, 2021.

How to open a bank account

You can open a new chequing account online. You will be prompted to provide ID online by taking a photo of your photo ID and a self-portrait. If you are not prompted to verify ID online, you will need to activate the account by verifying ID at your local TD Branch.

Services Offered

- TD ways to bank : Bank online, in-person, by phone or mobile.

- TD Applications – Mobile banking with TD app or bank online through EasyWeb

- TD Mobile Deposit – Deposit cheques through TD mobile banking app

- TD MySpend – Paired with the TD app, use TD MySpend to keep track of your monthly spending and help improve your spending habits.

- Simply Save Program – Automatically help grow your savings every time you use your TD Debit Access Card. You can choose to save when you do a debit purchase, ATM withdrawal or both. Transfer $0.50 to $5.00 per transaction.

- Overdraft Protection Options – Monthly overdraft protection or Pay as you go overdraft protection

5 Types of Bank Accounts:

Information subject to change, so please go to https://www.td.com/ca/en/personal-banking/products/bank-accounts/chequing-accounts/ for current information.

TD All-Inclusive Banking Plan

- Unlimited banking transactions and premium banking benefits

- Monthly Fee $29.95 with unlimited transactions per month. No monthly fee if you have $5,000 or more in your account at the end of each day in the month

- Free cheques, drafts and more

- No TD ATM fees for TD and non-TD ATMs

- Free Interac e-Transfer® transactions

- Small safety deposit box, certified cheques, money orders and personalized cheques for free

- TD Fraud Alerts

- Paper Statements are free

- Free Cheques and drafts

TD Unlimited Chequing Account

- Monthly Fee $16.95 with Unlimited transactions per month. No monthly fee if you have $4,000 or more in your account at the end of each day in the month.

- Free Interace-Transfer® transactions

- No TD ATM fees for TD and Non-TD ATMs

- TD Fraud Alerts

- Paper Statement $2.00 per month

TD Every Day Chequing Account

- Monthly Fee $10.95 or (Senior 60 or older Monthly Fee $8.50) with 25 transactions per month. No monthly fee if you have $3000 or more in your account at the end of each day in the month.

- Additional transactions are $1.25 each

- Free Interace-Transfer® transactions

- Non-TD ATM Fee in Canada $2.00 each

- Paper Statement $2.00 per month

TD Minimum Chequing Account

- Monthly Fee $3.95 with 12 free transactions per month and must have 2 full-service transactions. Additional transactions are $1.25 each.

- No Monthly Fee for – Seniors (60 years or older) collecting GIS, RDSP beneficiaries, Students enrolled full-time at a college or university, Under the age of majority in their province of residence.

- Fees are associated with Interace-Transfer® transactions.

- Non-TD ATM Fee in Canada $2.00 each

TD Student Chequing Account

- No monthly Fee with 25 transactions included per month. Additional transactions are $1.25 each. $0 Monthly Fee (until 23 years old or with proof of enrollment in full-time post-secondary education)

- Free Interace-Transfer® transactions.

- Non-TD ATM Fee in Canada $2.00 each

- Free Paper Statements

How To Get a Void Cheque or Pre-Authorized Payment Form

To obtain your account information and download a pre-filled form for Direct Deposits (or Pre-Authorized Debits):

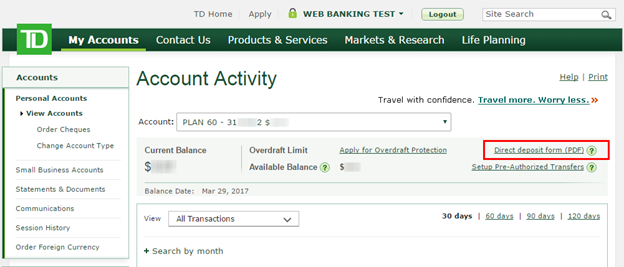

After you log in to EasyWeb:

- Select Accounts in the left menu

- Select the account for which you require Direct Deposit information (or Pre-Authorized Debit Payments)

- Once on the Account Activity page, select the “Direct deposit form (PDF)” link on the right side of the page

- You will then get a pop-up page (PDF) pre-filled with your account’s 5-digit Transit (branch) number, 3-digit Institution number (004) and your 7-digit Account number.

- Use the account details provided in this PDF to set up Direct Deposits (or Pre-Authorized Debit Payments).

The PDF form also contains useful information about setting up direct deposit with the federal government and your employer.