Get Tax Debt Relief

Do You Owe Taxes to CRA?

Anyone can need help with tax debt. In fact, 40% of our clients owe some debt to CRA. This includes self-employed individuals owing HST, source deductions, and personal income tax debt; individuals who have cashed out their RRSPs or are working multiple jobs without adequate withholdings; and pensioners owing taxes for the first time in their lives as their pensions did not have enough taxes taken off resulting in tax debts too large to manage on a fixed income.

CRA Has Strong Powers of Collection

The Canada Revenue Agency (CRA or formally Revenue Canada) has several powers to force collections of unpaid taxes – including wage garnishments, freezing bank accounts, investment seizures; they may even register a lien on a residential home.

Any tax debt solution you choose must take into consider the risk that the CRA will pursue these collection options.

Only a formal tax relief solution like a bankruptcy or consumer proposal can stop CRA actions and eliminate back taxes.

If you owe tax debts to Canada Revenue Agency request a free confidential consultation with a Hoyes Michalos debt solutions expert. We can help you eliminate penalties & interest and reduce the amount you have to pay.

Options When Dealing With Tax Debts

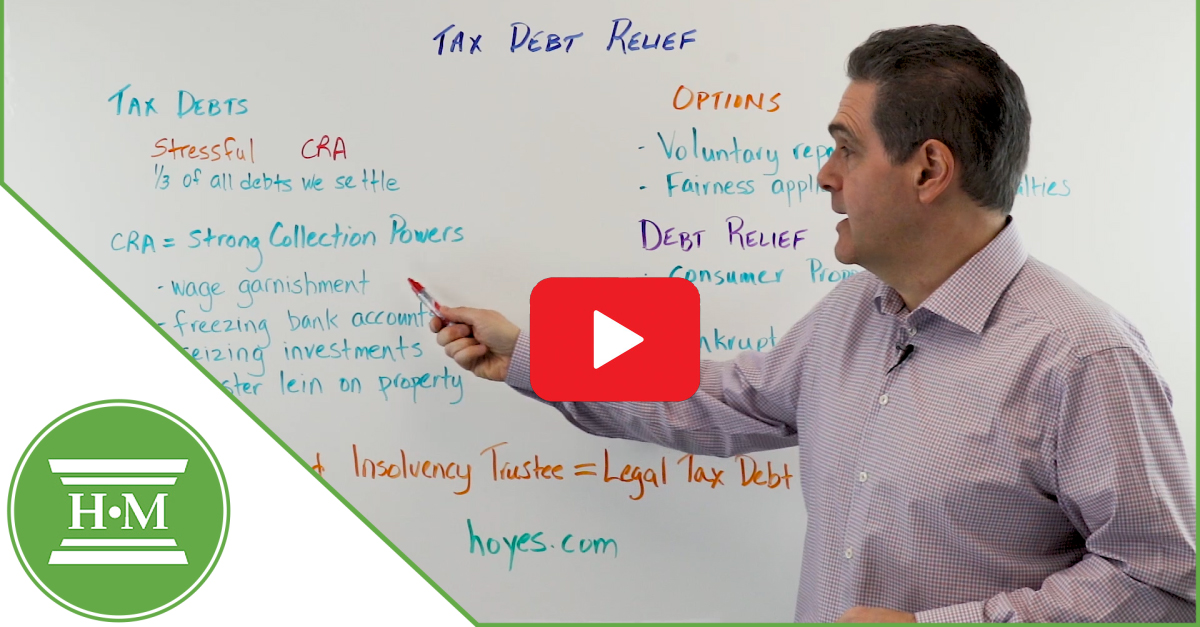

I’m Doug Hoyes, a Licensed Insolvency Trustee with Hoyes, Michalos & Associates, and today I’d like to talk to you about tax debt relief.

Tax debts are one of the most stressful kinds of debts. Dealing with CRA is very intimidating, but there’s good news, it is possible to settle tax debts just like we settle other debts, like credit cards. In fact, about a third of all the debts we settle are tax debts. The problem of course is that CRA has very strong collection powers. They can do things, unlike a regular creditor, who needs to go to court and sue you and get a court order, without a court order.

For example, they can get a wage garnishment against you or they can take steps to be freezing your bank accounts, seizing investments, or registering a lien on your property. So if you owe money on taxes you don’t want to delay and wait around until they’ve put a lien on your home.

So what are your options if you can’t pay your taxes? Well if you just need a bit of a break in terms of time, then it’s possible to enter into a voluntary repayment plan with CRA; they will give you up to a year provided you can pay your taxes in full. It’s also possible to make a fairness application to CRA and ask them to reduce or eliminate the interest and penalties that you owe. Now, this is a somewhat cumbersome procedure; often you would hire a tax lawyer or a tax accountant to do it, and to be successful, you have to demonstrate that you have extraordinary circumstances and you’re suffering hardship. So it’s not a simple matter. If you can’t afford to pay your taxes in full, then you need debt relief. Unfortunately, CRA will not make a deal with you directly to pay less than the full amount owing.

Why? Well, it’s the law and they certainly don’t want to set the precedent of making a deal with you because then everyone else will want a deal as well. The only exception to that is a consumer proposal filed by a licensed insolvency trustee.

Why? Well, a consumer proposal is a part of the Bankruptcy and Insolvency Act and because it’s federal law it’s binding on CRA just like it’s binding on every other creditor. It also includes other debt. So if, for example, you have money owing on credit cards, you can include the credit cards with your tax debts in the consumer proposal you file.

To find out more about consumer proposals, you can click on the little “i” in the top right-hand corner of this video. Now if you can’t afford a consumer proposal, bankruptcy is also an option to deal with tax debts. Either a consumer proposal or a bankruptcy does give you debt relief because it deals with an eliminates income taxes, as well as things like source deductions, HST and GST.

However, a consumer proposal or a bankruptcy can only be filed by a licensed insolvency trustee, that’s the only way you can get legal tax debt relief. To find out more you can visit hoyes.com or check out our playlists right here on YouTube.

1. Arrange a repayment plan with CRA. The Canada Revenue Agency will only negotiate repayment terms directly with individuals that result in repayment of 100% of your tax debt. You may work with a Canada Revenue agent to make monthly payments until your tax obligation is repaid, in full. You will also be required to pay all penalties and interest.

You could consider getting a loan to pay off your tax debt however, as with any debt consolidation loan, this comes with it’s own risks. If you can only qualify for a high-interest rate loan you may be trading one debt for another and may still face financial problems down the road.

2. Make a CRA Fairness Application. This is a government program that grants relief from interest and penalties, but not the principal portion of your tax debt. You must prove extraordinary circumstances and financial hardship that supports your inability to repay your full tax obligation. You may also need to engage the services of a tax lawyer to assist you with this application.

3. File a consumer proposal. The only tax relief program that the CRA will accept is a consumer proposal filed with a Licensed Insolvency Trustee. With a consumer proposal, you make a deal to repay what you can afford. An offer is made to the Canada Revenue Agency, along with your other creditors, to repay less than what you owe.

An advantage of a consumer proposal to clear tax debt is that you can also deal with other unsecured debt at the same time including credit card debt.

The Canada Revenue Agency generally requires that all outstanding tax returns be filed prior to voting to accept the proposal in order to confirm the actual tax amount owing to CRA.

4. File personal bankruptcy. For some, their annual income tax debt combined with other financial obligations becomes insurmountable. Tax debt is no different that other unsecured debt and can be eliminated by filing bankruptcy.

Why get tax debt help through a Licensed Insolvency Trustee?

By filing a bankruptcy or consumer proposal under the Bankruptcy & Insolvency Act, a Licensed Insolvency Trustee can gain an automatic stay of proceedings which will immediately stop CRA collection actions. In the case of a consumer proposal, this allows you the time to negotiate an acceptable payment arrangement with CRA.

- Stop wage garnishments

- Reverse frozen bank accounts

- Keep HST/GST and child tax credits

- Remove property liens

If you own a home and have tax debt, it is best to contact a trustee about filing a consumer proposal or bankruptcy before the CRA placed a lien on your home.

What to do when you owe taxes and can’t pay

It doesn’t matter what type of CRA tax you owe:

- back income taxes

- unpaid source deductions

- GST/HST tax

- small business (unincorporated) income tax

If you owe taxes in Canada, we can provide you with options to deal with money owing to the Canada Revenue Agency. Our trustees are experts in negotiating with the CRA and eliminating all tax debt.

Here are some additional resources written by our team of Licensed Insolvency Trustees:

- What happens if I haven’t filed my tax returns?

- How to make a deal for tax debt forgiveness with the CRA

- What are my options if Canada Revenue Agency places a lien on my house for unpaid taxes?

Tax Debt Relief Is Much Like Any Other Debt

One common misconception that people have is that tax debts are different from their other debts and have special rights – this is only partially true. Tax debt is governed by federal tax laws, and as such there are special rules. However, the Bankruptcy & Insolvency Act is also Canadian law and as such Revenue Canada is treated like any other creditor in a consumer proposal or personal bankruptcy. If they are your major creditor CRA may request additional conditions in your proposal, however at Hoyes Michalos, we have the experience necessary to work with you and the CRA to arrange a plan, that you can afford, to deal with your tax debt.

Hoyes Michalos & Associates provides tax debt relief solutions in the following locations

Other service areas

We offer the convenience of phone and video-conferencing only services for the following additional areas. Many people find it advantageous to begin the initial consultation and debt assessment over the phone or by video. If you decide to file, you can sign and complete your paperwork electronically. Credit counselling sessions can also be completed through video conferencing, which eliminates the need to miss work or schedule a time to attend the office.