A consumer proposal is one of Canada’s best solutions for dealing with debt.

If your bills are too much to handle and you’re looking for an easier way to pay off debt without filing for bankruptcy, a consumer proposal may be for you.

This guide to consumer proposals tells you what you need to know to determine if a consumer proposal may be a good debt relief solution for you. If you’d like to discuss how a consumer proposal can help you get rid of debt and see how it can compare to other options, call 1-866-747-0660 to book a free consultation.

What Is A Consumer Proposal?

A consumer proposal is a legally binding agreement between you and your creditors to repay a percentage of what you owe in exchange for full debt forgiveness. A consumer proposal is a proceeding under the Bankruptcy and Insolvency Act and is administered by a Licensed Insolvency Trustee.

If you struggle with monthly debt payments, a consumer proposal plan provides debt relief while avoiding bankruptcy.

How Much Does a Consumer Proposal Cost?

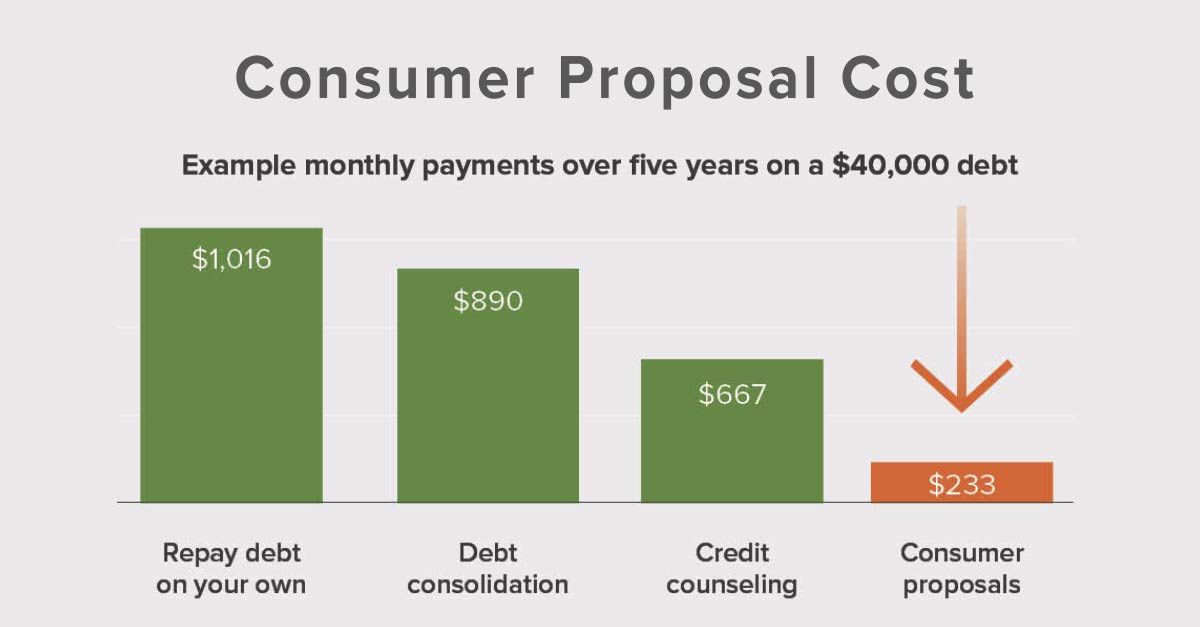

A consumer proposal is a form of debt settlement which means you pay back less than you owe. Your payment terms are based on a negotiation between what your creditors expect to receive and what you can afford to repay.

Acting as a consumer proposal administrator, your Licensed Insolvency Trustee will meet with you to review your financial situation and help you determine how much to offer. The cost of a consumer proposal and ultimate settlement amount depends upon your income and what assets you own. Every proposal to creditors is unique.

Settlements of 30 cents on the dollar are not uncommon; however, every debt proposal is different.

Proposal payments can be spread out over a maximum of 5 years and are interest-free. In most cases, your debt can be reduced by as much as 70%-80%.

To compare possible payments in a consumer proposal with other options, try our consumer proposal calculator.

What Debts Are Included in a Consumer Proposal?

A consumer proposal deals with unsecured creditors and can eliminate almost all unsecured debts, including:

- credit card debt

- bank loans or personal loans

- unsecured lines of credit

- payday loans

- overdrafts

- outstanding bills

- accounts in collection

- tax debts

- certain student loans.

Secured creditors

A consumer credit proposal does NOT affect secured debts, including:

- mortgages

- car loans

- vehicle lease agreements

- home equity loans

- a home equity line of credit (HELOC)

Filing a consumer proposal can make it easier to keep up with secured debt payments because it eliminates other problem debt and helps balance your monthly budget. As long as you maintain your secured loan payments, you can keep your house or car. A secured creditor cannot change the terms or conditions of an existing loan even if you file a consumer proposal.

If you cannot afford the regular payments on your home or car, talk with your trustee. You can voluntarily surrender a vehicle or property and include any shortfall in your consumer proposal.

Student loans

Student loan debt is given special treatment in a consumer proposal.

If you have been out of school for seven years, you can include your student loans in your proposal.

If your student loans are too new to be discharged, your trustee can help you decide how best to proceed. One option is to file now to eliminate other debt like credit card debt to improve your budget sufficiently to afford your student loan payments. A second option is to wait until the student loan limitation period expires.

CRA and tax arrears

Since a consumer proposal is a federal government program, it has jurisdiction over government debts, including income tax debt, unpaid HST or GST tax payments, and payroll withholding taxes.

A consumer proposal is the only debt settlement option the Canada Revenue Agency will accept to eliminate or reduce actual taxes owing.

Payday loan cycle

Roughly 40% of our consumer proposal clients owe money to at least one payday lender, and many owe money on multiple loans. A consumer proposal can break the payday loan cycle and help you get back on track, so you stop living paycheque to paycheque.

High-interest installment loans

A growing money problem among many Canadians is the rise in the availability of easy-access lines of credit and term loans through alternative lenders. These loans typically charge between 39% and 48% and can be available for $10,000 or more. Many Canadians take out these loans in an attempt to consolidate credit card debt and other outstanding loans. However, the monthly payments often prove to be unaffordable.

If you are struggling with high-interest debt, a consumer proposal can be a way to erase that debt and start fresh.

Pros and Cons of Canada’s Consumer Proposal Plans

A consumer debt proposal is the only debt settlement program sanctioned by the Canadian government. This makes it a safer debt settlement solution than informal options through a debt consultant or credit consolidation company.

Advantages of a Consumer Proposal

As the #1 alternative to filing bankruptcy, a consumer debt proposal provides several benefits over other debt relief options:

- Reduce your debts by up to 70% and get out of debt sooner.

- You will be out of debt in 3 to 5 years.

- Keep all your assets, including any equity in your home.

- Consolidate debts into one, easy to make, affordable, monthly payment.

- Freeze interest on your debts.

- Legally bind all creditors to your offer if the majority agree.

- Stop calls from collection agencies

- Stop legal action and lawsuits

- Stop wage garnishments.

- Once accepted, your payment terms do not change even if your income increases.

- You avoid bankruptcy.

Disadvantages of Consumer Proposals

If you cannot repay your debts, the advantages of a consumer proposal almost always outweigh any disadvantages. However, there are some short-term negative consequences of filing a consumer proposal:

- It will lower your credit score initially

- Your creditors may not approve your proposal; however, this is rare – 99% of consumer proposals are accepted.

- If you miss three consecutive payments, it will be automatically annulled, and your debts will return.

- Some debts are excluded, including child support, alimony, fines, debts due to fraud and some student loans.

How Does a Consumer Proposal Affect Your Credit?

As with any debt repayment program, including a debt management plan, a consumer proposal will impact your credit rating for a short while.

When you file a consumer proposal, a note will appear on your credit report. After completion, this note is removed by the credit bureaus:

- In the case of TransUnion, the earlier of 3 years from completion or 6 years from the date you filed.

- Equifax has a similar policy; however, in practice, they will remove the notice 3 years after completion.

Most clients see an improvement in their credit score shortly after completing the program, long before the notice is removed. If you have a lot of debt now, your credit rating may already be damaged by late payments, missed payments or high balances. Even if you have a good credit score, you may not be eligible for any new loans other than bad credit loans like payday loans because you have too much debt already.

Getting out of debt with a consumer proposal is often the first step to rebuilding credit. It eliminates unsecured debt, resetting your credit position and allowing you to build a new and better credit history. You can take steps during and after your proposal to improve your credit score, and we will provide you with the know-how to rebuild your credit as part of the consumer proposal process.

In most cases, people can rebuild their score enough to obtain a low-interest loan or mortgage within two years of completion if they take the appropriate steps to rebuild.

How Does a Consumer Proposal Work?

The decision to file a consumer proposal begins with a debt assessment with a Licensed Insolvency Trustee to help you determine if a consumer proposal is the best way out of debt for you. Your trustee will discuss alternatives, including credit counselling, a debt management plan, debt consolidation and bankruptcy.

Once you choose to make a consumer proposal to your creditors, the basics of the proposal process are as follows:

Repayment Plan

Your trustee will recommend a payment plan that will balance what you can afford and what may be acceptable to your creditors.

Here is a typical example. Our average client owes roughly $50,000 in unsecured debts. They may offer to settle this debt for $17,400, payable over 60 months. Their monthly proposal payments would amount to $290, significantly less than the monthly minimum payments on their debts.

Payment plans are flexible. You can make a lump sum payment, pay monthly or based on your paycheque schedule. All proposals must be completed within five years, with 3 to 5-year terms being most common.

Paperwork and Documentation

Once you determine how much you want to offer your creditors, your trustee will prepare the required documents, which you will sign. Once signed, your proposal is filed with the government, and your creditors will be notified.

Stay of Proceedings

Since a consumer proposal is a legal procedure under the Bankruptcy & Insolvency Act, it is the only debt relief solution outside of bankruptcy that protects you from further creditor actions. Once filed, a consumer proposal prevents creditors from pursuing you for repayment.

Voting and Approval

Your creditors have 45 days to review your offer. They can accept your offer as is, reject your offer and ask for a creditors meeting. If less than 25% of creditors ask for a meeting, your proposal is deemed to be approved. If a meeting is required, votes are counted, and your proposal is approved if the majority (in dollar amount) accepts.

Make Payments and Duties

A consumer proposal has far fewer duties than bankruptcy. You are required to make your scheduled proposal payments, attend two financial or credit counselling sessions and generally comply with any information requests by your trustee.

Debt Elimination

Once all your proposal payments are made, you will receive a Certificate of Full Performance, which indicates that you have completed your proposal. At this point, your debts are eliminated, and you have a fresh start. You can begin the process of rebuilding your credit now that you are debt free.

Why File a Consumer Proposal? Is it Better Than Bankruptcy?

A consumer proposal is a debt relief option when other options to consolidate debt fail. You may not qualify for a debt consolidation loan and may not be able to afford a debt management plan. A consumer proposal is almost always the lowest cost debt solution of these alternatives.

There are several reasons why you might choose a consumer proposal over bankruptcy to eliminate debt:

- To keep assets you might have to forfeit in a bankruptcy, such as equity in your home or an RESP.

- To avoid high surplus income payments. If you earn more than the government-mandated minimum threshold in a bankruptcy you will be required to make higher monthly bankruptcy payments. A proposal allows you to spread these payments over a longer time, reducing your monthly costs. Think of it like extending the term on your mortgage or loan to reduce your monthly payments, except that a proposal is also interest free.

- To repay what you can afford. Many people just don’t want to file bankruptcy. A proposal allows you to offer what you can afford to pay while still reducing your overall debt burden.

- You can pay off a consumer proposal early. Bankruptcy has a mandatory length and cannot be completed any sooner.

- It is often easier to get a credit card during a consumer proposal than while bankrupt.

If you would like to compare a consumer proposal to other debt reduction options, you can read these articles:

- Consumer proposal or credit counselling

- Consumer proposal vs debt consolidation

- Second mortgage or consumer proposal

If you face severe financial difficulty and can no longer pay your bills, a consumer proposal can solve your debt problems.

Eligibility: Who Can File a Consumer Proposal?

As a federally regulated program, proposals have specific requirements you must meet to qualify to file a consumer proposal in Canada:

- You must be able to afford to pay a portion of your debts;

- You must be insolvent, meaning your debts must be greater than the value of any assets you own, or you can no longer keep up with debt payments as they become due;

- Your unsecured debt must not exceed $250,000 (not including your mortgage);

- You must be a resident of Canada or have property in Canada.

Citizenship is not a requirement to file a consumer proposal. You can be a permanent resident or residing in Canada under a work permit or other immigration status.

If your income is high enough that you would be required to make high monthly surplus income payments and you want to avoid bankruptcy, a consumer proposal program may a good choice for you.

How To Hire a Licensed Insolvency Trustee in Canada

Consumer proposals can only be filed with a Licensed Insolvency Trustee in Canada.

Beware of unlicensed debt consultants.

A credit counsellor or unlicensed debt consultant cannot provide consumer proposal services legally. All they can do is refer you to a trustee licensed by the federal government to provide insolvency and restructuring services. You do not need a referral to an LIT, and you should never pay fees to an outside consultant to help you prepare any paperwork.

It is better to work directly with a Licensed Insolvency Trustee.

As a Licensed Insolvency Trustee, Hoyes Michalos is licensed to file consumer proposals.

- All consultations are free

- We will meet with you as often as you need

- We explain all your debt relief options

- We’ll find a solution you can afford

- We have a 99% acceptance rate for consumer proposals we file

Hoyes Michalos & Associates provides consumer proposal services in the following locations

Other service areas

We offer the convenience of phone and video-conferencing only services for the following additional areas. Many people find it advantageous to begin the initial consultation and debt assessment over the phone or by video. If you decide to file, you can sign and complete your paperwork electronically. Credit counselling sessions can also be completed through video conferencing, which eliminates the need to miss work or schedule a time to attend the office.

More about consumer proposals in Canada on our blog:

- Filing a joint consumer proposal with your spouse

- Consumer proposal issues when you are self-employed

- What is a registered consumer proposal?

Find out how to file a consumer proposal in Canada or contact us for a free consultation.