CEBA, the Canada Emergency Business Account, is a government-provided loan that was designed to provide financial support to small businesses during the COVID-19 pandemic. A CEBA Loan was an interest-free loan of up to $60,000 with loan forgiveness of up to $20,000 for eligible CEBA borrowers.

According to the Canadian government, more than 898,000 businesses were approved for CEBA loans. Most will be able to repay their loans, some will not. What happens if you can’t repay your CEBA loan?

Table of Contents

Loan Repayment and Forgiveness Terms

Under the program, CEBA loans are interest free until January 18, 2024 and no principal repayment is required before January 18, 2024.

Here is how CEBA loan forgiveness works:

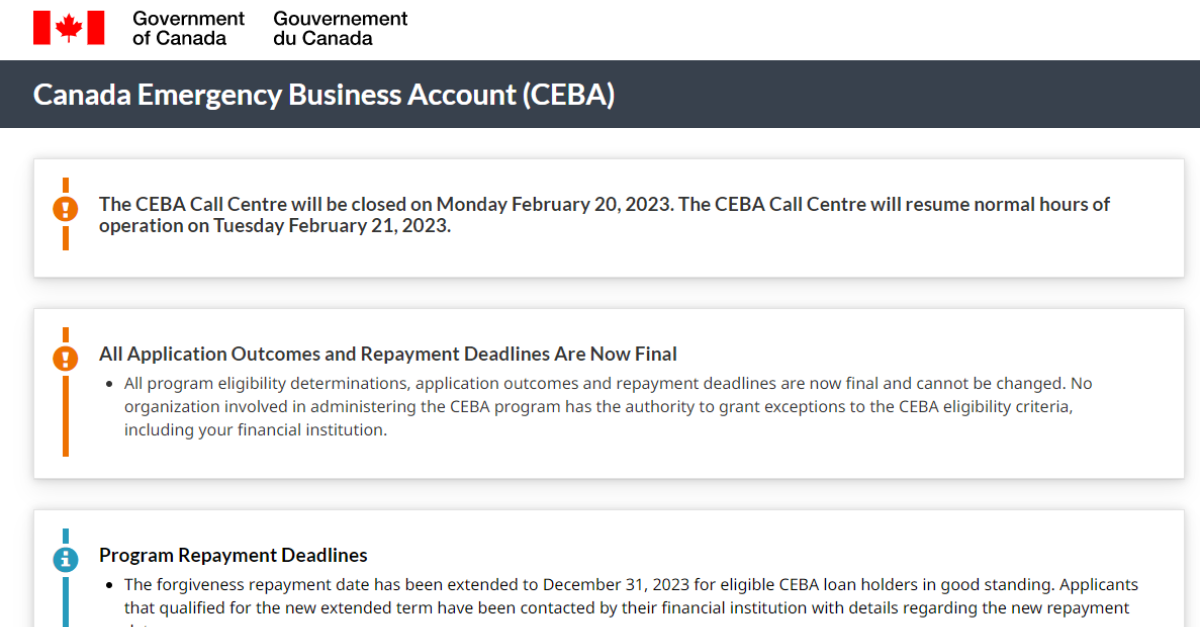

NOTE: This is our summary of the rules. Please see the government of Canada CEBA loan information for full and current details.

If the loan is in good standing and the balance excluding any potential forgiveness amount is repaid by January 18, 2024, up to 33% is forgiven. The exact percentage of forgiveness depends on when you received the loan and how much you received. Applicants who received only the initial $40,000 CEBA loan are eligible for 25% forgiveness while those who received a further $20,000 expansion loan may receive 50% forgiveness on amounts borrowed above $40,000.

For loans outstanding past January 18, 2024, the interest rate is 5% per year. Only interest payments are required until maturity, with full principal due in a balloon payment on January 18, 2024.

The key to CEBA loan forgiveness is that your CEBA loan must be in good standing. If you cannot repay the required 75% of the principal balance under your CEBA loan by January 18, 2024:

- you lose any forgiveness eligibility.

- you must start paying interest at 5% on any amount remaining until the loan is repaid.

- the balance outstanding converts to a 3-year loan due January 18, 2025.

If you are unable to pay back your CEBA loan within this three-year period contact your lender to discuss options. If you are unable to make arrangements or may default on payment, consider talking with a Licensed Insolvency Trustee for options available if you are unable to repay your CEBA loan. Licensed Insolvency Trustees are professionals who are licensed by the Government of Canada to assist individuals and businesses who are facing financial difficulties.

Should You Refinance Your CEBA Loan?

Canada’s major banks have indicated their willingness to consider refinancing the CEBA loans for small businesses. On Thursday, September 14th, 2023 Ottawa adjusted repayment deadlines, with partial forgiveness available for loans repaid by January 18, 2024. A new deadline allows partial forgiveness for loans in the process of refinancing by March 28, 2024. Refinancing options include larger loans at 5% interest or smaller loans at higher rates.

Several banks, including Bank of Montreal, National Bank, and Royal Bank of Canada, are offering refinancing assistance, while others are evaluating requests individually. Some alternative lenders are also promoting CEBA refinancing as well.

There are several advantages to refinancing, including the following:

Preservation of Loan Forgiveness Eligibility: If you opt for another loan to settle your CEBA loan by January 18, 2024, you can retain your eligibility for loan forgiveness.

Extended Prepayment Period: With a personal loan, you’ll benefit from a longer prepayment period, resulting in smaller monthly payments.

Credit Score Protection: Refinancing allows you to avoid defaulting on the loan, safeguarding your credit score.

Keep in mind that you will end up paying a higher interest rate compared to your CEBA loan and you will need to apply with your lender to see if you qualify. If you are denied a refinance with your bank, you may have better luck with an alternative lender although these types of loans typically charge extremely high rates.

You will need to consider your ability to maintain monthly payments on your new loan, including interest. If you cannot repay this loan your creditor will pursue collection options. If repayment is a concern, you may want to consider discussion options like a consumer proposal.

Can CEBA Loans be included in a bankruptcy or consumer proposal?

Many small businesses utilized their CEBA loan to fund operating expenses during a period when sales were slow. If sales picked up, they may be able to repay the loan as required. However, not all small businesses survived the closures during the pandemic or have been able to recover enough to repay their CEBA loan.

Here is what happens if you can’t repay your CEBA loan:

If your business was incorporated and you close the business, there is no need to file for personal insolvency as the debt is owed by the corporation. You are not personally liable for the CEBA loan of a corporation. See further details below.

If your business was a sole proprietorship or partnership, you are personally liable for repayment. If you cannot repay your CEBA loan (or other small business debts), any CEBA loan can be included in a personal bankruptcy or consumer proposal. CEBA loans are not secured. They are considered an unsecured debt and hence can be discharged in an insolvency proceeding under the Bankruptcy and Insolvency Act in Canada.

You may also have tax debts in addition to a CEBA Loan if your business is struggling. It is possible to make a financial arrangement through a consumer proposal with the Canada Revenue Agency to deal with unpaid taxes and with your financial institution for your CEBA Loan.

Remember, even if you can’t repay your CEBA Loan by January 18, 2024 you still have two additional years to repay the loan, with interest. If you think you might default and are struggling with small business debts, your best option is to talk with a Licensed Insolvency Trustee to explore different options for resolving your debt including a CEBA Loan. It’s important to note that each option has its own set of pros and cons, and it’s important to speak to an LIT to understand which one is the best for your situation.

Your LIT will talk with you about the viability of your business. Do you want, and can you afford to continue to operate? Do you have other business debts? Will eliminating these debts make your small business viable going forward? Your Licensed Insolvency Trustee can also explain the implications of filing insolvency on your ability to restart your business, including its ability to obtain credit.

CEBA Loans to a corporation that is no longer operating

As noted above, if you obtained the CEBA loan as an individual or a sole proprietor, you are personally liable for the loan.

If the borrower was a corporation, the corporation is liable for the loan. If the corporation is no longer operating, and has no assets, if the corporation does not repay the loan, CRA can pursue the corporation (but not the owners because CEBA loans were not personally guaranteed).

We suggest that you consult your corporate tax accountant and/or your corporate lawyer to review your options. If the corporation is no longer operating, one possible approach (after consulting your accountant and lawyer) is as follows:

First, file the final corporate tax returns (T2 corporate tax return and final HST return). Check “Yes” to the box on the final corporate tax return that says, “Is this the final return up to dissolution?” When the return is filed, CRA will send a message back saying:

The request to close your corporation income tax account has been sent. In order to complete this request, send the articles of dissolution using the Submit Documents service within 7 business days.

NOTE: As per CRA guidance, a corporation cannot be dissolved if it has outstanding debts (such as a CEBA Loan), so you can’t submit articles of dissolution. However, you can upload a letter to CRA that says, “The corporation has ceased operations and has no assets, so this is the final tax return.” While this is not an official dissolution, it will explain to CRA why the corporation is no longer filing tax returns.

Second, close the corporation’s bank account since if the corporation has ceased operations, there is no point in incurring monthly bank service charges.

Finally, resign as a director since if the corporation is no longer operating, there is no point in you serving as a director.

CRA will likely contact the corporation for payment, but you can advise that the final tax return was filed, and eventually, CRA will presumably write off the CEBA loan and discontinue collection activities.