I’m saddened that we continue to receive calls and emails from Canadians who signed a contract with a non-licensed debt professional for assistance in choosing a consumer proposal, only to find that the costs of these services are harming them financially. This time it was York Credit Services.

As we have done in the past with other debt consultants, we will review the contract details as provided through our client (with their permission) to help others avoid unnecessary costs. To protect our client, personal information has been removed from images taken from the York Credit Services contracts provided to us.

Table of Contents

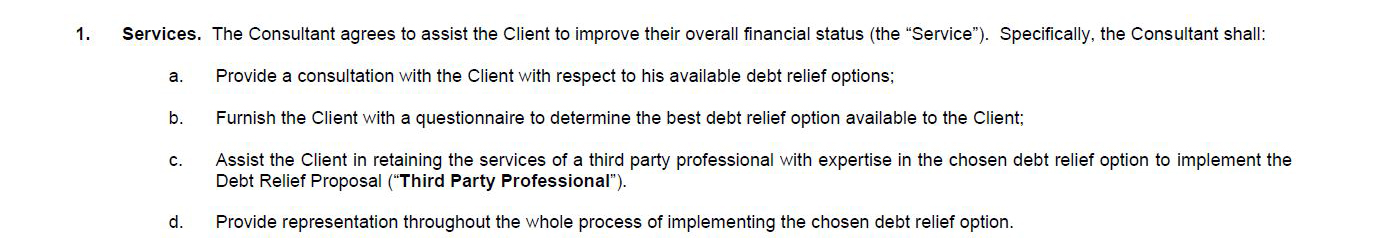

Services Provided

According to their contract, York Credit provides debt relief consultations, helps clients choose a ‘Third Party Professional’ and represents the client while implementing the chosen program.

In other words, they collect information, and when they suggest a consumer proposal, they refer you to a Licensed Insolvency Trustee.

For this review and referral, they charge a hefty fee.

How Much Does This Cost?

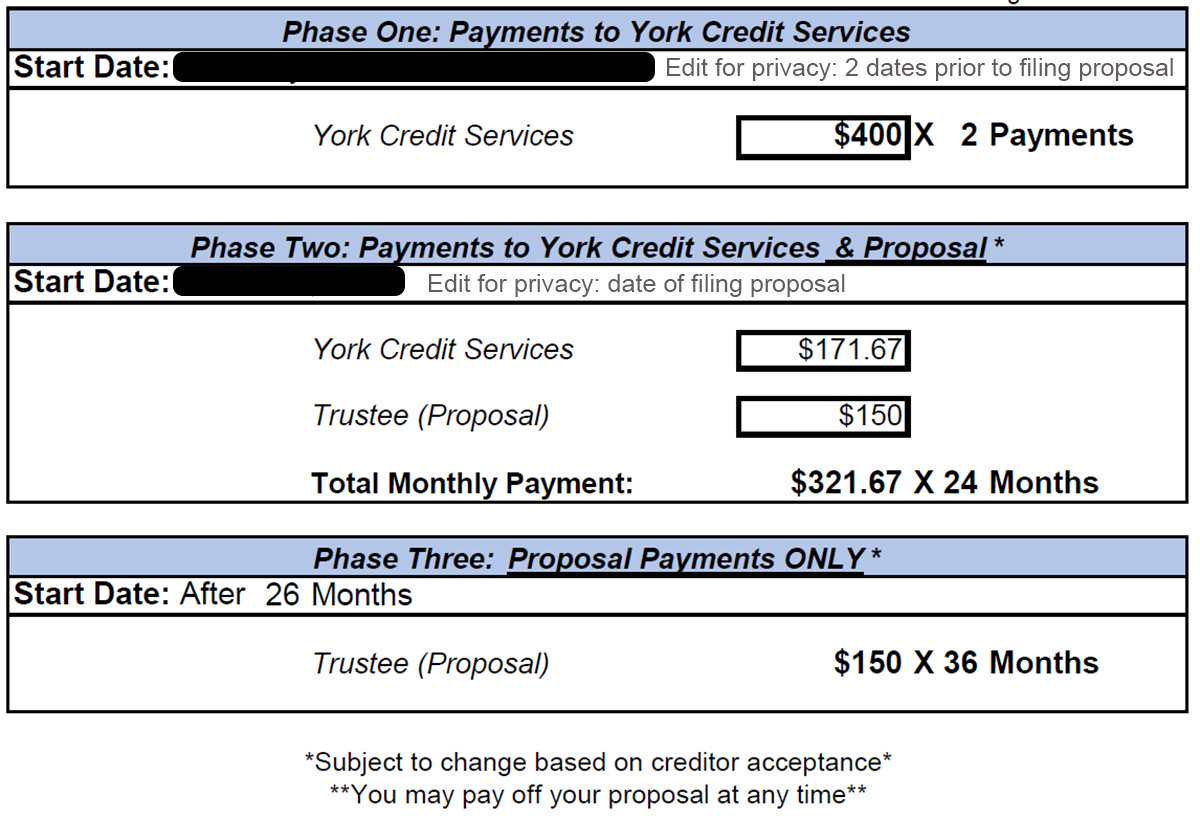

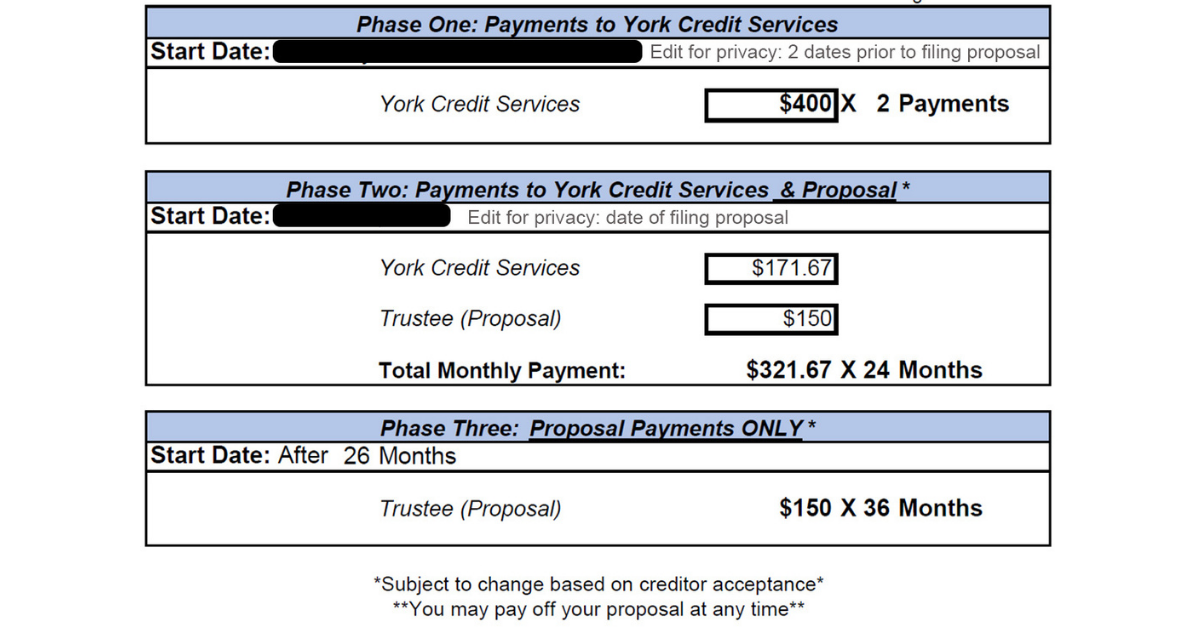

In this case, the consultation fees charged amounted to $4,920, payable as two installments of $400 each BEFORE the consumer proposal was filed, and 24 ongoing installments of $172.

On top of this, the client would pay proposal fees to the Licensed Insolvency Trustee bringing his total recommended payments to $13,920 on unsecured debts (as listed in his proposal filing) of $31,010.

- $4,920 payable to York Credit Services

- $9,000 for the proposal to his creditors

As many who read our blog know, a consumer proposal allows you to settle debts for less than you owe, and settlements as low as 20 cents on the dollar are possible. In this case, York Credit Services recommended monthly proposal payments of $150 a month payable over five years, or 29 cents on the dollar.

However, when you factor in their consulting fees, the total settlement cost increased to 45 cents on the dollar! That means going through a debt consultant increased the cost by 55%.

Whether the proposal payments of $150 a month were reasonable, I cannot determine as I did not conduct a debt assessment at that time. However, I can say that it was completely unnecessary for this client to pay an additional $4,920 for a referral to a Licensed Insolvency Trustee.

To be clear, Licensed Insolvency Trustees are required by law to conduct a complete financial assessment (more robust than the cursory services which appear to have been provided for by York Credit Services), and an LIT does so for free. All reputable LITs provide free consultations. If you are not happy with the recommendation of one trustee, seek a free second opinion from another Licensed Insolvency Trustee.

As you can see from this scenario, debt consultants cannot get you a deal that is better than the one you can achieve going directly to a trustee, especially after factoring in their consulting fees. Consultation fees by debt consultants can increase the overall cost by 50% or more.

Additionally, LITs do not require clients to make payments prior to filing a consumer proposal with the federal government. And when you work directly with an LIT, the ONLY payments required are those under the proposal, in this case, $150 a month.

This client continued to pay an additional $171.67 a month to York Credit because they thought these payments were required as part of the proposal process. They were not.

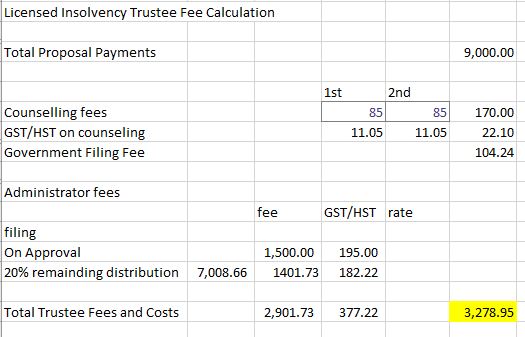

And yes, Licensed Insolvency Trustees do get paid to administer consumer proposals. That administration including filing the proposal with the government, collecting credit claims and counting votes, communicating with creditors, holding meetings if necessary, and making distributions to the creditors.

A $150 a month proposal for 60 months would result in total fees of $3,279 to the trustee plus costs (government filing fees and counselling fees) of $296.34. I should also point out that Licensed Insolvency Trustees are regulated, and our fees are included in the monthly proposal payment. The creditors bear the cost since they receive a smaller distribution after the trustee has been paid. Debtors do not pay extra.

That means, in this scenario, the Licensed Insolvency Trustee would be paid $3,279 over five years to administer the proposal while the ‘consultant’ was paid $4,920 to recommend a proposal!

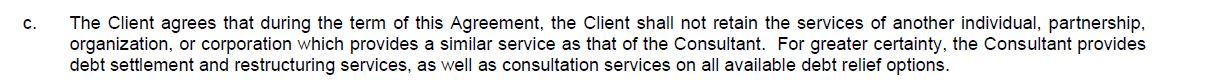

Other Clauses

Also of note is a clause in the agreement prohibiting the client from retaining the services of anyone else conducting similar services, including consultations regarding their debt relief options. In other words, this contract tells a client they cannot engage another Licensed Insolvency Trustee since these are the services they provide.

While this clause may or may not be enforceable, it certainly capitalizes on the confusion, fear, and stress a client is feeling to prevent them from seeking a second opinion.

Another pressure clause we found was 8 (c) which indicates that failure to make payments will result in cancellation of the program. Many clients may believe this means that if they stop paying York Credit, their consumer proposal will be cancelled. This is not the case. A consumer proposal is annulled according to law, and only when someone is behind three consumer proposal payments. The payments to York Credit are not part of the proposal and stopping payment to York Credit cannot impact an ongoing proposal. However, the fear of cancellation is enough to keep many people from questioning the extra payments to York Credit even after having filed their consumer proposal.

What happened in this case?

In this situation, the client filed a consumer proposal with another Licensed Insolvency Trustee in March 2021. This was, of course, after paying $800 to the debt consultant prior to filing. They then continued to make payments to both the Trustee and York Credit for several months.

Unfortunately, the burden of paying an extra $172 a month was unaffordable, so this person turned to payday loans to keep up. To be clear, this person thought that these additional payments were part of the proposal. They did not know the charges by York Credit were not legislated payments.

After they contacted us a few months later, we advised that they stop all payments to York Credit while we conducted a new debt assessment. This individual then proceeded to file bankruptcy, which was a more affordable option for them.

Could this individual have afforded the $150 a month proposal? Perhaps, however, they could not afford those payments plus $800 upfront and another $171 a month on top of their proposal fees.

Recommendations

If you have contacted or signed an agreement with any debt consultant, we recommend the following to protect your interest:

- Confirm their credentials. When seeking debt advice, be sure you know who you are dealing with. If the advisor recommends a proposal, ask: “Are you a Licensed Insolvency Trustee?” If you are uncertain, search the government website.

- Never sign an agreement that requires fees in addition to your proposal payments which are payable to the Licensed Insolvency Trustee.

- Never make payments before your consumer proposal is filed with the government and you receive your official insolvency filing documents, including estate number.

- Stop paying the debt consultant if you have entered into such an agreement prior to filing a consumer proposal. Our position is that this is an agreement for services rendered prior to the signing of a consumer proposal and that the ongoing payments are money owing in the future for past services and hence should be included as an unsecured debt in the consumer proposal.

- If you were paying these types of fees and were under the impression they were part of your consumer proposal, contact the Office of the Superintendent and file a complaint.

We also recommend that the Office of the Superintendent of Bankruptcy:

- Place under administrative review any Licensed Insolvency Trustee consistently obtaining file referrals from debt consultants.

- More strictly regulate the provision of debt assessment and consulting services for consumer proposals. Licensed Insolvency Trustees are tightly regulated, however, the advertising and provision of consulting services around consumer proposals are not. Like medical services, the service, not just the provider, should be regulated.

Licensed Insolvency Trustees have many years of training and practical experience, are required to take many courses and pass many exams and are regulated by the federal government. LITs are the only professionals that can file a consumer proposal or bankruptcy in Canada. We are the professionals. Our fees are set by the federal government. We are not allowed to charge up front fees.

Don’t be scammed. If you have debt, get a free consultation from a Licensed Insolvency Trustee, not an unlicensed debt consultant.

And I’d really like for the government to protect consumers by taking action to fix this problem.