Payday lenders never cease to amaze me in their creative attempts to deceive their borrowers.

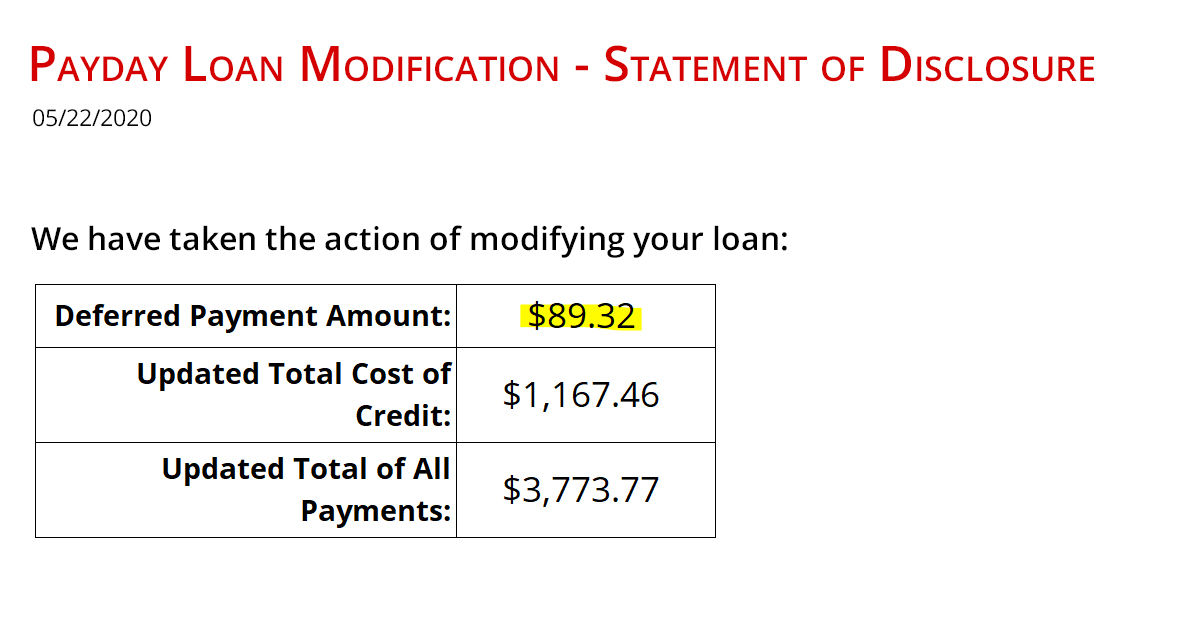

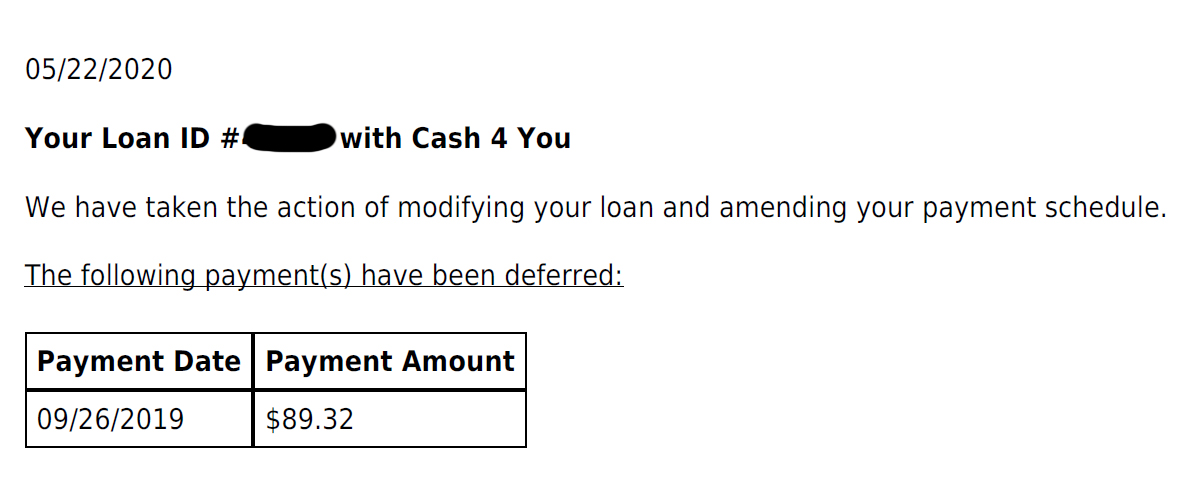

Last week, one of our consumer proposal clients received an e-mail from a payday lender called Cash 4 You. The e-mail included a “Loan Modification” agreement, outlining an amended payment schedule by offering to defer payments.

Here is a snippet from the actual document with identifying information hidden:

Here is the problem: Our client is already in a consumer proposal, which means, this loan to Cash 4 You has already been included in their filing and therefore no longer needs to be dealt with outside of the proposal. You can tell by the deferred payment date offered (09/26/2019) in the agreement that this loan is outdated, even though this agreement was sent on May 22, 2020.

One of the many benefits of filing a consumer proposal is that it is legally binding for the debtor and all of their creditors. With few exceptions (support payments being one example) no unsecured creditor is excluded from the insolvency process, which must be fair to all parties. If you owe money to a payday lender at the time of filing a proposal, this debt is included in your proposal. During the proposal creditors are stayed from enforcing collection. Once your proposal is finished, the debt is discharged and forgiven.

But, Cash 4 You sent this communication anyway and it was not the only instance. A few more of our proposal clients who once borrowed from Cash 4 You were sent a similar loan modification agreement.

We have been advising our clients to ignore loan modification emails from any payday lender, assuming the lender was notified of their consumer proposal or bankruptcy. Clients can contact their Trustee if they have any concerns and do not have to deal with the lender directly.

Maybe I am being too harsh. Cash 4 You may have truly been ignorant of our client’s proposal status. It could also be that they did not run any filters through their email list to exclude individuals who did not owe. Whatever the case may be, the communication caused a lot of confusion and distress to our clients.

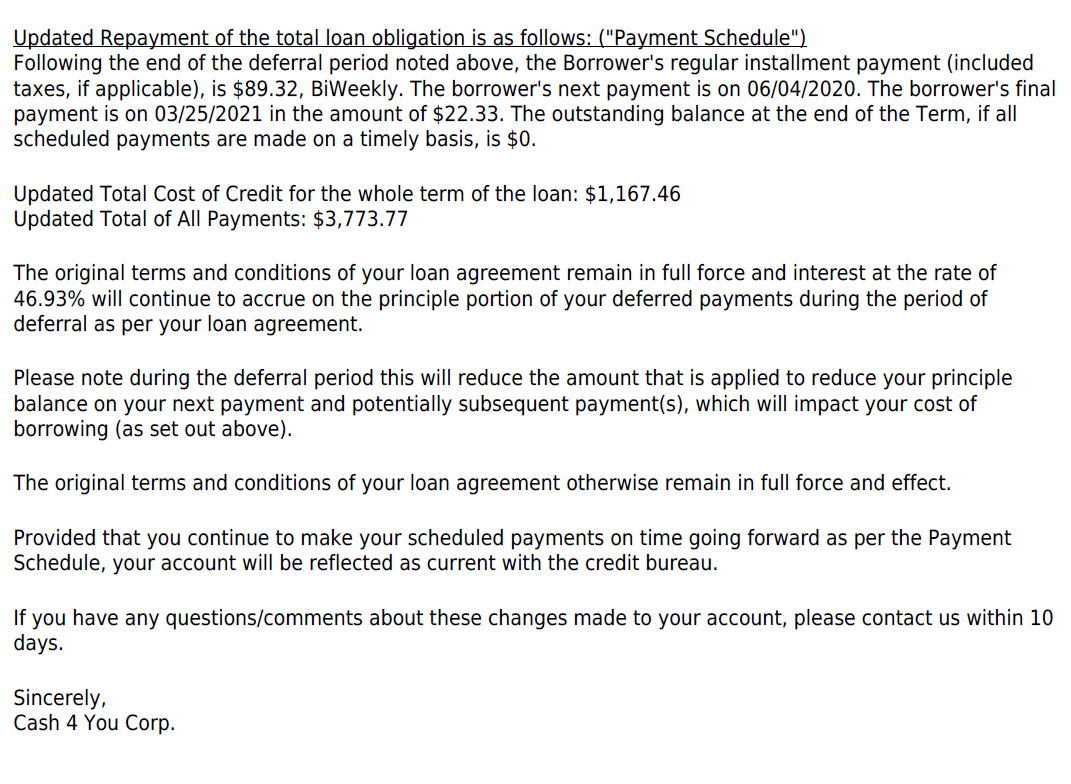

However, I have another objection where the lender cannot plead ignorance. But first, below are the rest of the terms of the loan modification agreement:

These terms are not surprising. Lenders often charge interest on the loan principal during a deferment period.

But I take great issue with the fact that none of the recipients of this loan modification provided their consent to it. Cash 4 You borrowers did not proactively email the company to ask for the deferral outlined in the document. This agreement was sent in a general email blast.

I would argue that this loan modification agreement is yet another example of the predatory nature of payday lenders. They make more money if borrowers defer a debt payment. And given the cash shortage their clients already face; they are likely to defer. With less of the loan principal paid down, and high interest accruing, Cash 4 You makes serious money, while taking advantage of their borrowers’ precarious income situations.

But they are honest. Predatory, but honest. They do not hide the higher cost of deferment from their clients. They state it right in the terms that the deferral period “will reduce the amount that is applied to reduce your principal balance on your next payment and potentially subsequent payment(s), which will impact your cost of borrowing (as set out above).”

What they hope for is that the borrower will not mind the offer and will not reach out to them in the 10 days they provide for questions. The key seller is that a deferral is offered at all in an exceptionally desperate time. In fact, payday lenders often tempt individuals with good customer service.

If a payday loan was not already a nightmare to repay, this deferral makes the repayment process that much more difficult for borrowers. And Cash 4 You knows this.

If you are struggling to repay payday loan debt, you don’t have to keep borrowing to make ends meet. You can stop the debt cycle by speaking to a Licensed Insolvency Trustee near you about options to achieve true debt relief and a fresh financial start. We now offer all services via email, phone, and video chat. Get a free, confidential consultation today.