A proposal to creditors is a deal you negotiate with your creditors to repay a portion of what you owe. In legal terms, a proposal is an arrangement to settle your debts for less than their full amount.

A proposal to creditors is an alternative to filing for bankruptcy. In most bankruptcies, the creditors receive little or no money back. In a proposal, the people you owe money to know they will receive something. Something is better than nothing – which is why creditors are willing to consider a proposal.

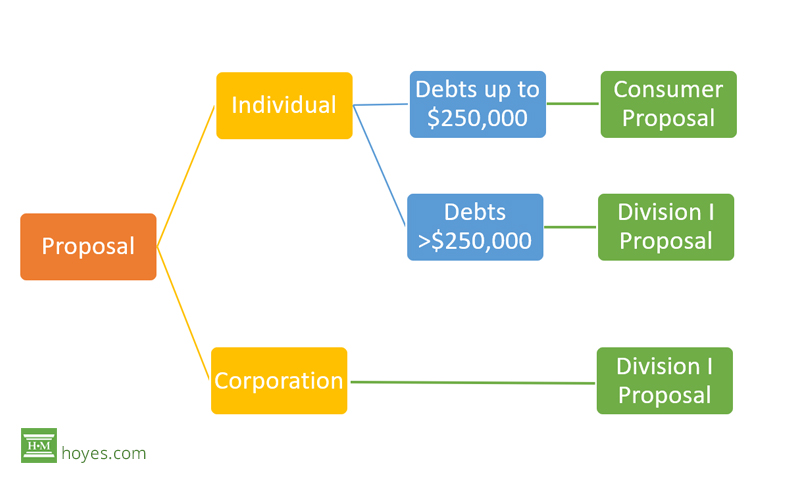

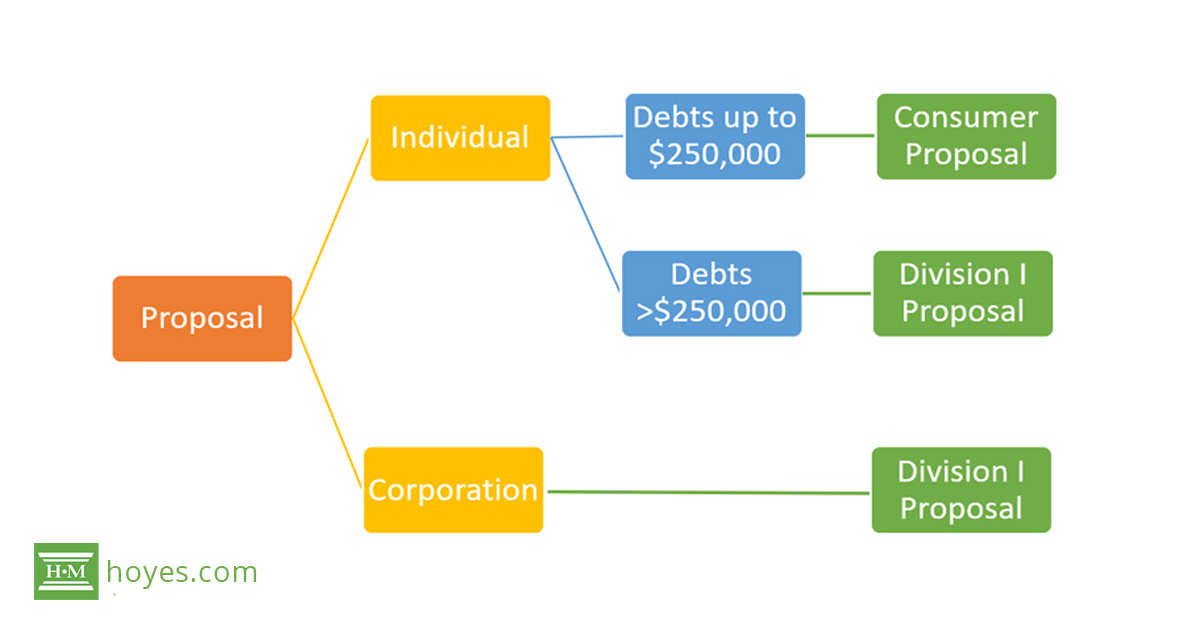

Now that you know what a proposal to creditors is, we need to explain the two types of proposals available to Canadians under the Bankruptcy and Insolvency Act (BIA). The first is called a consumer proposal and the second, a Division I proposal to creditors.

Table of Contents

Consumer proposal: For individuals with debts up to $250,000

Consumer proposal provisions were added to the Bankruptcy & Insolvency Act in 1992 to be used solely by individuals to deal with personal debts.

A consumer proposal is an option for individual debtors with debts (excluding the mortgage on your principal residence) not exceeding $250,000. When a couple files a consumer proposal together, the total debt that may be included is $500,000, excluding mortgages. If your total debt exceeds this debt limit, you are not eligible to file a consumer proposal.

Division I proposal: For corporations and individuals

A Division I proposal is a procedure to restructure debts under the Bankruptcy & Insolvency Act (BIA), available to both corporations and individuals.

While individuals can file a Division I proposal with less than $250,000 worth of debt, most choose to file a consumer proposal instead. This is because of some significant differences between a consumer proposal and Division I that make a Division I proposal much more complicated and expensive.

Key differences between a consumer proposal and Division I proposal

While both programs provide a stay of proceedings to stop creditor actions, and eliminate unsecured debts, there are some costly differences between these programs for individuals:

- A consumer proposal provides more options if it is rejected by creditors. If a Division I proposal is rejected, you are automatically deemed to be bankrupt. If you cannot negotiate a deal with your creditors when you file a consumer proposal, you simply end up back where you started; there is no automatic bankruptcy.

- Consumer proposals have a lower voting threshold. If a simple majority, in dollars, of creditors agree to the terms you have offered, then your consumer proposal is binding on all your unsecured debts. Division I proposals require a majority in number and two-thirds in dollar value of a person’s liabilities to agree to the terms.

- Division I proposals have a mandatory meeting of creditors. Consumer proposals only have a creditors’ meeting if one is requested explicitly by at least 25% of a person’s debt in dollars. Consumer proposals are deemed approved unless a meeting is required.

- A consumer proposal has more lenient allowances for default. If a debtor misses three months’ worth of payments in a consumer proposal, the proposal is ‘annulled’. The stay providing creditor protection is lifted, and creditors can pursue you for the amount owing plus accumulated interest. In a Division I proposal, any default can cause the stay to be removed unless the debtor returns to court for approval of new proposal terms.

Why file a Division I proposal over a consumer proposal?

If a Division I proposal is more expensive and more complex, why would an individual file a Division I proposal? If your debts like credit cards, lines of credit and bank loans exceed $250,000 and you need the protection provided by the BIA, a Division I proposal is the only way to avoid bankruptcy.

While most Division I proposals are for a five-year term, they can, in unusual circumstances, be extended for longer. By contrast, a consumer proposal is mandated to be completed within a maximum of five years. Both programs can be paid off early.

Proposal vs bankruptcy

Both proposal procedures are an alternative to filing bankruptcy. The main advantage over bankruptcy is that the debtor keeps all assets.

The easiest thing to remember is that Division I proposals are used in complicated situations, with high levels of debt. For most people, a consumer proposal is the correct answer to deal with their debts.

If you’re considering filing a consumer proposal to deal with your debt or need more information about the process, contact a Licensed Insolvency Trustee for a free consultation to review all of your options.