Your credit report summarizes how well you manage credit accounts. Lenders and creditors report information, such as payment history, types of accounts, balances and limits to the credit bureaus. If you are or have been struggling with debt, some of that information can be damaging to your credit score.

This article explains what types of negative information affect your credit score, how long bad information stays on your report, and what you can do to hasten its removal or improve your score.

Table of Contents

What negative information appears on your credit report?

Equifax and TransUnion are the two main credit reporting bureaus in Canada. The reports are often different between the two since not all creditors communicate with both credit bureaus, and each credit reporting agency has its own purge rules as to when information is removed from your report. That’s why it is always best to understand how each credit bureau treats negative information.

Below is a list of negative items that can appear on your report and the purge periods.

Inquiries

Every time you make an application for credit and your potential lender or creditor requests a copy of your credit report. This credit check is called a hard inquiry. A hard credit inquiry remains on your report for 3 years.

Late payments

Late or missed payments are the most common negative information on credit reports.

- Late payments are removed from your Equifax credit report 6 years from the date reported, even if you pay the past-due balance.

- TransUnion removes accounts with negative payment history 6 years from the date you defaulted.

Accounts in collection

If you are several payments behind, your creditor may send your account to collection and report such action to the credit bureaus. If you never pay off the account, the creditor may eventually write-off, or charge-off, the balance.

- Equifax removes collection or charged-off accounts 6 years from the date of your last payment.

- TransUnion automatically removes accounts in collection 6 years from the date of default.

Judgments

A judgment occurs when a creditor sues you in court and obtains an order, or judgment, from the court to confirm that you owe the debt.

- Equifax retains the notice of a judgment on your report for 6 years.

- TransUnion retains this information for 6 years from the date of judgment except in Ontario, Quebec and Newfoundland, where it remains for 7 years and 10 years for PEI.

Debt management plan

A debt management plan (DMP) is a repayment program arranged through a credit counselling agency.

- Accounts under a DMP remain on your Equifax credit report for 3 years from completion. If you did not complete your DMP, the accounts remain for 6 years from the date filed.

- TransUnion removes debts satisfied (paid) through a credit counselling agency 2 years from the date the program was completed or 6 years from the date you defaulted, whichever comes first.

Consumer proposal

A consumer proposal is a formal, legally binding debt settlement arrangement made through a Licensed Insolvency Trustee to settle debts for less than you owe.

- Equifax’s website says that a consumer proposal will be removed 3 years from completion or 6 years from the date it was filed, whichever comes first. In practice, we have seen most proposals removed 3 years from completion.

- TransUnion will remove a consumer proposal 3 years after completion, or 6 years from the date you defaulted (filed), whichever comes first.

Bankruptcy

- Equifax will remove a first-time bankruptcy 6 years after your discharge, or 7 years if you have not been discharged. A repeat bankruptcy means both bankruptcies will show for 14 years.

- TransUnion removes a bankruptcy from your report 6 years from the date of discharge except in Ontario, Quebec, Newfoundland and PEI where it is removed after 7 years. A repeat bankruptcy remains for 14 years.

How negative information affects your credit

In general, negative information will lower your credit score. The more negative information you have, the lower your credit rating.

However, not all negative activity has the same impact. In addition, the impact of any item does fade over time.

No-one knows exactly how credit scores are calculated. This information is proprietary or secret to each credit bureau. However, here is some information that is useful for you to know.

Missed or late payments have a very large impact on your credit score. The more late payments you have, and the longer you are late, the lower your score.

Not all credit inquiries will affect your credit score. You can check your credit report as often as you like, and this will not affect your score. Other soft inquiries, like a landlord or insurance company checking your report, have no credit score impact.

A bankruptcy or consumer proposal will lower your score upon filing. However, these programs are designed to help you eliminate overwhelming debt that may also be dragging down your score. Carrying high debt balances and constantly missing payments will harm your credit score. For the right person, a bankruptcy or consumer proposal can be necessary to eliminate that debt, allowing them to start fresh with the process of repairing bad credit.

It is important to understand that lenders look at more than your credit score when deciding whether to approve a loan or credit card application. They look at your entire credit history as well as additional information, including your income, how long you have lived at your current address, types of loans you already carry and how much.

What can you do to improve your credit before negative information is cleared?

You do not have to wait for negative information to age enough to be removed to start a process of rebuilding your credit.

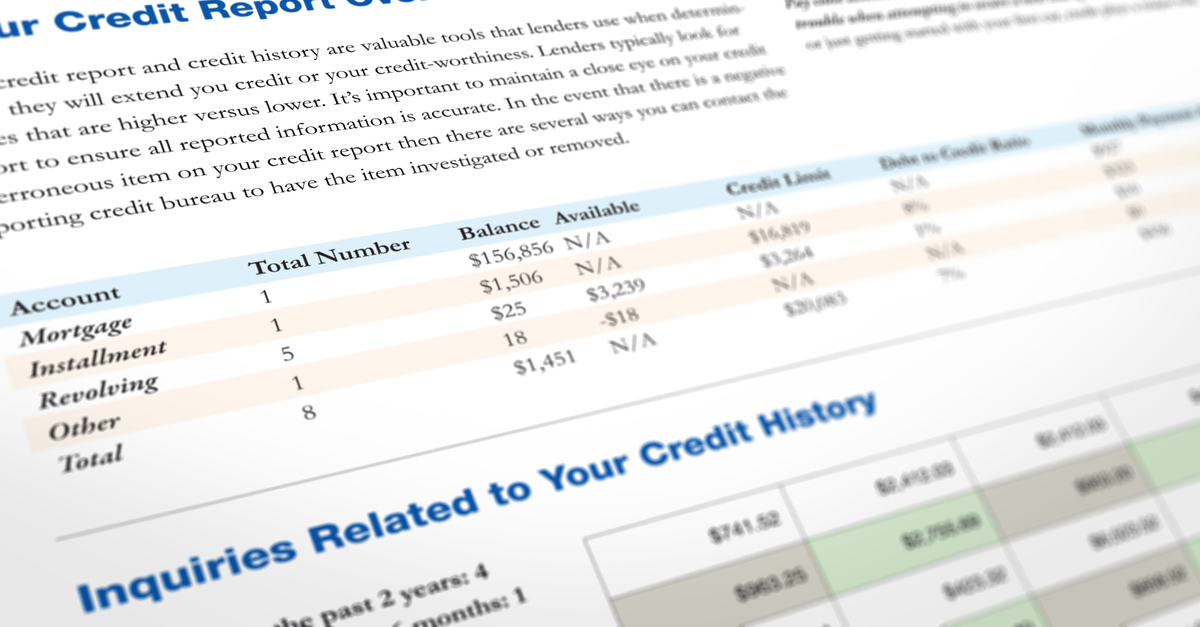

Your first step is to get a copy of your credit report and look for both negative and incorrect information. False information on your report can also lower your credit score. An example is if a creditor incorrectly reports a late payment.

Check your report for errors and file a dispute resolution with each credit reporting company to fix any incorrect information.

Next, consider the other factors that might be affecting your credit score:

- If you are not paying your bills on time, catch up on all payments.

- If you carry high credit card balances relative to your credit limit, pay them down or talk with a Licensed Insolvency Trustee about debt relief options if you can’t do that on your own.

- If you have a lot of low-credit debt like payday loans or high-interest loans, this is something else that will be considered a negative by any potential lender. Again, talk with a trustee if you can’t pay these off.

- Don’t apply for credit too often. Too many loan applications will lower your score. If you apply at more than one lender in a very short window to shop around for better interest rates, TransUnion says their algorithm accounts for this and won’t lower your score. However, applying for two or three credit cards in a matter of weeks will certainly hurt.

Credit scores are calculated based on the information that appears on your report. When items are purged by the credit bureau, they no longer impact your score. However, the result is not like an on-off switch. Negative information has a smaller impact on the calculation of your credit score over time. One late payment five years ago will lower your score less than one recent late payment. A bankruptcy filing four years ago that still appears on your report will not have as big an impact as it originally did.

Should you pay off negative items on your report?

Making payments on overdue accounts will not remove the late payment mark on your credit report. Your account will now be current, but the original missed payment will remain for 6 years. This is better than continued late payments.

However, there are times you may not want to pay off that account.

Let’s say you have an old account in collection from 5 years ago. Legally, your creditor can no longer sue you to collect because the statute of limitations period has expired – the Ontario limitations period is two years. Also, that account will fall off your credit report in one year. Should you pay off negative items like a collection account to get them off your credit report?

Technically you owe the money, and that debt will never go away so debt collectors can keep calling. However, making a payment can restart the timeframe for when an account is removed from your credit report. If you decide to pay off the old account, ask the debt collector to remove the negative item from your credit report as part of any payment or settlement offer with the collection agency.

Negative history vs. too much debt

As I mentioned, negative payment history will lower your credit score, but so will carrying high balances relative to your credit limit. If you cannot repay your debts as they come due, it may be time to talk with a Licensed Insolvency Trustee to help you eliminate debt so you can work to build a better credit report for future lenders to see.