The scams continue. Once again, we are hearing from people struggling with debt responding to advertisements about consumer proposals by companies not licensed to provide those services. I understand that we live in a buyer beware world; however, when someone is charged $2,000 unnecessarily for advice on filing a consumer proposal, I get very upset.

We recently received a phone call from a very distraught individual, already struggling with debt, who paid an up-front fee to Trust Advisory Service (TAS) and then had second thoughts. We had to explain that no, Trust Advisory Service was not a Licensed Insolvency Trustee, and she did not need to pay this ‘consulting’ fee to get advice about a consumer proposal. You can see the outcome of her story at the end of this post.

Here are my thoughts on her ‘contract’, and why I think these types of fee charging debt consultants are bad for consumers. I hope this can help someone who may see similar advertising and offers.

Table of Contents

Unnecessary up-front fees

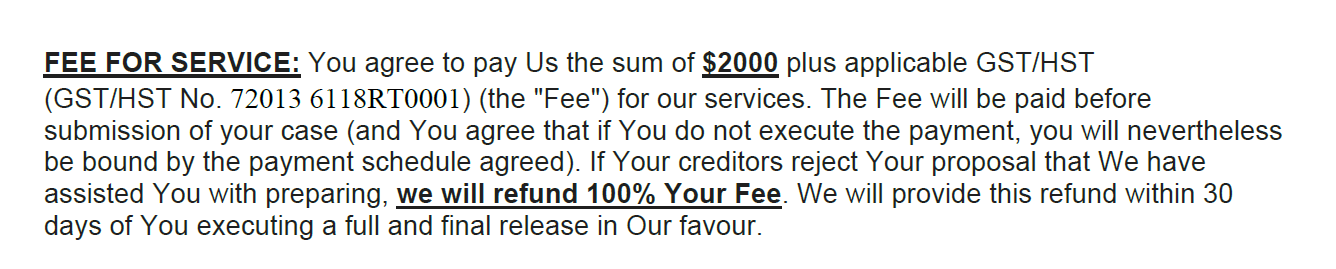

I’m going to start with the up-front fee. I want everyone to understand that it is entirely unnecessary to pay a third-party company money to discuss a consumer proposal or a bankruptcy and to collect information to prepare the documentation.

Their services, as stated in their contract:

Once You sign the Agreement, we will contact Your creditors to obtain balances of Your debts to them. We will inform Your creditors that You have commenced the proposal process and most creditor calls should stop at that point. Where permitted by law, we will insist that Your creditors communicate with you only in writing. We will collect and organize your information and help you prepare the materials to present to our preferred Administrator. Although we will submit the materials on your behalf and will recommend an Administrator, the final choice of Administrator is Yours. The Administrator will receive the proposal package and submit Your proposal to Your creditors who will approve or reject the proposal.”

“As needed, we also will assist you with rebuilding your credit and personal budgeting and we will provide referrals for appraisers, mortgage brokers and others for specialized loans. We will take reasonable steps to amend your credit bureau information in accordance with any applicable legislation dealing with credit reporting activities. We will attend at creditors’ meetings on your behalf if needed and we will arrange for legal representation for you for any court claims relating to your debt and only if the claim commences after the Commencement Date.

These are all the services we provide to you and We do not perform any direct debt negotiation, debt reduction, debt consolidation or debt settlement on your behalf with your creditors. We also do not do any activities relating to a debt repayment agreement with your creditors or relating to obtaining credit from a creditor.

You will note they do not say they file a consumer proposal on your behalf. They will only collect information for the benefit of the Administrator – in other words, for the Licensed Insolvency Trustee.

What is this information? Mostly a list of creditors and amounts owing as well as a list of assets. Every reputable Licensed Insolvency Trustee in Canada has an application that helps with this process – here is our fresh start application in pdf form. We make this process even easier on our clients by offering a mobile version and work directly with clients to collect this information, free of charge.

In the case of Trust Advisory Service, they want their fee. So much so that they say if:

You do not provide Us with timely, accurate, complete or consistent information or updates to information, especially as to your debts or income, as We may request of You;

You do not attend at the offices / location of the Administrator when scheduled, including if You choose to abandon or discontinue the process and receipt of Our services.

… we will not be required to refund any of Your Fees if Your proposal is rejected and We may also terminate the Agreement and retain all the Fee as liquidated damages and not as penalty.

In other words, if you decide not to file, they keep your $2,000.

If you work with Hoyes Michalos, or any reputable Licensed Insolvency Trustee, we might spend time collecting information from you so we can better understand your situation. We might then recommend you don’t file, or you might decide you don’t want to. That’s fine. The point is the collection of this information is part of a proper debt assessment and there is no fee. You are never out of pocket money if you don’t file if you work directly with a Licensed Insolvency Trustee from the start.

Collecting this information is the responsibility of the Licensed Insolvency Trustee. Section 66.13 (1) of the BIA says:

A consumer debtor who wishes to make a consumer proposal shall commence proceedings by

- obtaining the assistance of an administrator in preparing the consumer proposal; and

- providing the administrator with the prescribed information on the consumer debtor’s current financial situation.

As you can see this section says you must obtain the assistance of an administrator, which is a Licensed Insolvency Trustee to file a consumer proposal. The intention of this section is that you provide this information to a Licensed Insolvency Trustee to help them understand your current financial situation. It’s part of what we do. There is no reason to pay a fee to a middle man to forward this information to the trustee.

Are they ‘offering’ consumer proposals?

First, let me state that Trust Advisory Service are not Licensed Insolvency Trustees. They cannot legally file a consumer proposal.

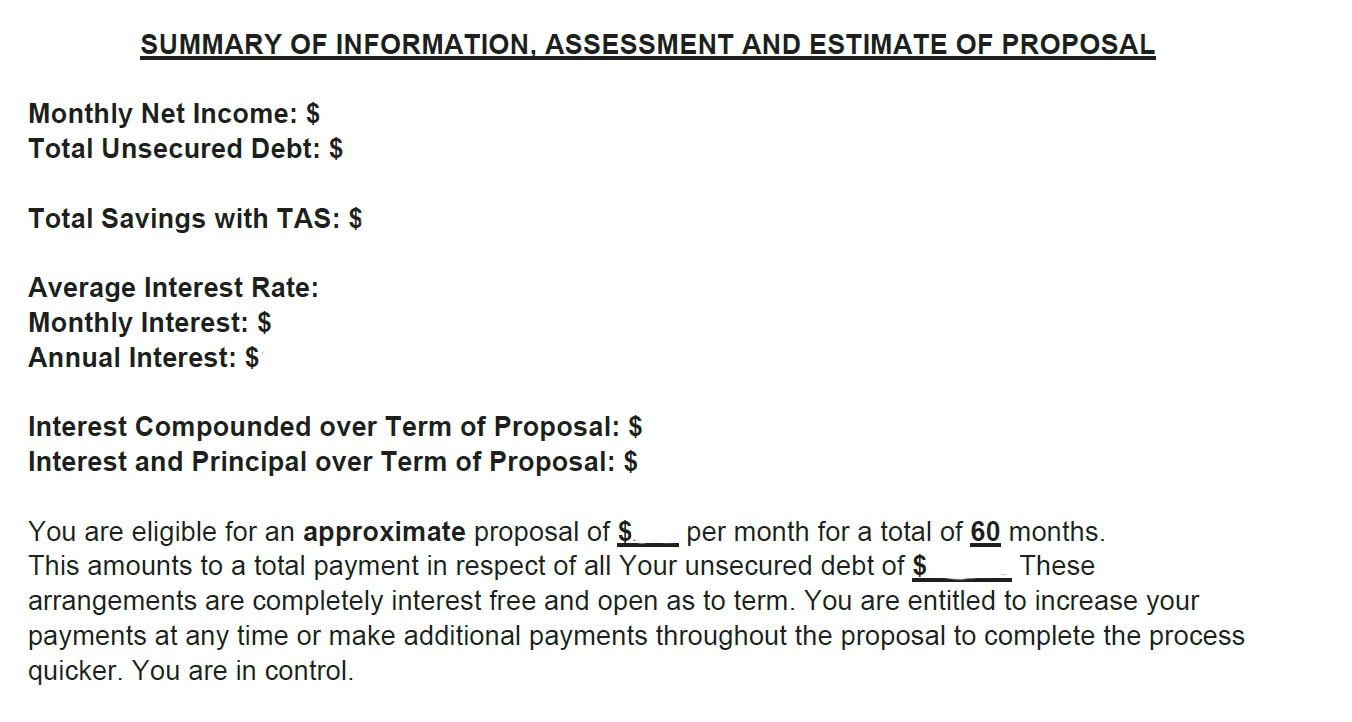

However, TAS makes it appear that they are providing some form of proposal services. They are strong enough in their wording to say that the client is ‘eligible’ to file a proposal.

Here is what their contract says:

While they do not use the word ‘consumer’ it certainly looks like they are making a debt assessment and suggesting how much this client should offer in a consumer proposal.

Are they qualified to make these recommendations? No. To them, it’s a math formula. In truth, determining what to offer your creditors is based on your unique circumstances. A Licensed Insolvency Trustee will review your situation and base their recommendation on many factors, including your job situation, expenses, assets, and family situation. The reason for this is simple:

- Creditors will expect to receive more than they would in a bankruptcy, so we need enough information about your income and assets to understand what that would be

- Different creditors have different expectations. Royal Bank, for example, is notoriously difficult to deal with if they are a majority creditor. Revenue Canada can also have a stronger bargaining position if you owe a lot of tax debt.

Only a Licensed Insolvency Trustee has the knowledge from past accepted and rejected proposals to understand these nuances. It is not just a simple math formula.

Talking with one of these consultants will not get you a better deal. As you will see later, in this case, the client would have overpaid. If you don’t like the terms recommended by your Licensed Insolvency Trustee, then get a second opinion from another LIT – for free.

Other contract concerns

There are other aspects to the Trust Advisory Service contract that I am concerned about, similar to posts I’ve done in the past around debt consultant companies:

- The client is authorizing a very broad array of creditors, financial institutions, schools, employers, utility companies, the CRA and more to furnish information to TAS when requested. This clause is over-reaching, more than a Licensed Insolvency Trustee would even require.

- TAS accepts payment by credit card. In effect, people are encouraged to charge the fee on their credit card knowing they will be filing a consumer proposal. Charging $2,000 on your credit card for a bogus service immediately before filing a consumer proposal is likely to upset the credit card company, and may cause them to vote against the proposal, or request a higher payment in the proposal to compensate them for this loss.

- TAS fully understands that, until the proposal is filed, collection activities can continue. In fact, they acknowledge the possibility by indicating that they will “arrange for legal representation for you for any court claims” and “inform us right away, if a creditor has placed your account in collections, or have taken legal action, so we can help you to file a timely defence.” TAS is not filing a consumer proposal so it cannot provide a legal stay of proceedings, a big risk when someone stops making payments to their creditors. And do you really believe that for your $2,000 fee TAS is going to hire a lawyer to represent you in court against a Big Bank? Not likely.

- TAS will also help with rebuilding credit and personal budgeting. Our experience is that many agencies provide questionably beneficial credit repair services for an additional fee.

It’s time to crackdown

The issue of debt consultants has been around for years. Provincial governments have tried to regulate away the up-front fee. In Ontario, for example, debt settlement companies are required to be registered under the Collection and Debt Settlement Services Act and are prohibited from charging up-front fees. However, this has not worked to prevent this kind of abuse. Companies like Trust Advisory Service specifically state they do not negotiate with creditors. They are charging for paperwork processing and advice.

How should we prevent innocent debtors from being scammed? The law should be enforced. Any company not licensed by the Office of Superintendent of Bankruptcy as a Licensed Insolvency Trustee should be prohibited from charging for any services covered by the Bankruptcy & Insolvency Act (the BIA), including performing debt consultations to file a consumer proposal.

Section 202(1)(a) of the BIA states (highlights are mine):

A person who not being a licensed trustee, does any act as, or represents himself to be, a licensed trustee, … is guilty of an offence punishable on summary conviction and is liable to a fine not exceeding five thousand dollars, or to imprisonment for a term not exceeding one year, or to both.

While Trust Advisory Service does not say they are a Licensed Insolvency Trustee, they act like they are authorized to conduct a debt assessment and present a consumer proposal recommendation to a client.

The profession of charging for advice and services available under the Bankruptcy & Insolvency Act should be fully and completely regulated and licensed, similar to how the medical profession is regulated. Practicing medicine and providing medical advice without a license is illegal. The professional services of a Licensed Insolvency Trustee should be the same.

It’s time for the Office of the Superintendent of Bankruptcy (the OSB) to crack down on trustees who accept clients from these agencies. They’ve highlighted the issue before but have not effectively dealt with it, obviously.

Even beyond preventing trustees from benefiting from the work of unlicensed debt consultants, I would argue the OSB should exercise, or enhance, its power to prevent their activity in the first place.

Section 202(1)(f) of the BIA states that:

a person who directly or indirectly solicits or canvasses any person to make an assignment or a proposal under this Act, or to file an application for a bankruptcy order … is guilty of an offence punishable on summary conviction and is liable to a fine not exceeding five thousand dollars, or to imprisonment for a term not exceeding one year, or to both.

While this may be a liberal interpretation, with their marketing methods and clear confusion as to their authority among those who contact them, are they in effect indirectly soliciting consumer proposals? It is in the best interest of these companies to have everyone sign up for their ‘proposal’ services. They are under no legal obligation, and unlike with Licensed Insolvency Trustees, there are no ethical standards requiring them to ensure that they present, discuss and recommend all options.

If the OSB needs more indication that Trust Advisory Service solicits consumer proposals and provides services around consumer proposals, let’s look at some additional contract wording.

- The terms of service state that TAS will advise creditors that the client has commenced the proposal process, even though it has not yet been filed and the client has not seen a Licensed Insolvency Trustee

- Trust Advisory Service states in the contract that “We will attend at creditors’ meetings on your behalf if needed.” If a creditors’ meeting is called, the filer must attend. Someone else cannot attend on their behalf.

- Additionally, the contract has the client confirm that they “consider TAS to be one of my legal advisors.” How can a non-lawyer, non-trustee be a legal advisor?

- They also advise clients, “Although not mandatory, it is our suggestion that, while the proposal process is ongoing, you suspend any additional payments to the creditors without prior written instructions from TAS.” This seems to indicate that they consider the collection of information they are doing as part of the proposal process.

It is time the federal government find a way to prevent this form of obfuscation of authority and expertise around an area of practice that requires extensive training, certification, and licensing. It’s time we legislate unregistered, unregulated, and unlicensed debt consultants completely out of business to better protect consumers. All the public warnings don’t seem to be working.

Perhaps we need a definition of the practice of providing insolvency services under the Act, much like the Medicine Act of Ontario has a definition around the practice of medicine. Individuals practicing within the scope of this definition must be licensed by the OSB. Consultants providing, or implying they provide such insolvency services without a license should be held legally accountable.

In the meantime, please, if you are struggling with debt, talk directly with a Licensed Insolvency Trustee. Do not pay any fees, ever, until your proposal is formally filed with the government.

A consumer proposal is a legal process, governed by federal law. It can only be administered by a Licensed Insolvency Trustee, who is regulated by the government and has many years of experience. Our role is much more than simply being an administrator. The most important step in the consumer proposal process is completing a debt assessment. Talking with the prospective client to understand their situation, combined with using our training and experience with how different lenders react to proposals is what is expected of us when we get our license from the Office of the Superintendent of Bankruptcy.

These debt consultants do not have the experience to properly assess your situation. It’s a little like talking with your neighbour or co-worker about whether you should file a consumer proposal because they read something about it and know all the right words. The salespeople you talk with on the phone are not trained or licensed in consumer proposals, and have no real experience with getting consumer proposals filed or approved.

Would you pay some unlicensed stranger to give you medical advice if you are sick? No, you would not. A better analogy might be would you pay them to ask you a bunch of questions about your illness, then send you and that information to a doctor you don’t know yet (or they won’t tell you the name of until you pay). No, you likely would not. So why pay some salesperson to sell you their ‘help’ with collecting information to send you to a Licensed Insolvency Trustee.

Oh, and in this case, the individual in question will be filing bankruptcy. It’s better for her. She did not have enough income to generate surplus income and could not afford the proposal payments as presented. And she received that guidance from a Licensed Insolvency Trustee for free.