Uncollected taxes in Canada are estimated to be almost $50 billion. This means many Canadians are stuck with tax debt.

Are you unable to pay your taxes right now? If this is the case, you are probably wondering about the consequences this has on your financial well-being, including whether owing taxes will affect your credit score. Well, it can but only in specific circumstances. Here’s what to know and how to seek assistance.

Table of Contents

Do Taxes Affect Your Credit Score?

Whether tax debts appear on your credit report and will impact your credit score depends on what type of legal action the CRA uses to enforce collection.

In general, the Canada Revenue Agency keeps your information confidential and does not report filing or personal information to Canada’s credit bureaus. They will only release information where they are legally authorized to do so and if they are forced to take legal action through the courts.

If you have a balance owing after filing your tax return, this is not reported to the credit bureaus. The CRA is not a normal reporting creditor like your credit card issuer, cell phone company or bank.

If you owe a significant amount of money in taxes and do not make efforts to repay, the CRA will get their collections department involved. Debt collection is the process of pursuing payments for the debt owed.

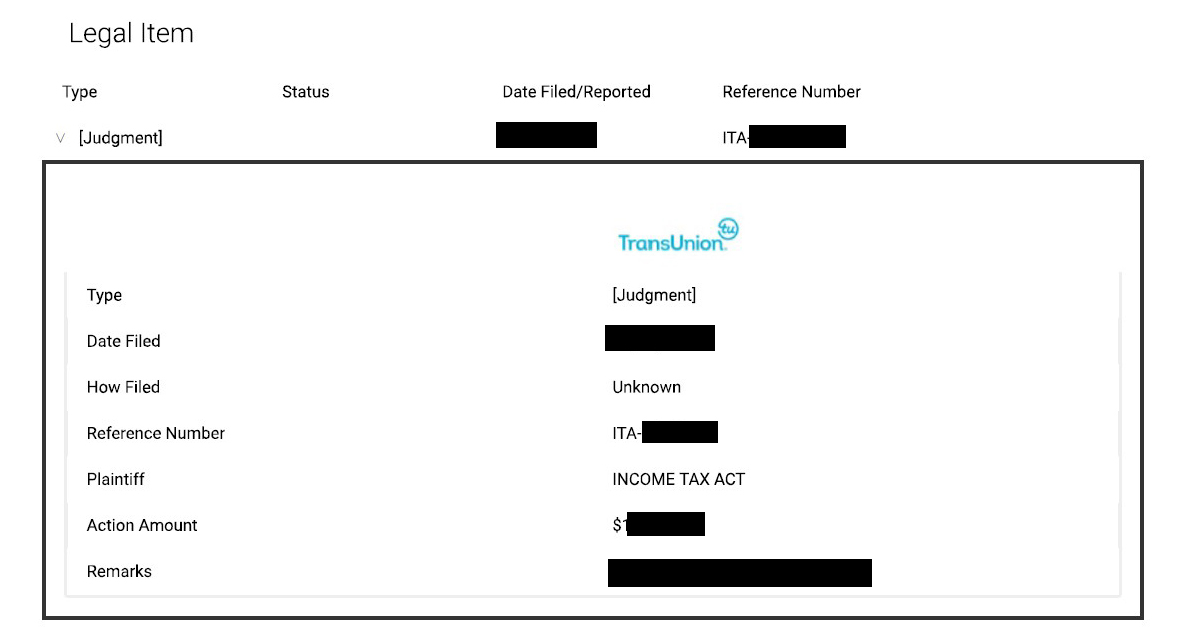

If necessary to pursue you for unpaid taxes, CRA can legally certify, or register, your debt with the Federal Court or get a judgement from a provincial court confirming the amount owed. This court judgement becomes a matter of public record and can appear in the legal section of your credit report.

A CRA judgement, like any other judgement order, will remain on your credit report for six to seven years from the date of filing, depending on the credit bureau and province. CRA may seek this judgement prior to registering a lien and taking action to seize or sell your assets. Any tax lien against the property remains until you pay back the taxes.

While your tax debt may not appear on your credit report, if you are applying for a mortgage or large loan, your lender or bank will often request that you provide proof that your taxes are current. This is almost a guaranteed request if you are self-employed or running a small business.

What Else Affects Your Credit Score?

Your credit score is a three-digit number that signifies your creditworthiness. Your credit score ranges from 300 to 900 points, 900 being the best. 650 and above is an indicator of good credit.

Your credit score is important to your overall financial health. Lenders look at your credit score when you buy a house, a car, sign up for a credit card, and more.

It is unlikely that any CRA judgement will be the major determinant of your current score. Here are other factors that will likely have a bigger role in the calculation of your credit score:

Your Credit History

Your credit history includes when you pay your bills and how you pay them off. Any missed and late payments will show up on your report, as well as any payments made either in full or partially.

Credit Utilization

Utilization is how much credit you have available to you versus how much you’re using. For example, if you max out your credit card, your credit score will be lower than someone who doesn’t use their credit card often.

Your Credit History

Your report keeps track of how long you’ve had your credit cards and other debt. For example, if you’ve had the same credit card for several years and use it responsibly every month, your credit score will be better than someone who has a new credit card with little payment history.

Credit Product Variety

Credit variety signifies the different types of credit you have: credit cards, car loans, a mortgage, etc. As long as you pay your bills on time, a variety of credit can be good for your credit score.

Understanding How Tax Debt Affects Your Finances

Tax debt, like all forms of debt, affects your finances in more ways than you think.

If you don’t pay your taxes in full and on time, you’ll get hit with interests and penalties.

As I mentioned earlier, the CRA will take action to collect any unpaid tax debt, including wage garnishment, freezing your bank account, or selling property. If you are owed money by another government agency, they can keep that amount to off-set any tax obligation you owe.

The key to paying your taxes and preventing tax debt is properly managing your finances.

First, always know how much you expect to owe in taxes.

If you do not have taxes deducted at source, I recommend setting aside money every pay to remit to the government either after you file or when your installments become due. The amount you need to save depends on your effective tax rate. This is relatively easy to calculate if you filed a tax return last year. Take the taxes payable from your prior tax return and divide that by your total income last year. Another option is to use this income tax calculator. In Ontario, someone earning $50,000 pays an average of 25% in total tax payments, which means you should set aside 25% of your gross earnings to cover your taxes owing.

If you are self-employed or own a small business, keep a separate bank account where you can keep your tax funds. That account can be linked up to the CRA’s website, so you can easily pay your taxes when they come due. To avoid late payment and interest charges, pay your installments from this account.

If your employer withholds tax money from your pay, but you have more than one source of income, don’t expect that these source deductions will cover your tax liabilities. Two jobs, or an outside source of income, can move you up to a higher bracket resulting in an unexpected tax liability when you complete your return. You should calculate how much taxes are taken out of your paychecks versus how much you expect you will owe and set aside funds to cover any difference.

What to Do If You’re in Tax Debt

If you do owe money to CRA, don’t panic. Make a budget and determine if you can afford to repay your taxes. If you can’t, you still have options.

Payment Arrangement

If you can’t pay your full tax bill right now, you can make a payment arrangement with the CRA. You make smaller payments over time, including interest, until you pay back your entire bill.

Apply for Taxpayer Relief

Your case may qualify for taxpayer relief through the CRA. You will still have to pay back your tax bill but you won’t be charged interest or penalties.

Voluntary Disclosure Program

Do you owe money in taxes because you didn’t file for a previous tax return or filed an incorrect return? If so, you can qualify for a voluntary disclosure program. This is a second chance to file a corrected return. This option can also mitigate penalties and some interest.

Financing Options

If you don’t qualify for taxpayer relief, you can take out a personal loan to pay taxes or other financing options. However, these aren’t always recommended. Loans often come with high-interest rates, short payback periods, and more. Most people will benefit from arranging repayment with the CRA. Only take a loan as a last resort.

Consulting a Debt Relief Professional

If you feel like you’re out of options, you can always seek help from a debt relief professional. Here are some ways a debt professional can help.

Consumer Proposal

You may need a consumer proposal. This is a legal debt settlement program filed with the help of a Licensed Insolvency Trustee. It is a payment plan to pay back a portion of your debts, including your tax debt, for a period of five years. At the end of this period, your debt is forgiven.

Bankruptcy

You can declare bankruptcy to clear most tax debt. Bankruptcy is a legal process that provides debt relief for taxpayers. At the end of your bankruptcy period, your debts are legally discharged.

While filing a consumer proposal or bankruptcy will affect your credit report, this is the best option if you have too much tax debt or other debts that you can’t pay back.

Keep in mind; both a bankruptcy and consumer proposal will clear most tax debts, including income tax, HST and payroll withholding taxes; however, it cannot remove a tax lien. If you have high tax debts, talk to a trustee before CRA seeks a judgement or acts to place a charge on your property.

We Can Help With Your Tax Debt

If you’re in tax debt or any type of debt, you’ll need a trustee to help you handle your debt. While a tax lawyer can help you with an interpretation of the tax code and perhaps negotiate a reduction in interest and penalties, only a Licensed Insolvency Trustee can help you get relief from the original tax owing.

Contact us for a free, confidential consultation. We have offices in Toronto and throughout Ontario.